This Under-the-Radar E-Commerce Platform Already Moves Half the Volume of Amazon Marketplace

I have to tell you about one of my biggest pet peeves. I think you’ll be on my team here.

Let me set the scene.

It’s 9 p.m. I’ve finally settled in on my sofa with a (well-poured) glass of red wine after a bustling day of data crunching, exercise, and family dinner, and the dishwasher is calmly humming in the background.

I realize it’s my best friend’s birthday next week. And I need a gift.

I navigate on my phone to find the pair of leggings I know she’s been eyeing but would never buy herself. As I click “check out,” the site asks for my credit card number.

“UGHHHH,” I groan.

I am not getting off this couch to rummage through my purse to find my wallet and my credit card. Who has time to enter credit card numbers, shipping addresses, and 32 other fields of info to buy a pair of leggings? It’s a deal-breaker.

But thankfully, the company selling these leggings has another option for me. I can simply check out via Shopify. And I don’t have to get up.

My purchase is secure, fast, and convenient. Most importantly, I’m still on my couch.

And companies are catching on.

Shopify Is Helping Brands go ‘DTC’

The e-commerce market is changing faster than ever, and keeping up with those changes is a full-time job.

One of the companies enabling all brands to adapt is Shopify. Shopify powers the complete gamut of the e-commerce experience for brands, from web design to payment processing and even order fulfillment/logistics, if the brand needs it.

Shopify essentially says: Own your brand. Meet your consumers directly. And let us handle the back end.

It’s no surprise that Shopify experienced rapid growth over the last few years.

During the height of the pandemic, when most stores were closed, Shopify revenue soared +85% to $2.9 billion. Shares of the e-commerce platform followed suit, reaching all-time highs above $1,760 in 2021.

But as physical retail stores have reopened, e-commerce growth has tempered. And Shopify shares have suffered.

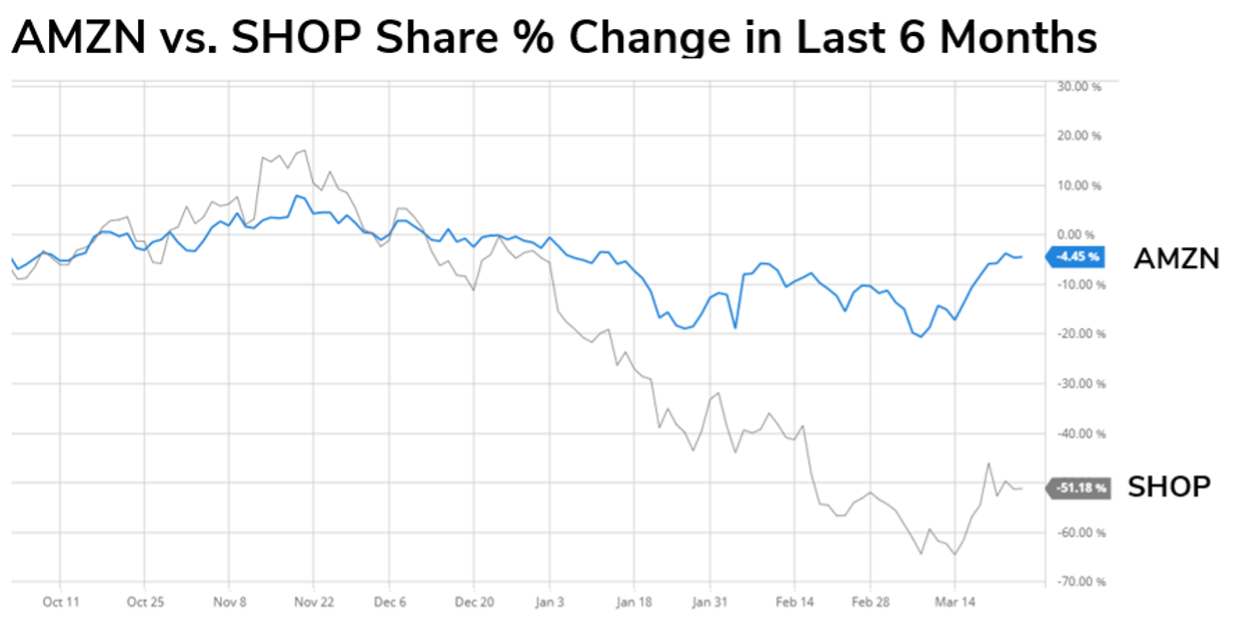

In fact, Shopify shares are faring much worse versus shares of e-commerce peers, like Amazon.

