Why the NVDA Dip Is a Screaming Buy

|

Listen to this post

|

Tech stocks are making waves lately…

Last Friday saw a monster rebalance occur in one of the largest technology ETFs on the market, the Technology Select Sector SPDR Fund (XLK).

Thanks to Nvidia’s meteoric rise this year, gaining 156.89% YTD, the company briefly became the largest in the world… overtaking both Apple (AAPL) and Microsoft (MSFT).

With Nvidia joining the $3 Trillion Club, the XLK fund made the announcement that they were increasing NVDA’s weight to 20% of the ETF, while at the same time reducing Apple’s slice of the basket to 4.5%.

According to Bloomberg, this shift created $10 billion of inflows to NVDA shares – and roughly $11 billion in outflows from Apple shares.

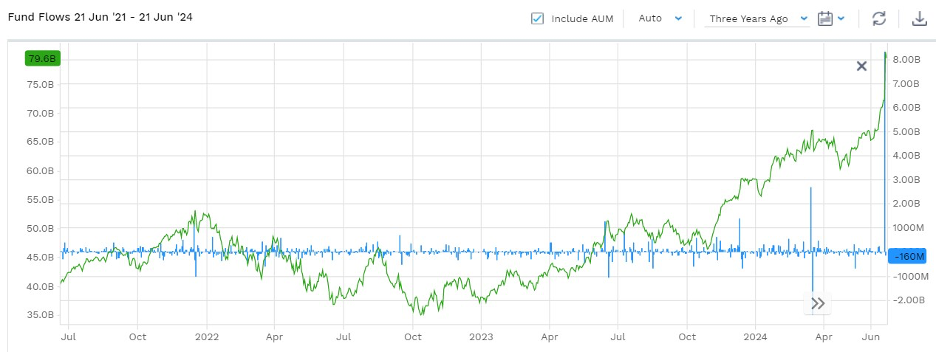

The resulting trading mania didn’t disappoint, as over $8 billion was added to the XLK ETF on Friday… the most in years. See the inflow (the blue line) in the chart below:

So, XLK went from about $71 billion in assets under management (AUM) to $79.6 billion AUM overnight. If you noticed a lot of trading activity in your tech stocks, now you know why!

But after these exciting events, there’s always a cooldown period.

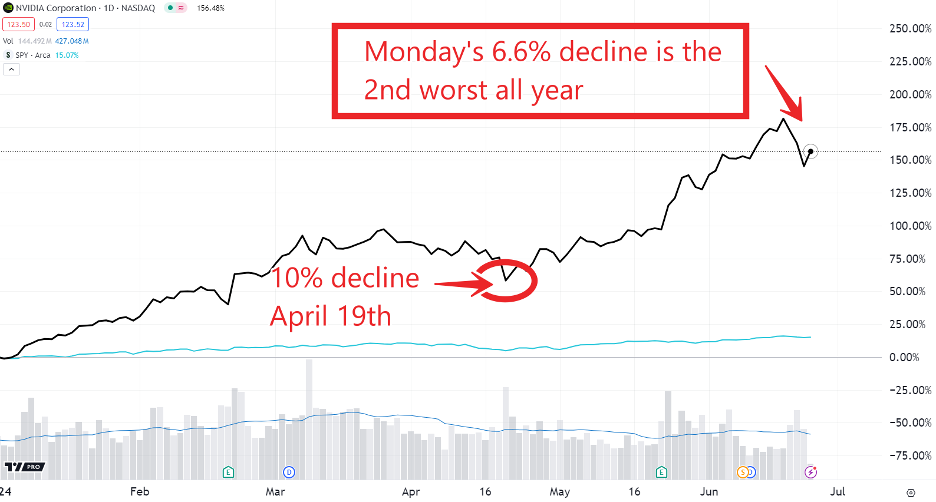

On Monday, Nvidia shares suffered a 6.6% pullback, the second-largest daily drawdown in nearly 18 months.

I’m sure many reading this are curious what that could mean for the future of arguably the most important company in the world.

Turns out, there’s a strong pattern that emerges after these violent selloffs. One that tells us now’s the time to buy NVDA stock with both hands.

But before we dive into the data-rich study, let’s take a look at Monday’s action and put it into some much-needed context…

The Second-Worst Trading Day for NVDA This Year

Until now, waiting for a dip to buy into NVDA shares has required patience… a lot of patience.

In 2024, the stock has ramped by the triple digits. Monday’s 6.6% drop is the second ugliest this year – the last time we saw a similar wipeout was on April 19, when the stock plunged 10%:

From this limited lens, it appears that we should buy the dip in NVDA. But let’s expand our range a bit to confirm.

