The Truth About Starbucks (SBUX)

Starbucks is in the news again.

This time (unfortunately) it’s NOT because of Pumpkin Spice Lattes.

This week, Starbucks workers voted to form their first U.S. union in a Buffalo, N.Y., store.

For now we’re going to table the union discussion. Because that’s not where LikeFolio data can provide unique insight.

Instead, let’s break down the second part of that headline…

Mobile Orders are Overwhelming Starbucks Baristas

The sheer quantity of Starbucks mobile orders has climbed so high that employees can’t keep up.

Reuters reported, “When Starbucks launched seasonal holiday drinks and gave out free tumblers in November, the mobile ordering system was so inundated with orders at one Buffalo area store that staff fell behind by as much as 40 minutes.”

Earlier this week on my way into the office, I contributed to this problem.

It was cold out, and I needed a caffeine fix. I tapped a few buttons to order my favorite drink while I was sitting at a red light. Coasted through the drive-thru minutes later. Steaming hot blonde roast in my hands. So easy.

LikeFolio captures hundreds of mentions from consumers detailing scenarios like mine every day.

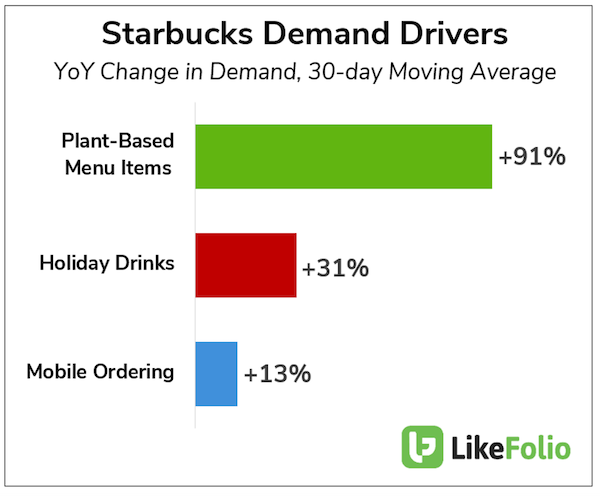

Unsurprisingly — and as reported by baristas — Starbucks mobile ordering mentions have increased by 13% YoY, gaining steam in the last month.

And mobile demand isn’t the only Starbucks segment flexing…

Plant-Based Menu Items, Holiday Beverages Drive Starbucks Demand and Ticket Price Higher

Consumer mentions of purchasing a plant-based food item (like the Impossible breakfast sandwich) or subbing in oat milk instead of dairy have increased by +91% YoY.

These options are so popular, they’ve even snuck their way into featured holiday drinks like the “Iced Sugar Cookie Almondmilk Latte.”

Comprehensively, consumer mentions of purchasing one of these seasonal bevvies have increased +31% YoY.

While it’s great to know that plant-based orders and holiday special releases are driving purchases, it’s even more impressive when you realize that these are *premium* items.

Meaning, they cost more.

Starbucks noted this phenomenon on its last earnings call: “We exited Q4 with even stronger 14% two-year comp growth in September and closed to a record average ticket, driven by the strength of our fall beverage lineup, a shift in customer behavior toward more premium beverages and strong food attach.”

This helped to propel U.S. same-store sales +22% YoY.

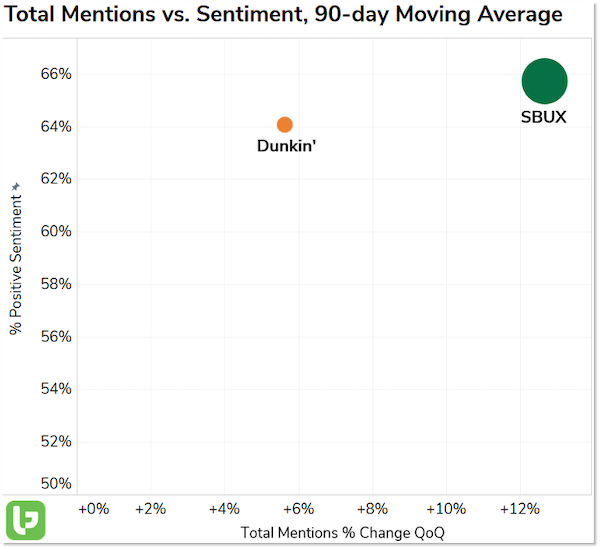

And data suggests Starbucks is building on this performance in the current quarter… even outperforming peer Dunkin’.

So – is this barista inundation dooming news for Starbucks?

Not necessarily.

Because thanks to LikeFolio data, we know:

- Demand is high, and growing.

- Starbucks has proven it knows what its consumers like: premium treats that fit their lifestyle.

- Happiness at scale has not been impacted by negative customer experiences like wait the times described by Reuters earlier. Sentiment is unchanged on a YoY basis.

While Starbucks certainly has some growing pains to work out from a digital execution and employee satisfaction perspective, growing pains resulting from surging consumer demand are arguably the best kind of growing pains to have.

Megan Brantley

Head of Research, LikeFolio