Shopify shares are trading more than 50% lower in the last six months, while Amazon shares have managed to remain mostly flat.

Amazon is a beast, with other proverbial pots on the stove, of course – but Shopify is making inroads when it comes to Amazon Marketplace.

Consider, for example, that Shopify surpassed $54 billion in gross merchandise volume (GMV) in the fourth quarter of 2021 – that’s almost half the gross merchandise volume moved by Amazon Marketplace.

That’s a huge deal. Just three years prior, the Shopify-to-Amazon GMV ratio was closer to 1:4.

And LikeFolio data suggests that gap is closing, which is one of many reasons why this name caught our eye.

Here’s why now may be a great time for investors to take a close look at Shopify.

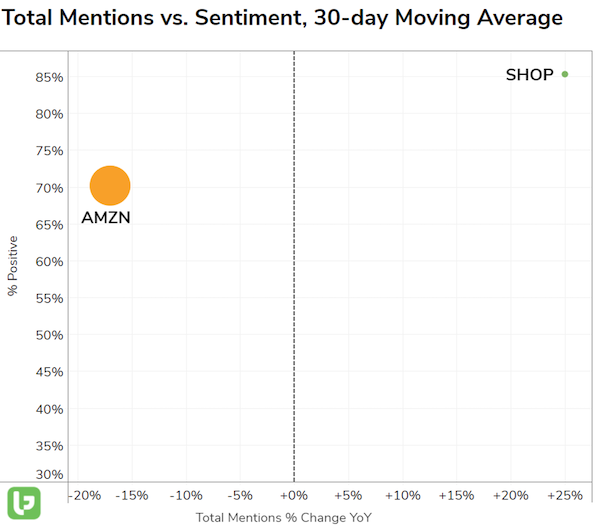

1. Shopify’s Buzz Growth and Happiness Are Outperforming Amazon’s

Shopify is in the sweet spot on the Outlier Grid above. Its happiness levels are 15 points higher than Amazon’s. 15 points!

And mentions of the platform are growing at a much faster clip. In fact, that chart shows Amazon’s mention growth rate is slowing down.

Interesting.

2. Shopify Is Still Innovating

Shopify understands that simply having a website where consumers can shop isn’t enough anymore.

So it’s adapting to changing social trends with a new tool called Linkpop.

How does Linkpop work?

Imagine you’re scrolling through TikTok or Instagram. You spot a product promoted by a new (or favorite) brand. The Linkpop tool allows the creators and merchants to launch storefronts to sell directly on these social platforms.

You can see how Shopify is pitching this to creators below:

Shopify knows this integration is important for brands.

