Is the META (FB) Disaster an Opportunity?

This week, Meta Platforms (FB) — formerly known as Facebook — made huge news as its stock cratered more than 25% on disappointing earnings and outlook.

At LikeFolio, we were neutral on the company going into this report.

But after a 25% haircut in the stock price, it’s time to take a look at whether the company’s pivot into “metaverse” territory has a chance of paying off.

Here are three things our consumer insights data is telling us:

They are catching the Web3 wave early

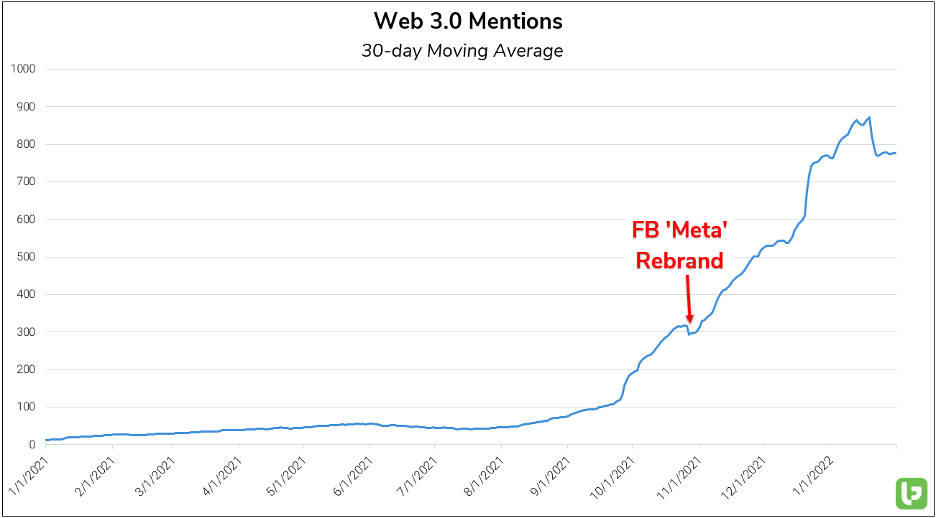

The concept of Web 3.0, a shared vision for the next phase of the internet, had just entered the popular lexicon when the Meta rebrand announcement dropped.

It’s debatable whether or not FB’s rebrand was the catalyst for the resulting surge in Web 3.0 awareness, but the outcome remains:

With a simple name change, a centralized Web 2.0 giant managed to attach itself to the decentralized revolution of Web 3.0.

Meta isn’t just talking the talk, either.

Its rebranding reflects a radical realignment of the company’s priorities.

Virtual Reality Leadership

Meta’s VR business, which began with its 2014 acquisition of Oculus, has become a focal point.

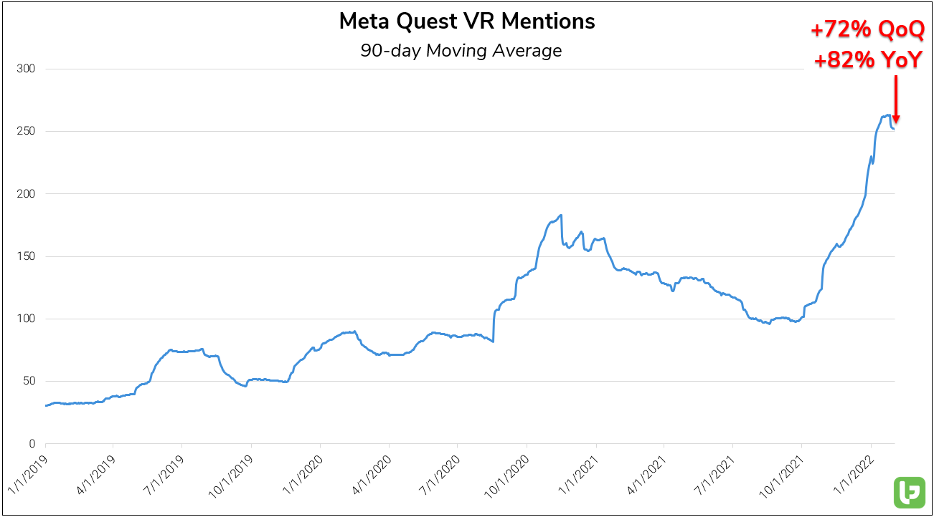

On its most recent earnings report, Mark Zuckerberg held up the company’s VR and AR products as “the foundational platform for the metaverse.”

This posturing has already served to bolster consumer Buzz in the near term:

Meta Quest (formerly Oculus Quest) mentions are at an all-time high, up +72% QoQ and +82% YoY on a 90-day moving average.

Meta has been incredibly effective in refocusing public attention toward new aspects of its business — like virtual reality.

Unfortunately, there is a good reason they want investors looking at the shiny new thing instead of their traditional business.

Their core business is under fire

Meta’s legacy business, social media, is facing a serious revenue decline at the hands of iOS privacy restrictions.

