What Biden’s LNG Rule Would Mean for Energy Investors

The annual G7 Summit – made up of representatives from Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States – took place over the weekend.

Each year, representatives gather from these seven advanced economies to discuss financial, social, and governmental policies.

During the event, the nations’ leaders pledged to reform vaccine rollouts and called out China on human rights abuses in Xinjiang and Hong Kong.

But the biggest development centered around climate change policy. The seven nations have agreed to a new framework to slash greenhouse gas emissions by 50% by 2030.

The Biden administration has been very active in pushing new policies here in the United States that would transition from traditional oil and gas. As a result, alternative energy stocks continue to enjoy a wave of positive sentiment due to domestic and global efforts to reduce the consumption of fossil fuels.

While the latest G7 pact generated headlines, I want to discuss another Biden proposal that would dramatically impact the U.S. energy sector.

This could shake up the midstream energy sector that we discussed at length last week. But it stands to favor a few select companies that operate in the pipeline business.

Let’s dive in.

Politics, Always Politics

The Biden administration is trying to walk a fine line on energy and environmental policy. Across the country, environmental advocates and lobbyists have pushed for bans on fracking, eliminating exports of liquified natural gas, a ban on permits for drilling on federal land, and much more.

At the same time, reality must be sobering for the administration. The shutdown of the Keystone Pipeline has eliminated jobs for union members – a traditionally solid voter base for Democrats.

According to The Hill, the pipeline would have created about 1,000 jobs and generated more than $8 billion in economic activity. Instead, the pipeline will turn into 48,000 tons of scrap metal valued aft just a little more than $50 million.

In addition, reducing U.S. energy production increases reliance on other nations while emboldening hostile countries that produce oil like Iran and Russia.

The transition away from traditional oil and gas is not going to happen overnight. It likely won’t be complete by 2030. This means that the U.S. will probably need to continue using natural gas as a major bridge fuel until mass adoption of alternative energy systems is possible and reliable.

With that said, the Biden administration is looking to reverse a rather important rule implemented during the Trump administration around liquified natural gas (LNG).

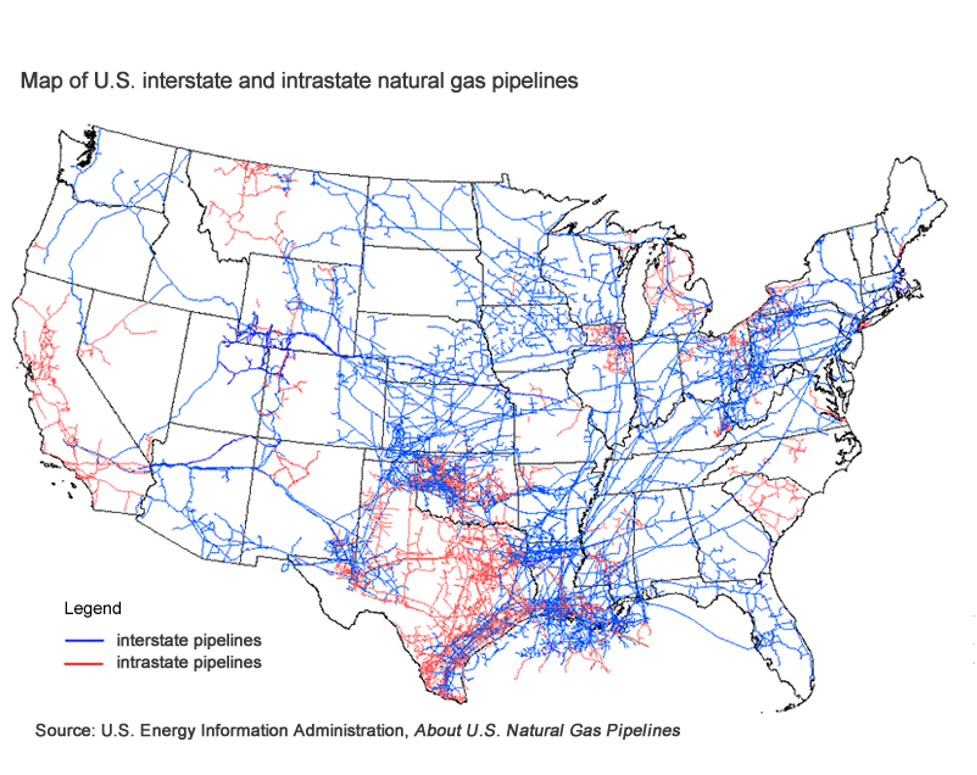

Remember, last week, I showed a map of oil pipelines all across the United States.

The map below is even more vast.

This tracks every natural gas pipeline in the continental U.S. Believe it or not, the United States produces so much natural gas that we don’t have enough pipelines.

Long battles over pipeline construction have made it harder to move natural gas. To make LNG, producers typically ship natural gas to a liquefaction plant. There, refrigeration units chill the gas to negative 260 degrees Fahrenheit. This converts the gas into a liquid and makes it easier to ship.

Then, the companies must get the LNG to export terminals, where it is sent to other nations.

Pipelines aren’t always available. And trucks can only carry so much of the fuel.

As a result, energy companies must turn to rail companies. It can be expensive. But it can also be dangerous, especially in more dense areas of the nation. For years, the U.S. government had not allowed trains to transport these fuels through highly populated areas.

But the Trump administration wanted to expedite the export of LNG. So the administration reversed a long-standing rule that would allow these trains – carrying a highly explosive fuel – through towns to reach export terminals.

And while the new rule required railcar companies to increase the size and thickness of the tanks to secure the fuel, the optics are highly concerning. Rail companies naturally want the business and have said 99.99% of hazardous materials transported by rail reach their destination without incident.

But as we know, it only takes one event to reverse social sentiment quickly.

The Biden administration is looking to make a change here.

While this would just return the supply chains to the pre-Trump guidelines, it will likely also spur both debate and innovation. Moreover, for the midstream – the companies engaged in transporting fossil fuels from production to downstream end-users – we will probably see changes.

- First, pipeline companies that already have existing deals will likely increase their rates as railways get less business.

- Second, we’ll start to see more trucking companies in the space, since these provide the most nimble approach to shipping.

- Third, we may see higher costs for the export terminals, which had counted on these rules to expand their international shipping.

We’ll continue to monitor the Biden administration’s creeping environmental agenda. This remains a critical point of policy that will likely grow more restrictive on energy firms in the year ahead, regardless of the economic impact.

The end of the Keystone Pipeline, the cessation of drilling in Alaska’s Arctic National Wildlife Refuge, and the Biden administration’s commitment to aggressive emissions reductions will profoundly impact the energy sector.

We’ll continue to explore stocks to buy or avoid based on these trends in the weeks ahead. In the meantime, if there is a topic you want to hear about or a question you have that you’d like me to cover here, I’d love to hear from you. You can reach out to me anytime. I can’t respond personally to every email, but I read them all!