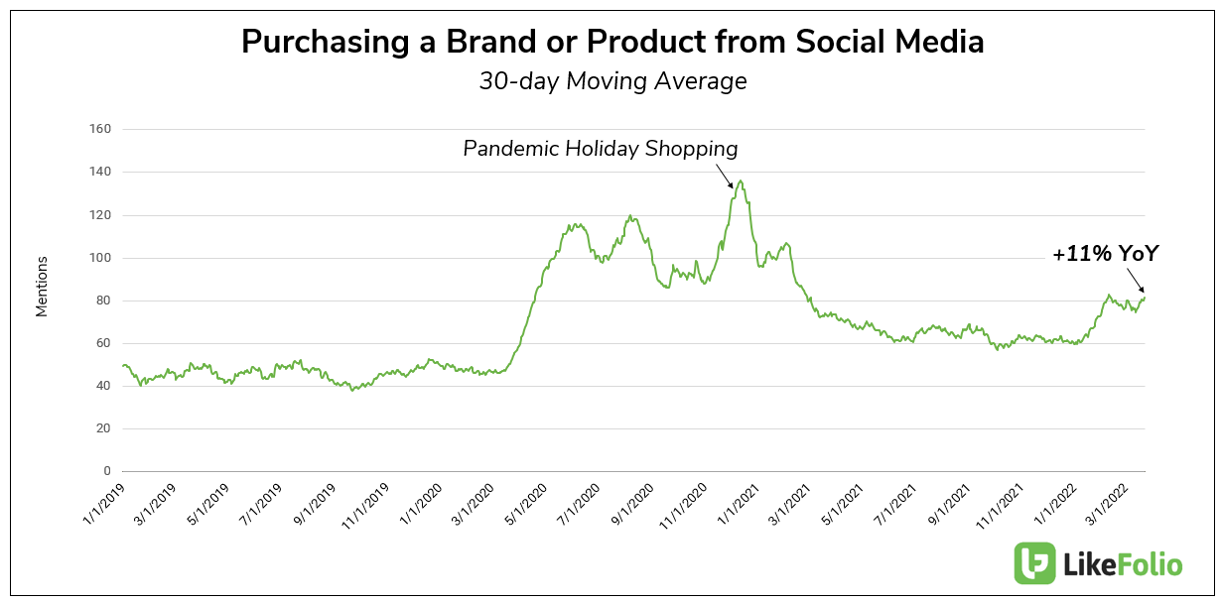

Because this type of shopping behavior is rising.

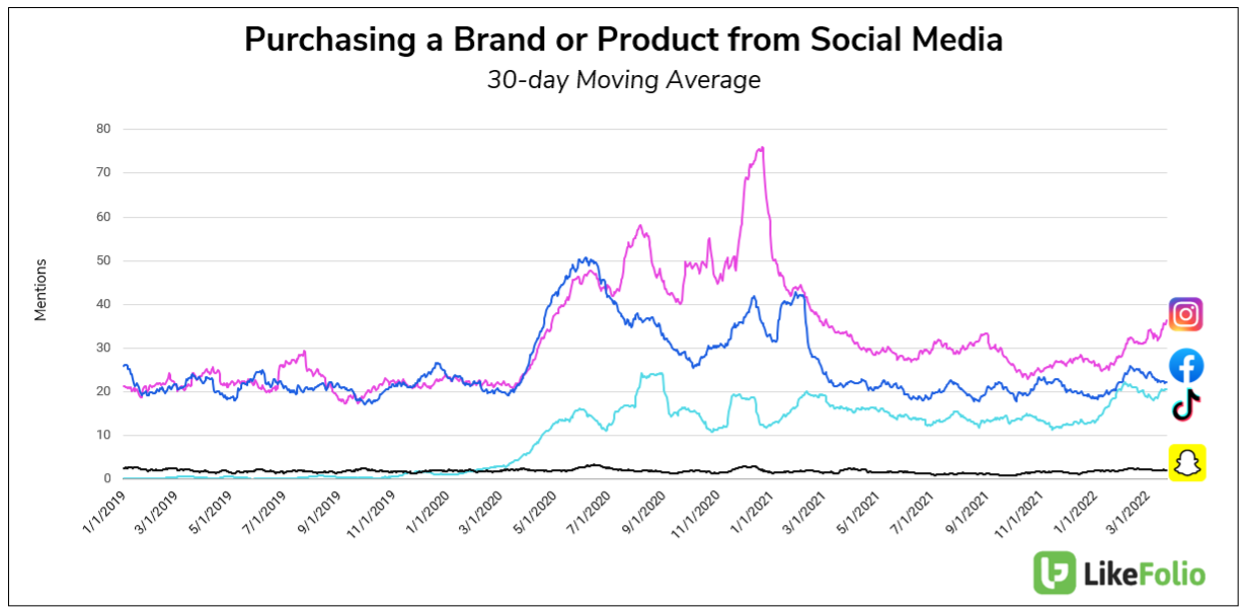

Mentions of Purchasing a Brand or Product from social media have increased by +11% YoY on a 30-day moving average – breaking a year-long stagnation.

