This Company is Disrupting Sports Betting

Where I was raised, football is almost religion.

Every week, I carefully set my fantasy pick’em and settle in for a weekend full of rivalries, hard hits, and thrilling upsets, as long as these upsets don’t involve my Crimson Tide. Looking at you, Ole Miss…

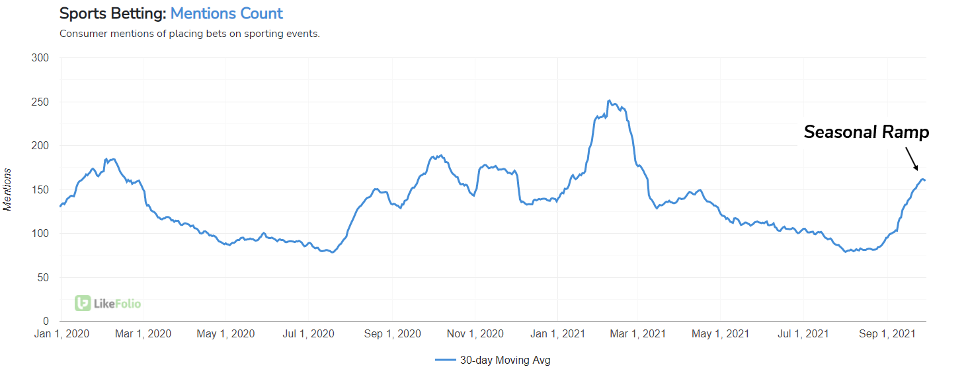

So it’s no surprise to see Consumer Mentions of placing bets on sporting events on the rise as live sports heat up: +52% QoQ.

At LikeFolio, we leverage these major consumer macro trends to help us evaluate big commercial players in respective sectors.

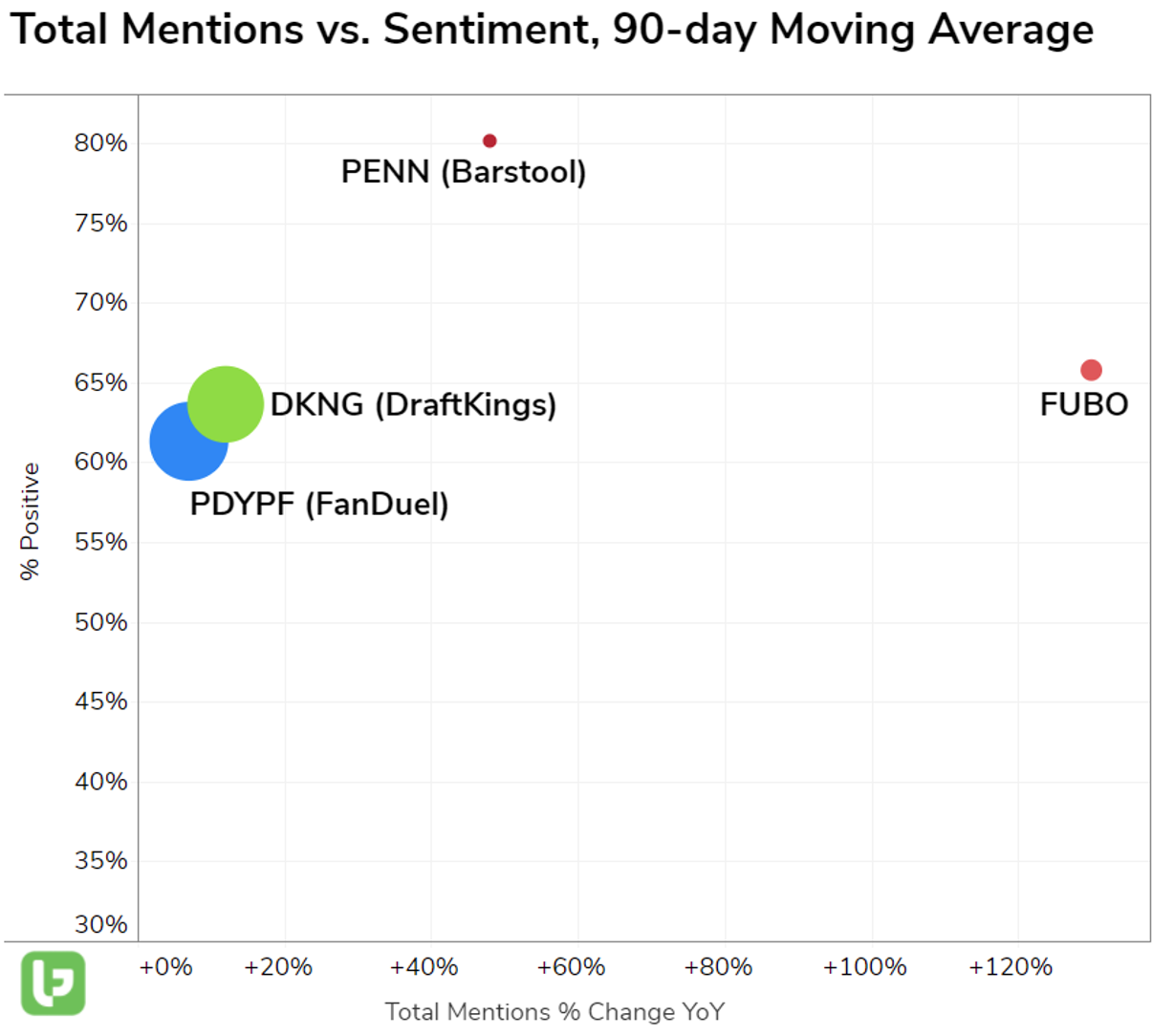

In this case, the building strength in sports betting turned our eyes to four companies in particular:

DraftKings (DKNG), Penn National Gaming (PENN), FanDuel (PDYPF), and one that may be a head-scratcher for some: FuboTV (FUBO).

