Why I Didn’t Take 200% Profits on ROKU

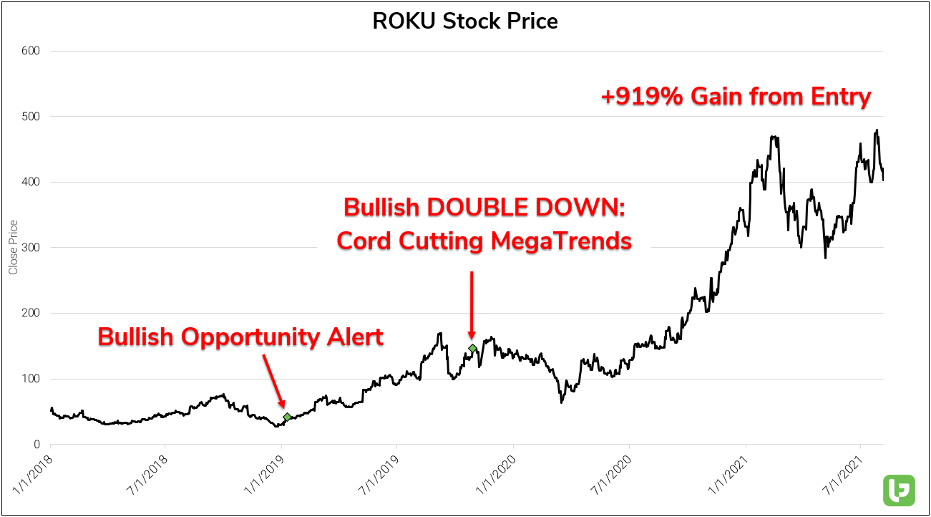

I’ve been bullish on Roku (ROKU) for 2.5 years now, after first alerting clients to the opportunity in January 2019, with the stock trading just under $40/share.

In that initial report, we cited the cord-cutting movement and Roku’s proven ability to maintain and grow its user base as primary drivers of future growth.

The stock took off like a rocket from there, zooming higher by more than 200% in a matter of months.

I have to admit, it’s always tempting to take profits when you’ve tripled your money in less than a year. It’s just a natural emotion!

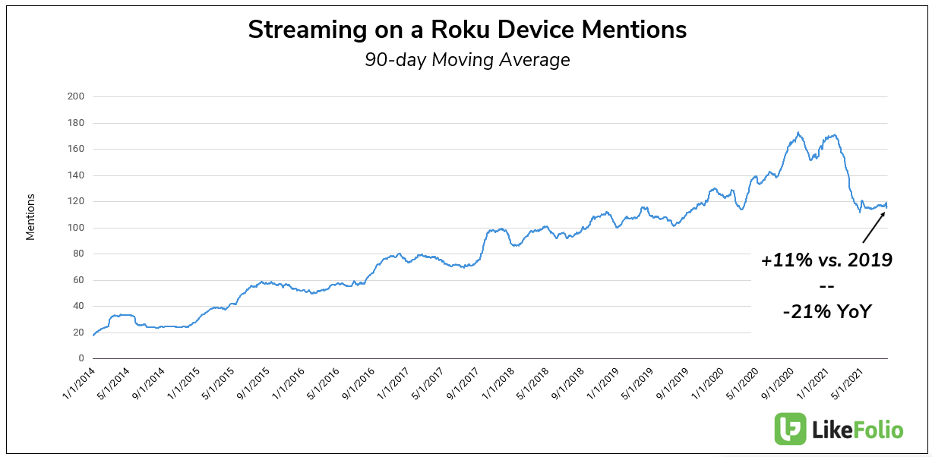

Luckily, because of LikeFolio’s consumer insights data, we don’t have to rely on emotion. Instead, we can keep riding a stock until the consumer tailwinds shift. And in ROKU’s case, that wasn’t even close to happening in the fall of 2019.

In fact, the Consumer Demand data was only getting stronger.

So much so that we doubled down on ROKU at $140/share in our October 2019 MegaTrends Report, “Cutting the Cord.”

In that report, we noted surging levels of Consumer Demand for Roku products and services, along with improving Consumer Happiness ratings — a killer combination of growth that told us ROKU’s stock still had lots of room to run.

And run it has. Since that MegaTrends report, ROKU stock has tripled again, moving from $140/share to as high as $473/share just a couple of weeks ago.

That’s a gain of more than 900% since our initial bullish report on ROKU — simply by following the consumer data!

Obviously, we’re thrilled with the company’s execution and returns so far.

But like all investors, we know the past is great for educational purposes (in this case, don’t take profits when consumer data is still with you!), but the money is going to be made in the future.

What’s next for ROKU?

In 2019, Roku was a story about user growth. Now that’s changed.

Today, it’s all about ad dollars.

In the first quarter of 2021, ROKU shares popped after hours on the heels of the company’s earnings report.

Even though Q1 active account growth slowed (+2.4 million, significantly lower than pandemic-driven growth), revenue soared +79% YoY, driven higher by ad sales.