And naturally, Instagram, Facebook, and TikTok are leading the pack.

Interesting how that works, right?

This type of innovation is nothing new for Shopify. One of the drivers of growth is its ability to generate tools that help its vendors operate more efficiently.

But perhaps most importantly, LikeFolio data suggests the improvements Shopify is making are moving the needle again with consumers.

3. Shopify Demand is Rebounding

Shopify’s usage mentions tempered in 2021 versus 2020. This is understandable; consumers were no longer pigeonholed into digital-only purchases.

But now, Shopify is proving it can still grow.

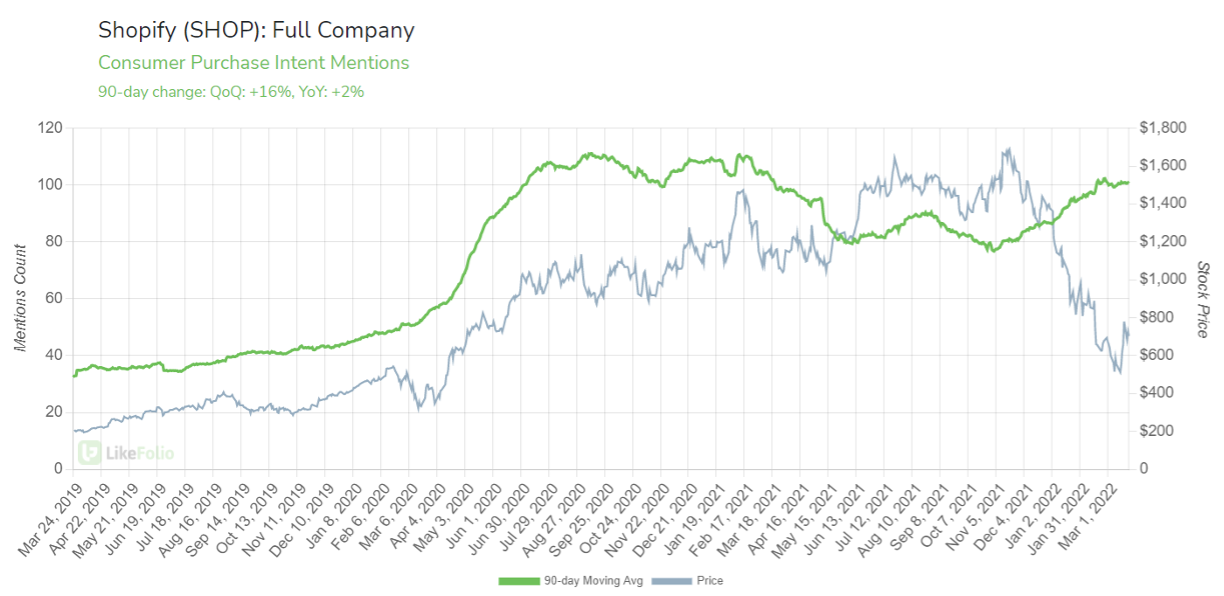

LikeFolio data shows that Purchase Intent mentions have increased +2% YoY and +16% QoQ on a 90-day moving average, continuing the consistent growth trend established prior to the pandemic.

The chart above is starting to look like just the type of divergence opportunity that we in the LikeFolio office dream about.

Solid company. High levels of consumer happiness. Building consumer demand.

And the market seems to be missing it.

Members should keep an eye out for official opportunities regarding Shopify. And I’ll continue to use the platform to complete my purchases from my couch.

Megan Brantley

Head of Research, LikeFolio