While every company with a hand in sports betting is exhibiting YoY Mention volume growth, the buzz surrounding FUBO places the company in a different league entirely.

FuboTV Mention volume has increased +130% YoY!

To be fair, FuboTV’s core offerings differ from those of peers on this chart: The company is a sports-first streaming provider rather than a traditional betting platform.

But this distinction may prove to be the company’s edge moving forward. Why?

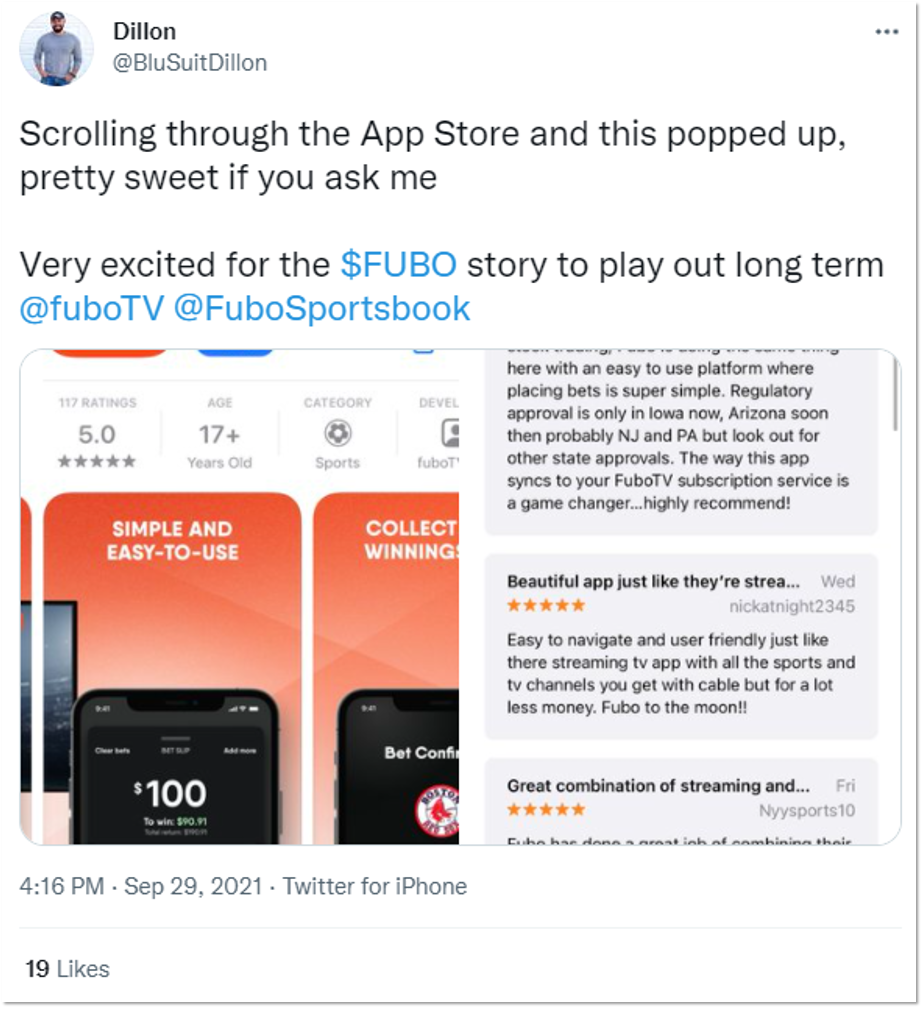

FuboTV plans to launch its Sportsbook this quarter — maybe sooner than users realize.

Last week, the company confirmed Paysafe would power Sportsbook payments, leading many to believe an official launch is imminent.

You can already download the app and check it out.

And so far, reviews look promising:

But here’s where it gets cool: FUBO is planning to leverage its own first-party data from FuboTV and Fubo Sportsbook to understand user viewing preferences, recommend bets, and keep users engaged.

This crossover could be very powerful and serve as a major stream of additional revenue.

Bottom line: From a consumer perspective, LikeFolio data suggests FuboTV’s userbase is expanding rapidly and buzz is accelerating.

However, the market isn’t quite sold… yet.

FUBO short interest is relatively high: about 17% of available shares have been “pre-sold” on the belief that the price will go lower in the future.

But LikeFolio members are armed with something Wall Street is not: real-time consumer data.

We’ll be closely watching as FuboTV launches its Sportsbook and expands its live sports offerings.

If growth continues at the current rate, we think the Street is in for a major surprise.

Megan Brantley

Head of Research, LikeFolio