This most recent quarter, ROKU disappointed investors, citing reopenings as a driver of lower total streaming, something that LikeFolio data accurately captured leading into the report:

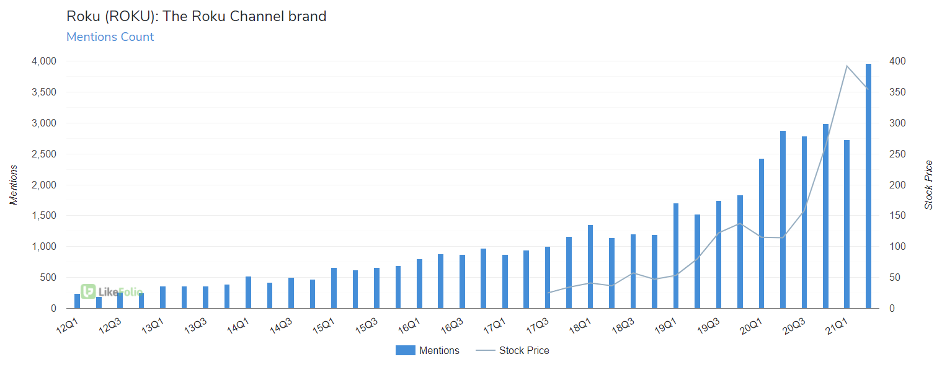

A positive sign for potential advertising capture is the growing consumer buzz surrounding the Roku Channel, where Roku will be able to generate the highest ad revenue returns.

The Roku channel just posted the strongest mention volume we’ve ever recorded, driven higher by its syndicated and original content: +37% YoY, +45% QoQ.

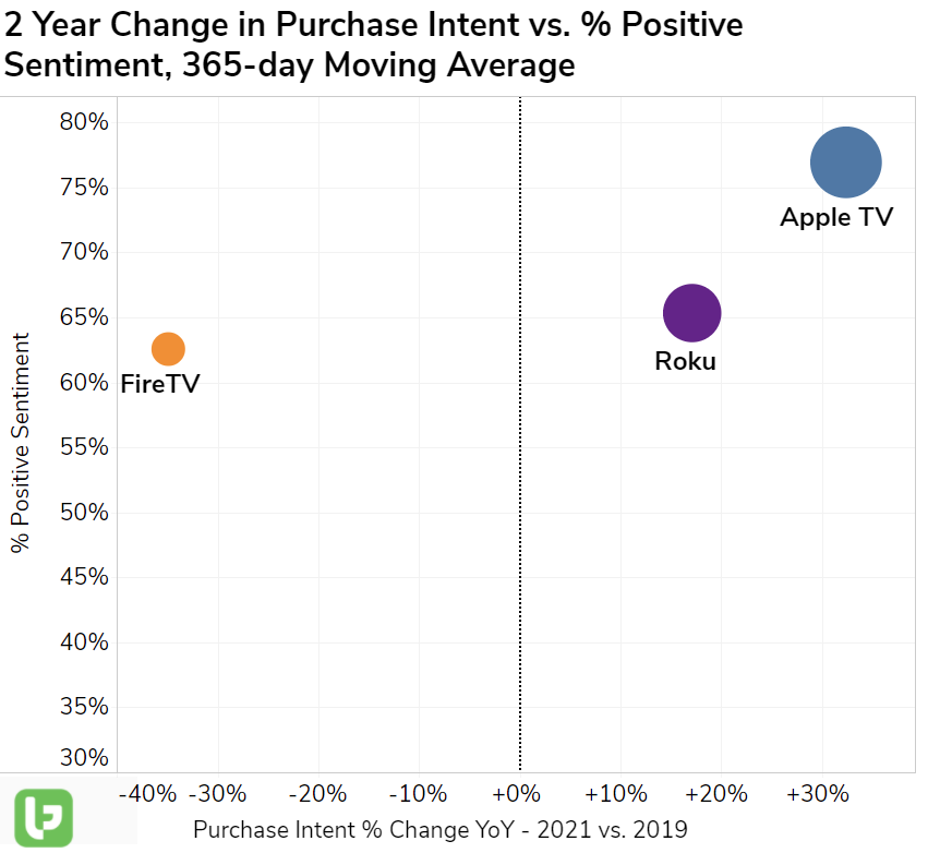

We’re also monitoring two headwinds for Roku moving forward: competition and carriage disputes.

Watch out for competition from Apple TV. While it’s tough to separate Apple TV content from device mentions on the brand scatter chart below, the end result is that Apple is receiving a lot of interest from consumers. In contrast, Amazon Fire TV is losing.

Carriage disputes have a big impact on sentiment. When Roku announced it was removing YouTube TV from its channel store in a dispute with Google, consumer sentiment for Roku dropped -12 points.

Sentiment has since normalized, but qualitative analysis reveals consumers are still frustrated when they can’t stream their desired content.

While user growth may be slowing, device-driven eyeballs are heading in the right direction.

We like this company long term, and think the name is well positioned to capture a growing amount of streaming ad spend.

Bottom line: The consumer data for ROKU is still trending positive, but not nearly as impressively as it was when we first noted the opportunity at $40/share, or when we doubled down with our MegaTrends Report at $140/share.

With ROKU stock sitting just above $400 now, we will continue to monitor the consumer data for opportunities in this stock going forward. As always, LikeFolio members will be the first to know.

Andy Swan,

Founder, LikeFolio