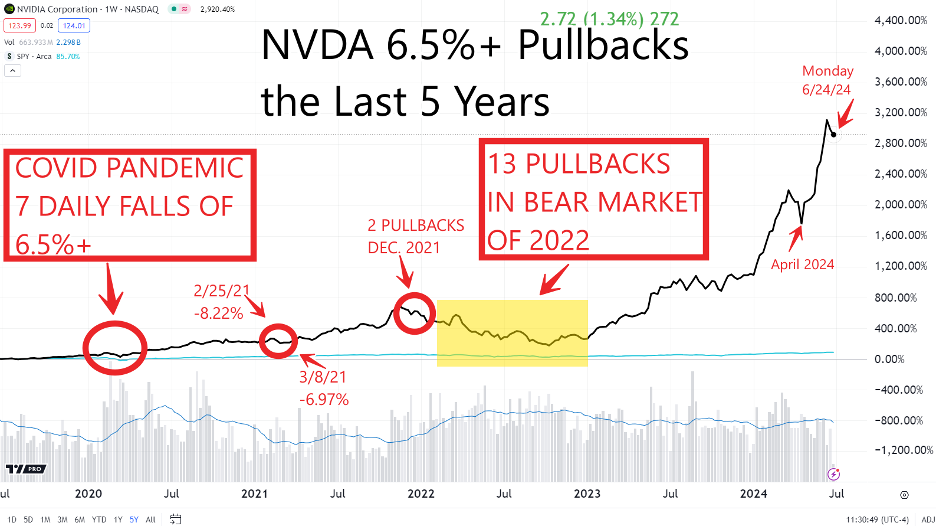

On a five-year horizon, there’ve been 25 price meltdowns of 6.5% or more in a single day – not counting NVDA’s Monday drop.

That sounds like a lot, but keep in mind that this includes both the bear market of 2022 and the COVID pandemic plunge of 2020… two of the nastiest market-wide pullbacks in recent memory.

I’ve culled together the five-year chart and detailed all 26 of the daily plunges greater than 6.5%. Here’s a quick takeaway:

- In 2020, there were seven instances of NVDA dipping 6.5% or more.

- In 2022, the tech bear market took NVDA shares down 6.5% or more on 13 occasions.

- Most importantly: Investors were paid handsomely to hold through the weakness, as shares vaulted nearly 3,000% over the last 5 years.

Look, as I’ve pointed out many times in these pages: Nvidia is a superstar stock. It’s a rare breed of company that has seen relentless institutional buying over the years.

The company’s growth has also been second to none.

But here’s where understanding history can make you a better investor…

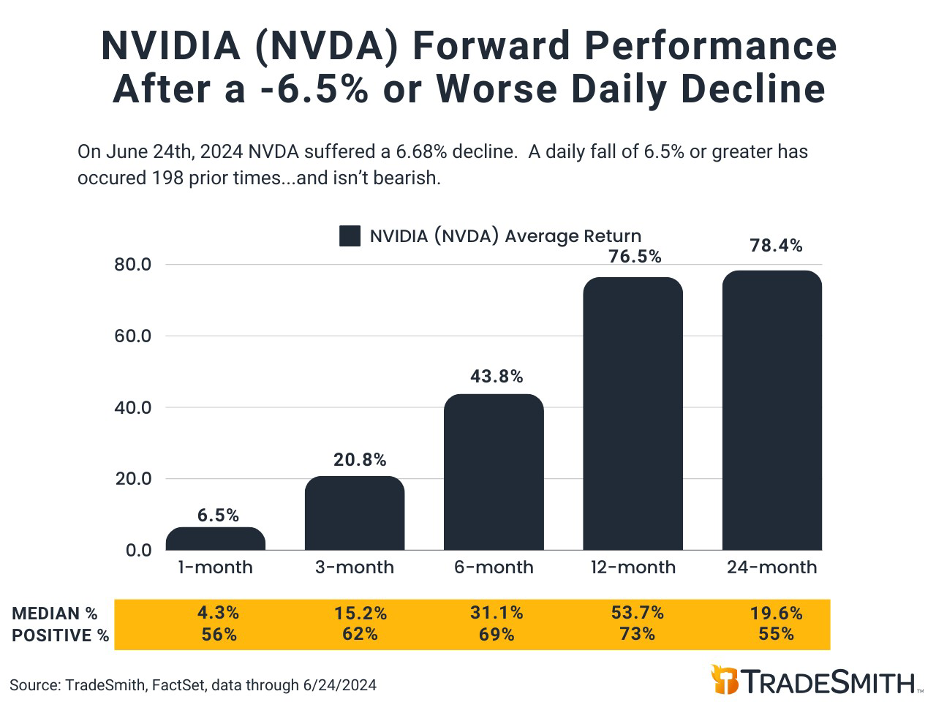

Since 1999, Nvidia has fallen 6.5% or more 199 times… roughly seven times a year.

If you think these bouts of volatility are a negative… try again. In fact, these dips tend to ignite ferocious rallies.

Since 1999, whenever Nvidia shares fell 6.5% or more in a day:

- Three months later, they ripped up for an average gain of 20.8%.

- Six months after, they soared 43.8%.

- 12 months later, we see them book a 76.5% gain.

If you’re second-guessing holding onto Nvidia, don’t let the decision have anything to do with Monday’s beatdown…

The data has spoken – keep holding.

Pullbacks are necessary and part of the process. So, don’t avoid them… use them to your advantage.

Nvidia’s recent setback shouldn’t last long.

By next month and even next year… history will likely be on your side.

Regards,

Lucas Downey

Contributing Editor, TradeSmith Daily

P.S. If there’s one person who loves Nvidia, it’s Louis Navellier of Breakthrough Stocks. He’s been clear about that with his fellow investors as far back as Aug. 5, 2005, before NVDA rose up to 37,000%.

But you should know – there is a new class of AI stocks that Louis is just as excited about today. In his free briefing, Louis explains that a new wave of AI is coming to America.

One that will create profitable new companies and reshape existing occupations on a scale we haven’t seen since the dot-com era.

Those dot-com days were good to investors like Louis who got in on stocks like Lam Research, before it rose up to 4,350%… Micron Technology, 2,050%… and Qualcomm, 6,235%.

Now, Louis predicts that history is about to repeat – in the LAST financial mania of this scale for the next 25 years. Click here to watch now. To thank you for your time, Louis gives two free recommendations to put you on the right side of this trend.