When to Sell 50 of the World’s Most Popular Stocks

|

Listen to this post

|

Introduction

Any successful investment plan has to tell you when it’s time to sell.

That’s big: If you’re sitting in stocks that are falling, or that you have a big loss in — and you don’t have an exit strategy in place — you’re putting your own financial future at risk.

Let’s make something clear: This report’s title is accurate — but not complete.

Yes, we’ll explain when you should sell 50 of the most popular stocks. However, the principles in this report will actually tell you when to sell (or buy) any stock — regardless of how long you may have held it, who recommended it, or what year the calendar says you’re in.

Indeed, we created this report because of what is almost a “dark secret” of the investing world. Not enough experts discuss it openly with Main Street investors who do not have access to the insider information and high-tech systems that Wall Street pros and hedge fund managers do.

What’s the secret? Simply this: It is not enough to pick the “right stocks” to succeed as an investor.

You also need to make these moves at the “right time.”

You need to know when to buy a given stock — and when to sell it.

Unfortunately, precious few seem to know how to do either with confidence and consistency. (Especially the knowing-when-to-sell part.) But for you, that could begin to change in just a few minutes.

The wild ride isn’t over yet — not by far. There are even bigger market moves still to come.

So let’s learn when to sell 50 of the most popular stocks — and how to identify others just like them.

When to Get In: Momentum, Trend, and Volatility

Of course, it’s extremely important to know what kind of stocks to buy and when to buy them. That’s not the focus of this report, but we can’t just skip the topic altogether.

Fundamentally, most successful investors strive to invest in stocks with strong momentum and a favorable trend. There’s much more to it than that — but without those, you’re probably better off taking a pass.

By looking at the momentum and trend, investors can have a good idea which stocks and options have the potential to be the most successful before even investing a penny.

There are two other factors we need to touch on: volatility and research.

Volatility: This measures the way stocks move up and down as a natural function of the market. No two stocks are identical — some are highly volatile, and others are much less so. And that’s as it should be.

This matters because having a reliable way of taking into account each stock’s unique measure of volatility is one of the keys to successful investing. It allows investors to compare one stock with another and align their picks with their investing goals.

Research: It’s critically important that investors make their picks based on research-backed information. Because if their picks are not based on research, they are almost certainly based on guesswork, emotions, or “blind trust” in some person or organization. And that isn’t likely to work out very well for most investors. Certainly not with any consistency.

In conclusion: The key to knowing when to buy stocks is to focus on momentum and trend, using reliable research to take account of each stock’s unique volatility profile.

When to Get Out: The Necessity of Having an Exit Strategy

How do you know when to get out of a stock?

Here’s the bottom line: You must know the timing of your exit before you even buy.

It’s called an exit strategy — and it is impossible to overstate the importance of having one.

This is critical for at least two reasons. First, an exit strategy helps smart investors lock in and preserve gains while protecting themselves from loss.

For example, by combining a stop-loss order with knowledge of a stock’s level of volatility, they can decide ahead of time how much give-and-take they are willing to tolerate for their stock pick.

This in turn helps them strike a critical balance as they watch the ups and downs of the market:

- If they sell too soon, because their stock is dropping at the moment, they’re likely to miss out on incredible gains. (This can especially happen with highly volatile stocks.)

- If they sell a stock too late, and ride its downward plunge too long, they’ll likely suffer a major loss. (This can happen especially with less volatile stocks.)

You definitely want to avoid either of those situations.

Second, an exit strategy removes dangerous emotions and guesswork from the equation.

In other words, the worst time for an investor to make a decision about whether or not to sell a stock is when they are in a state of uncertainty, or maybe even anxiety, about their stocks — and reacting to all the fear-mongering and chaos the media puts out 24/7.

Under those circumstances, it’s far too easy for investors to tell themselves they’ll sell their stock “when it returns to breakeven” — and then watch it keep falling until it’s all but worthless. Or they may panic and dump their stock too soon — only to watch it soar hundreds of percent afterward.

In fact, psychologist Daniel Kahneman won a Nobel Memorial Prize in Economic Sciences for his work with Amos Tversky proving that investors are not rational decision-makers. Instead, investors regularly do things like buy high and sell low (instead of the opposite) and get caught up in the “herd mentality.”

So, successful investors don’t rely on their irrational decisions made in the moment. Instead, they decide ahead of time under what conditions they will sell their stock. And when those conditions come together, they sell — regardless of their emotions or what the news and “experts” are telling them.

That is the best time for an investor to sell their stocks.

