When Wall Street Yawns, It’s Time to Do This

|

Listen to this post

|

Lucas Downey, Contributing Editor, TradeSmith Daily

Investors are giddy. After a 10% rise in the S&P 500 in the first quarter, I can’t blame them.

Day after day we’re getting more and more analysts upgrading their price targets. Finally, the crowd is in full force behind the mammoth rally.

That is, the mammoth rally in large-cap stocks…

You see, in 2024 if you’ve been fortunate enough to hold select companies like NVIDIA (NVDA) or Meta Platforms (META), chances are you’re sitting pretty. They’re up 78% and 38% year-to-date, respectively.

These are the types of firms Wall Street is enthusiastic about right now. They get all the airtime.

But try uttering words like “small caps” in a trading room, and you’ll be greeted with yawns.

Plenty of smaller names have flatlined in 2024. The S&P Small Cap 600 eked out a gain of only 2% in the first three months of the year, illustrating the massive dichotomy in investing styles.

But those yawns breathe opportunity…

As I’ll show you, history is extremely kind to small-cap stocks whenever they have a lackluster first quarter.

And that’s not all we have to be excited about.

Under the surface of the market, there’s a massive rotation starting in many previously unloved areas…

Sleeper stocks are finally on the move.

A Massive Trend Change Beneath the Surface

With Q1 in the books, the story I keep hearing is to keep buying large caps and underweight small caps.

One look at the year-to-date chart below could have you believing that narrative. The S&P Small Cap 600 is drastically underperforming the S&P 500.

For the small cap barometer, I’m using the iShares Core Small-Cap ETF (IJR), and for the S&P 500 I’m using the SPY ETF.

Large caps are up 10%, while small caps are barely positive at 2%:

The favoritism for large caps has been in place for more than a few months. It’s actually been a theme for well over a year.

But, recent under-the-surface action reveals how the market seas are shifting. Diving into sectors in a shorter time frame showcases brand new leadership.

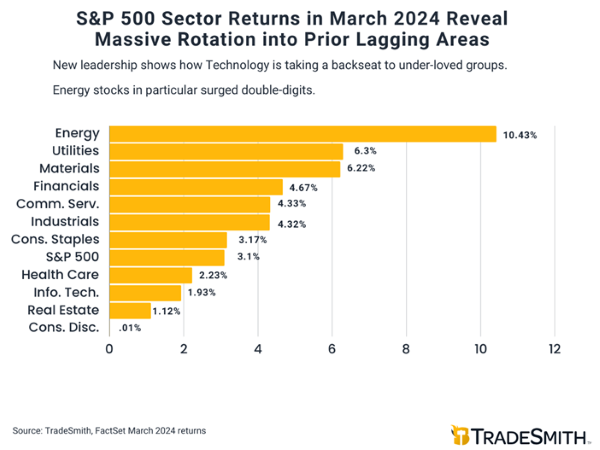

Below lists the S&P 500 sector performance for March. This may come as a surprise, but Technology is nowhere near the top of the leaderboard.

In fact, all sectors except two outperformed the growth-heavy sector in March:

And for those keeping tabs, TradeSmith Daily recently beat the drums on the Energy sector based on a few bullish traits for the group.

But why this sudden leadership change is important is twofold:

- First, it indicates that large caps can underperform in the near-term given Tech’s high concentration (30%) in the S&P 500..

- Second, this lends a lot of runway for prior sleeper stocks in groups like Energy (4%), Materials (2%), Financials (13%), and Industrials (9%), with each containing much smaller allocations in the large-cap index.

More to this last point… If you’d like to make a better wager on these new leading sectors, betting on the S&P 500 may be suboptimal.

Small caps, specifically the S&P Small Cap 600 Index, have chunkier allocations to these reawakening areas.

Financials and Industrials exposure jumps to 18% each. Materials clock in at 6%, while Energy slightly lifts to 5%.

Importantly, the small-cap technology weighting sits at just 12%… a fraction of the large-cap allocation. In other words, it’s more diversified into sectors that are outperforming right now.

If you’re not yet convinced that small caps could be the next hot ticket… this historical study will do the trick.

History Says Small Caps Could Surge into Year-end

It’s one thing to get bullish on an underperforming group based on new leadership… it’s another altogether when there’s rock-solid, data-driven evidence.

And that’s exactly what we have.

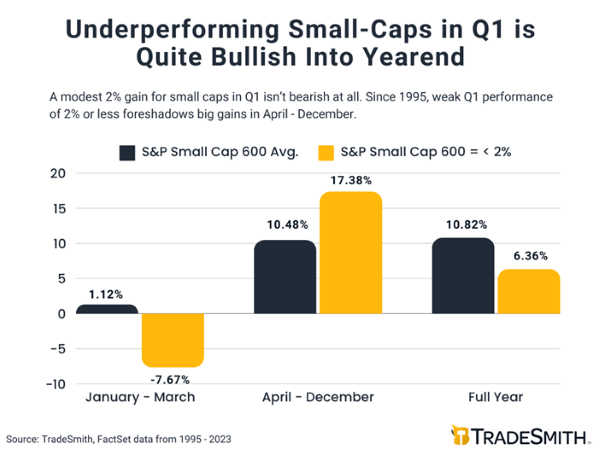

Turns out, when small caps produce lackluster returns in the first quarter, the remainder of the year tends to crush market averages.

Looking back to 1995, whenever the S&P Small Cap 600 returns 2% or less in the first quarter, like we had in 2024, the remainder of the year averages a 17.38% gain:

This graphic tells you all you need to know. Don’t sleep on your smaller stocks. Odds favor a resurgence… just when the crowd least expects it.

While no one is paying attention to the new groups slowly improving like Energy, Materials, Industrials, and Financials… take it as a very good sign.

As Warren Buffett famously said, “Beware the investment activity that produces applause; the great moves are usually greeted by yawns.”

Regards,

Lucas Downey

Contributing Editor, TradeSmith Daily