Your Zero-to-Hero Investment Guide

|

Listen to this post

|

| Note from Michael Salvatore, Editor, TradeSmith Daily: TradeSmith CEO Keith Kaplan owes much of his success to two hardworking, loving, and influential people: his parents. As Keith shares below, his folks weren’t wealthy. They had to scrape and sacrifice to provide for him and his sister – even spending 10 years in one of the most dangerous school districts in the U.S. just to get a chance at a better life. But these principles, among others, showed Keith what it takes for anyone to become a success. A little diligence and a three-step plan, Keith proves, go a long way. Read on to learn Keith’s three key pillars that form the foundation of a great investor. And get some actionable guidance to help you no matter what stage you’re at in your journey – whether you’re at a negative net worth or have billions to your name. |

Your Zero-to-Hero Investment Guide

By Keith Kaplan, CEO, TradeSmith Daily

My parents grew up in Baltimore City. While it wasn’t as dangerous in the ’40s and ’50s as it is today, it was still riddled with poverty and crime.

They had a dream to get educated, get out of the city, and move to the county. The problem was … they were poor. No one in their families had gone to college and they couldn’t afford it.

But they caught something of a lucky break. At the time, Baltimore City ran a program where they paid for higher learning… so long as you committed to teaching in the city for 10 years.

My parents would eventually become the first in their families to graduate from college… and they went for free.

Though, it didn’t come easy. As they served their time in the inner city, they had to break up fights with knives and guns, putting their life on the line every day. They had to appear in court numerous times for their students. The stories they told us were nuts.

As soon as they could, they moved on from working in the inner city and got teaching jobs out of the city.

My parents were two of the most incredible people anyone could ask to have in their life. They’re my heroes. And they taught me valuable lessons that I never even realized I was learning until later on.

For example, I never even realized how poor we were. No one ever talked about it growing up. And we were never made to feel like we were a financial burden.

We just never had much, and I didn’t even realize it until I reflected on what we had growing up – later in life.

You see, we rarely got out of Maryland for a vacation, typically landing at Ocean City, Maryland, in a dump motel.

But one time, we trekked 17 hours by car to Orlando. There we stayed in a run-down Econo Lodge Motel where my sister and I were locked in our room until 10 a.m. every day so my parents could go to timeshare presentations to get us free Disney World tickets.

It was the vacation of a lifetime. I felt like royalty that week…

Things are much different today. My parents are in their late 70s, have zero debt … two homes … two cars … and a nice nest egg. They will survive retirement comfortably.

So, how did they do it? And, most importantly, what can we all learn from them?

The key to being a great investor comes down to what I call the three core pillars of wealth…

Debt… Savings… Investment

These three factors are what separate those who struggle financially with those who thrive. The zeroes from the heroes. And the order is just as important as the pillars themselves.

My parents followed these three principles throughout their life. And while it took some time, it got them to where they are now.

Step 1 on your wealth journey, no matter your situation, is to have little to no debt.

The more debt you take on, the more you are someone else’s investment. You’re just part of the system. So kill all debt before you ever try to “make it big” in the stock market (or options or crypto market).

Our reach at TradeSmith is to hundreds of thousands of people. Some of you have no money, absolutely none. And some have tens of millions of dollars to your name.

Heck, I’m sure we have a billionaire reading this article right now.

But the most important thing we can all learn… debt is someone else’s investment in your financial struggle.

Credit cards charge over 20% on your balances that you carry past a due date. Mortgages are running at 6% to 7% depending on your credit score right now, and you oftentimes pay more in interest on the life of that loan compared to the cost of your house. Car loans are running around 6%… and your car depreciates with every single payment!

Then there’s student loans, lines of credit, and everything in between. Lenders everywhere are making loads of money off people who needlessly hold onto debt.

The more debt you have, the more you’re handing lenders your future. When you think of it that way, you realize you’ll never be financially free.

So, you have to focus on dramatically reducing your cost of living and paying down that debt so you can be the financier in the relationship – making money as the investor!

If you’re in the depths of debt, it may seem like you just can’t get ahead. But I promise you, it’s a long-term game and you have to play strategically, one day at a time. Discipline always pays off.

Step 2 is to have at least a year’s worth of savings to help you get through unplanned and unwanted times.

While you’re paying off your debt, don’t ignore that savings account. Unexpected things happen all the time in life, whether it’s your refrigerator breaking down, a car accident, or losing your job.

You don’t want to be one of the 66% of Americans who said they can’t afford an unexpected $1,000 expense. That’s a dangerous place to be.