In Conclusion: The key to knowing when to sell stocks is to develop an exit strategy before even buying a stock, and then hold on to the stock until the conditions of that strategy come to pass.

What Not to Do: Even Billionaires Miss This

At this point, let’s look at a real-life example to show you that it’s all too easy to pick the right stocks — but miss out because of not knowing when to exit.

Backtesting shows that even the most esteemed billionaires have made big emotional mistakes that cost them massive sums of money.

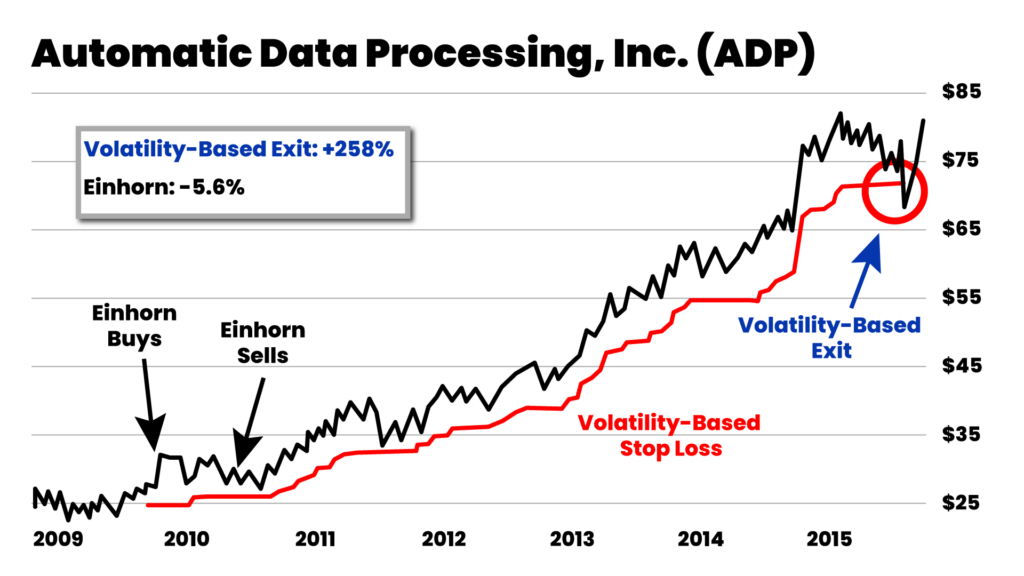

Take David Einhorn, for example. He is the founder and president of Greenlight Capital, a “long-short value-oriented hedge fund” with nearly $1.6 billion in assets under management.

In late 2009, he opened a position in ADP, a provider of payroll and HR solutions software, for about $31 per share. He went on to hold the position for about nine months, during which time it did not do anything spectacular — it primarily fluctuated between $29 and $33 per share. You almost can’t blame him for stopping out with a small loss — 5.6% — and moving on to something potentially more profitable.

But our backtesting shows that if he had used a simple, volatility-based trailing stop, he could have stayed in the position for nearly six years — and would have had a 258% gain to show for it.

Of course, this is just one example of a mistake a particular billionaire made — and Einhorn didn’t become a billionaire without plenty of successes, too. But it’s a solid reminder of how important it is for investors to get their exit strategy right.

Case Study: When to Sell These 50 Big-Name Stocks

A proprietary system of volatility-based trailing stops can tell you when to sell any stock you own.

You can interpret this system of volatility-based trailing stops as follows:

Green: The stock is healthy. Do not sell it; but follow the listed Health Stop Price. (This also tells you the stock is a good buy if you don’t currently own it.)

Yellow: The stock could go either way. If you already own the stock, keep a close eye on it. If it reaches the listed Health Stop Price, it’s time to sell.

Red: The stock is not healthy. It’s time to sell.

*Note: The list of stocks below is refreshed after every trading day.

Time to Sell Your Stocks?

No two investors are exactly alike — and no two stocks are, either. But when it comes to knowing when to sell any stock you own, there are a few powerful principles that apply across the board.

If you are an investor and want to know when to sell a stock:

- You accept that the timing of when to buy — and when to sell — is a critical part of the equation. Merely getting your hands on a stock isn’t likely to help you very much.

- You decide the best time to make your exit before circumstances force you to ask yourself if you should sell.

- You make this possible by developing an exit strategy before even purchasing a stock.

- You base your exit strategy on reliable research to take account of each stock’s unique volatility profile.

- You hold on to a stock until the conditions of your exit strategy come to pass.

Good investing!