Why Gold Is Lagging Despite Rising Inflation

I love gold.

Love it.

It’s an incredible hedge against geopolitical tensions around the world.

But if you’re like me, you’re scratching your head when you look at today’s price. It’s currently trading under $1,900 per ounce.

On Friday, gold prices fell despite news that the Consumer Price Index (CPI) hit its highest level for May since 2008.

It fell despite the fact that other inflation trades are breaking out.

It fell despite Bank of America’s aggressive $3,000 price target at the height of COVID.

It fell despite its historical protection against all things uncertain.

What is going on?

I know you want answers.

Let me walk you through why this time is different for gold and inflation.

More importantly, we’ll talk about the best way to generate real income from one of the most common positions among gold investors.

What Is Happening Here?

Want to see an absolutely amazing chart?

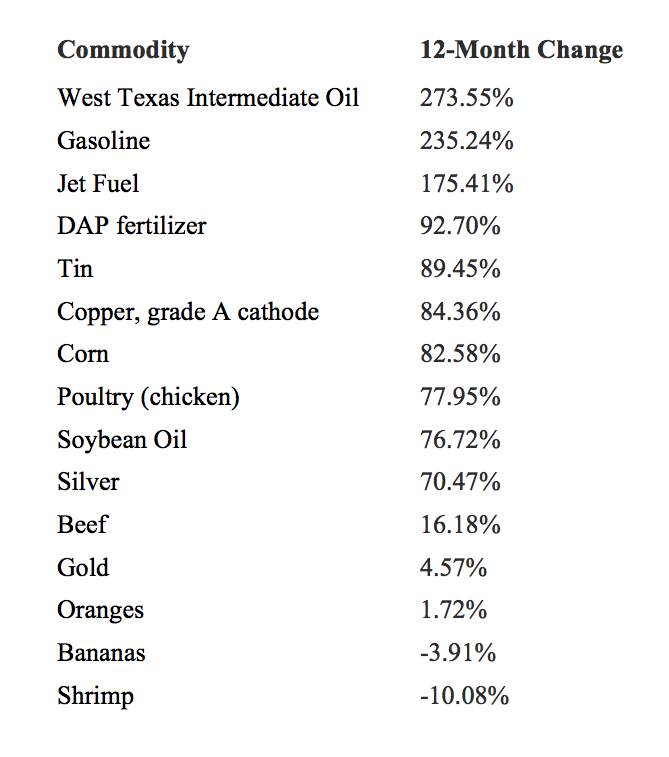

Check out the performance of certain commodities over the last 12 months.

West Texas Intermediate crude oil is up more than 273% year-over-year.

As you know, commodity prices have generally gone through the roof this year. The ongoing reopening trade has created pent-up demand across the board.

Yes, we are still recovering from a pandemic. And yes, producers of many different commodities dramatically slashed production last year due to growing uncertainty around the length of economic shutdowns and the expected impact on demand.

Prices of everything have risen over the last 12 months, with few exceptions. Keep in mind, however, that the prices of some commodities that are off sharply (like peanuts down 30% year-over-year) did hit decade-long highs due to a surge in demand at the onset of the crisis.

The reinflation trade around the global economy has sent many commodity prices to nosebleed levels. Chicken prices are up nearly 78%. Copper prices are at record highs due to strong industrial demand. Oil and gasoline continue to rise.

But what inflation play is not performing up to standards?

Gold prices are up just 5.47% over the last 12 months.

How can this be? Isn’t gold supposed to be the great inflation hedge?

Well, we have to better understand the role of gold in this economy.

You see, gold doesn’t have any significant industrial demand. More than 80% of gold is consumed each year in the form of jewelry. Yes, it does have some demand for manufacturing.

For example, Apple uses about 0.034 grams of gold in mobile phones, and it’s even used in replacement teeth.

But for the most part, this is not something used very much as an industrial or commercial metal.

Silver, however, is. It’s up more than 70% in a year. The commodity is commonly used in X-ray machines, solar energy systems, medicine, mirrors, automotive components, and silverware. Yes, it’s very popular in jewelry, but it has that critical industrial component.

I stress the commercial and industrial factors because I don’t want gold investors to get too hung up on the current situation when it comes to their holdings.

Right now, we’re seeing big moves in other commodities because of economic activity and growing demand in those commodity-dependent industries. One should not ditch their gold holdings or panic because gold has lagged these other commodities.

How to Buy and Hold Gold

I think it’s very important to own gold in any economic environment. It’s also important to balance your portfolio to avoid overexposure to the yellow metal.

I personally hold about 10% of my money in “alternative” assets like gold and cryptocurrency. I think this level represents the most that one should own in these assets.

This provides a nice hedge against the rest of my stocks and bonds. And it provides some upside given current economic events. Although gold has lagged against other assets this year, I expect that it will find its footing.

In a period where interest rates are in focus, gold will unfortunately face some pressure due to its lack of dividends. And keep in mind that it is subject to the same fundamentals of supply and demand as any other commodity in the world.

That said, I do have a solution to help you generate gains from an existing gold position.

Instead of holding an asset that doesn’t generate interest or dividends, you can use one of the strategies I recently outlined. By selling covered calls on an ETF like the SPDR Gold Trust (GLD), you can boost your income and wait for gold to break out.

If gold prices do rise above the strike price, and you have to sell your stake, you won’t complain. You’ll have made solid gains on your position, and you can rebuy that stake and just start over again selling covered calls for more income. I’ll be talking more about strategies like this on gold and other commodities very soon, and the frequency with which you can earn income from these positions.