In some cases, it may even make sense to generate a savings cushion before paying off your debt, in case you lose your job or have a major financial hardship.

One way to ensure you’ll get there is to always live well below your means. Make more than you spend, and your wealth line will move up and to the right. And you should always hang onto this mindset – even after you’ve “made it.”

As for what savings account to use, we’re in a unique and beneficial moment in time. Right now, a lot of savings accounts are paying out a risk-free rate of close to 5% annually. Even a balance of just $10,000 will pay out $500 a year in income. That’s where your long-term savings should be, full stop.

So to recap, your first steps are to get out of debt and build up the savings you don’t touch. These are non-negotiables. Only once you have these first steps sorted can you start investing for the long term.

If you’re not there yet, I’d advise you print out or save this article and return to it once you do. Because it really is important to get those two factors settled before you move on.

Your Long-Term Investing Blueprint

So, you’ve shored up your financial life. You have no short-term debt in credit cards or student loans, and you have a healthy balance in a savings account earning decent yield.

Congratulations… you’re already ahead of more than half of everyday Americans. Seriously, it’s a huge feat.

So now, let’s talk about growing your wealth even more: with investing.

I’ll say right at the top that your goal should be to get rich slowly. You won’t hear about any get-rich-quick schemes here – because they never work.

What you need instead, at least to start, is a portfolio of quality, dividend-paying stocks. I recommend buying individual stocks over something like a mutual fund or ETF for two reasons:

- Funds tends to carry management fees, which eat into your returns.

- Individual stock investing helps diversify your portfolio, and helps you focus on building an army of dividend-generating names.

Dividends, too, are incredibly powerful. If you reinvest dividends into great stocks, your positions will build over time. By the time you retire, you’ll have a substantial income stream even if you start today with just a couple hundred bucks.

Here at TradeSmith, we have an incredible set of tools to help you invest.

Today, we’ll be using our Screener to help uncover a few stocks to get started on your investment journey.

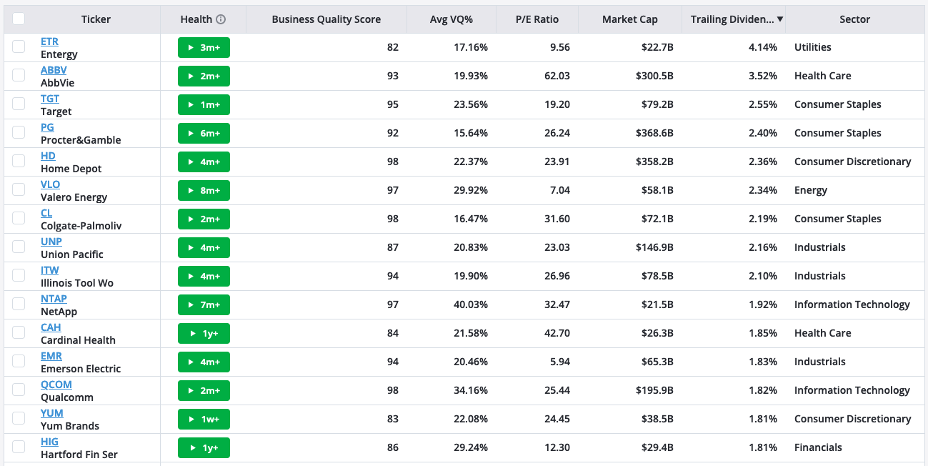

For our screen, I’ve searched our database for stocks in the Green Zone – our algorithmic measure of an uptrend. I’ve also made sure to include only stocks in the major benchmarks like the S&P 500, the Nasdaq 100, and the Dow.

All the stocks in this screener have a forward dividend yield of 0.5% or higher – to get you started with some solid dividends. And most importantly, they all have a Business Quality Score (BQS) of 80 or higher (out of a possible 100) – telling us they have strong fundamentals.

Here are the top 15 results of that Screener, sorted by each stock’s trailing dividend yield:

There are some good picks in here across multiple sectors. You have Valero Energy (VLO) in the energy sector – with an incredible 97 Business Quality Score and a 2.34% dividend yield. You also have Qualcomm, a 98-rated tech stock that pays a 1.82% dividend yield. And there’s Home Depot – a titan of retail that rates a 98 on the BQS and pays a 2.36% dividend yield.

I hope this selection is enough to get you started building a high-quality portfolio of stocks. For more, stay tuned to TradeSmith Daily – where we’ll keep sharing our best ideas to help you get ahead in your financial journey.

All the best,

Keith Kaplan

CEO, TradeSmith