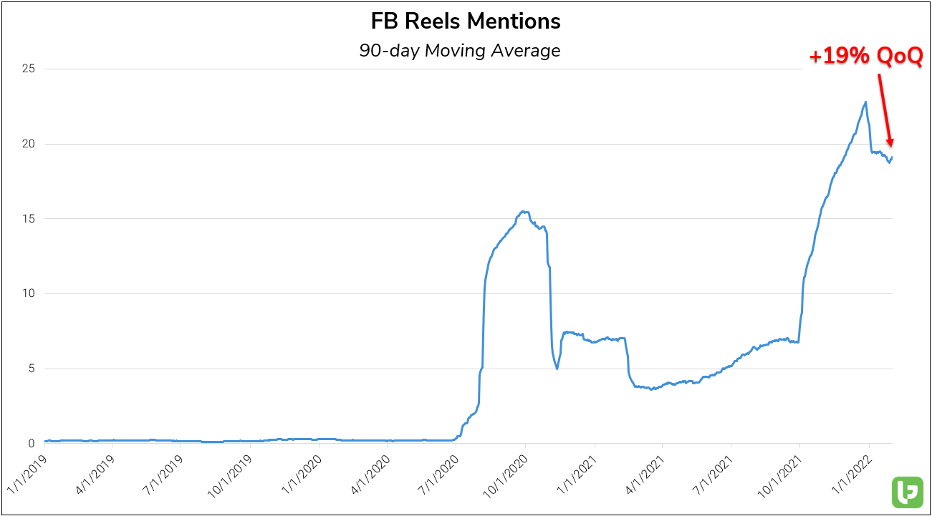

Facebook’s relatively new Reels feature has been stressed as a key area for expansion and a way to attract a younger userbase.

Underlying Reels mentions show promising adoption: +19% QoQ (90-day MA).

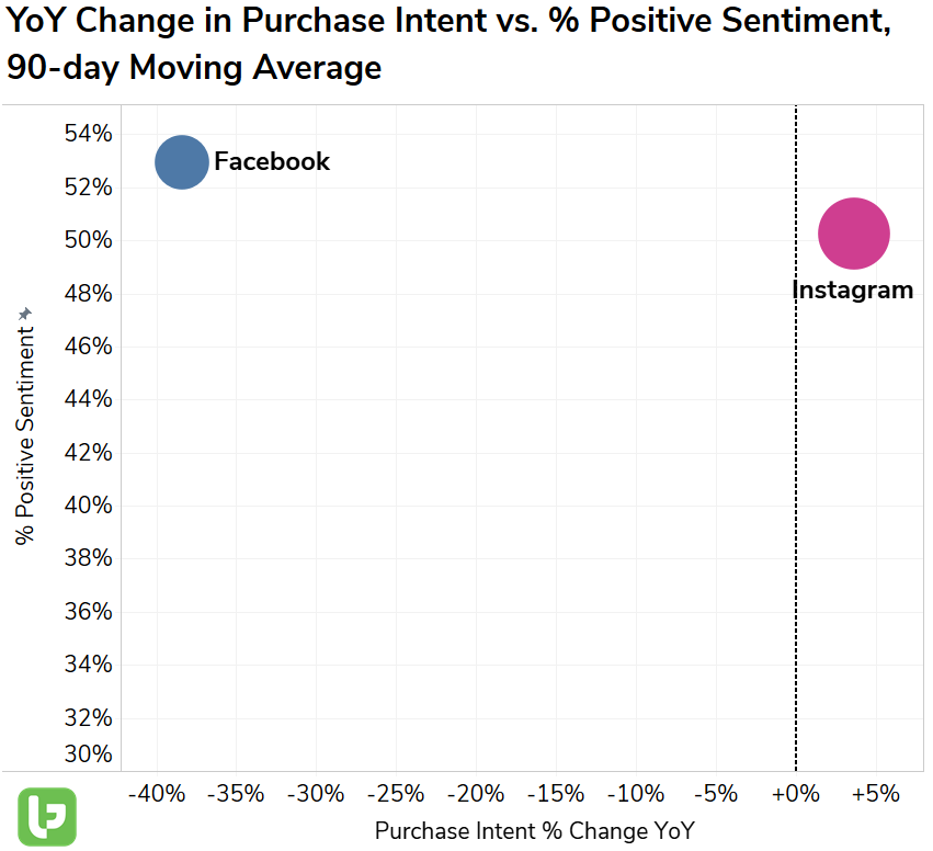

Yet the former namesake brand is still losing ground with American consumers of all ages, lagging Instagram in terms of YoY demand growth.

It remains to be seen whether Meta can effectively pivot away from its traditional business and deliver on the metaverse hype.

The transition has already been bumpy, to say the least.

That said, we’ll be watching closely for continued indications that Meta Platforms can live up to its new name… and deliver outsized returns for investors from here.

Andy Swan

Founder, LikeFolio