This Is My Favorite Way to Make Money in Stocks

For the past several weeks, we’ve been taking a “deep dive” into the world of options.

This subject matter can be a little difficult and tedious at times. But I’ve done my best to explain it to you in a simple and (hopefully) interesting way.

We’ve covered a ton in this series so far, including what options are, how different types of options trades work, and the benefits and potential risks of each. I’ve also walked you through examples of a covered call trade and both long call and long put trades.

Today, we’re going to wrap it all up with an example of my favorite type of options trade: selling put options.

As we’ve seen, whether you buy or sell an option, you’re essentially making a bet on the future price of an underlying stock or fund. If the price of the stock does what you expect, you win the bet.

When you sell a put option, you’re betting that the stock won’t fall below a specific price (the strike price). Because you’re selling the option, you get paid your potential winnings (the premium) up front.

If you’re right and the stock price stays above the strike price, you win the bet and get to keep the premium.

If you’re wrong and the stock price falls below the strike price, you lose the bet and must give back some or all of the premium (and may even have to pay more out of pocket). Depending on how wrong you are, you can potentially owe much more than you were paid up front.

This risk-to-reward profile technically makes selling puts one of the riskiest options trades you can make.

However, we’ve also seen that these trades can have a very high probability of profit (POP).

In other words, while you can potentially lose a lot when you’re wrong, your chances of being wrong on a single trade can be surprisingly low. And we can further reduce the risk in these trades by following a few simple rules.

First, you should only sell puts on great companies. It’s simple, but the stocks of great companies tend to perform better than the stocks of not-so-great companies. They’re more stable and predictable, and there’s less risk of bad things happening.

Second, you should generally only sell puts on stocks you would be willing to own at current prices. That is one of my favorite secrets of options trading. It can transform the most significant risk of put selling into an advantage.

For example, suppose we’re bullish on Apple (AAPL) today. We expect the stock will continue to do well for the foreseeable future and would be happy to own it at today’s price of around $147 a share.

Rather than buy shares, we could sell a put option such as the AAPL $120 put expiring on Sept. 17. In return, we’d receive a premium of $33. That’s a return on investment (ROI) of around 0.3% on our capital at risk. (This is just an example. This specific trade may not be suitable for every investor.)

Now, suppose the worst-case scenario occurs. We’re wrong, and AAPL falls significantly to $115 per share before Sept. 17. We’re “put” the stock, meaning we’re required to buy 100 shares of AAPL at the strike price of $120.

Now, we’ll technically be holding an unrealized loss of $467, or $4.67 per share, on the position. That’s a loss of $500 ($5 per share) less the $33 in premium we collected up front. There’s no way around that.

But remember, we were already bullish on AAPL and willing to own it at $147. But now we get to buy it at $120 per share, or nearly 20% less than today’s prices.

We’ve lost our bet, but still get to own an excellent company for much less than it would’ve cost us to buy the shares initially.

That leads into my third rule: You should only sell puts on stocks whose shares you can afford to own.

Now, I don’t just mean you need to have enough cash to cover the potential purchase of 100 shares for every contract you sell. Obviously, that’s important, too. But it’s not enough. We want to be able to comfortably own those shares if necessary.

In our AAPL example above, it would cost us $12,000 to purchase 100 shares at the strike price. But if our total account size was only $50,000, this would probably be too much risk for us to take on a single position.

Even if we had the $12,000 in cash available, AAPL would account for nearly 25% of our total portfolio. Assuming we used a standard 25% trailing stop, we would be risking 6% of our portfolio on the position. That’s three to six times higher than the 1% to 2% we generally recommend risking on an individual position.

And finally, you should always be sure to use a stop loss on these trades.

Some folks prefer to use a fixed-percentage stop loss on the option itself. In other words, if the price of the option were to rise by 25% or 50% above the premium you received, you would receive an alert and close the trade.

This is generally a more conservative approach. It will help ensure you don’t suffer a large loss on a trade, but it will also lead to you getting stopped out much more frequently.

Others prefer a fixed-price stop loss on the underlying stock at or near the strike price. This approach will alert you only if the option moves (or threatens to move) in the money.

Personally, I like the latter. Options prices can be volatile from day to day. But so long as the stock remains above the strike price — and therefore, the option remains out of the money — it’s extremely unlikely you’ll be put the stock.

And of course, you might decide to use one or the other depending on the specific risk-to-reward profile of a particular trade.

If you stick to these rules, you can significantly reduce the risks of put selling.

OK, now let’s look at how a sell puts trade works in practice.

For this example, we’ll assume we’re bullish on digital payments company PayPal (PYPL). (Again, this is just an example. This specific trade may not be suitable for you today.)

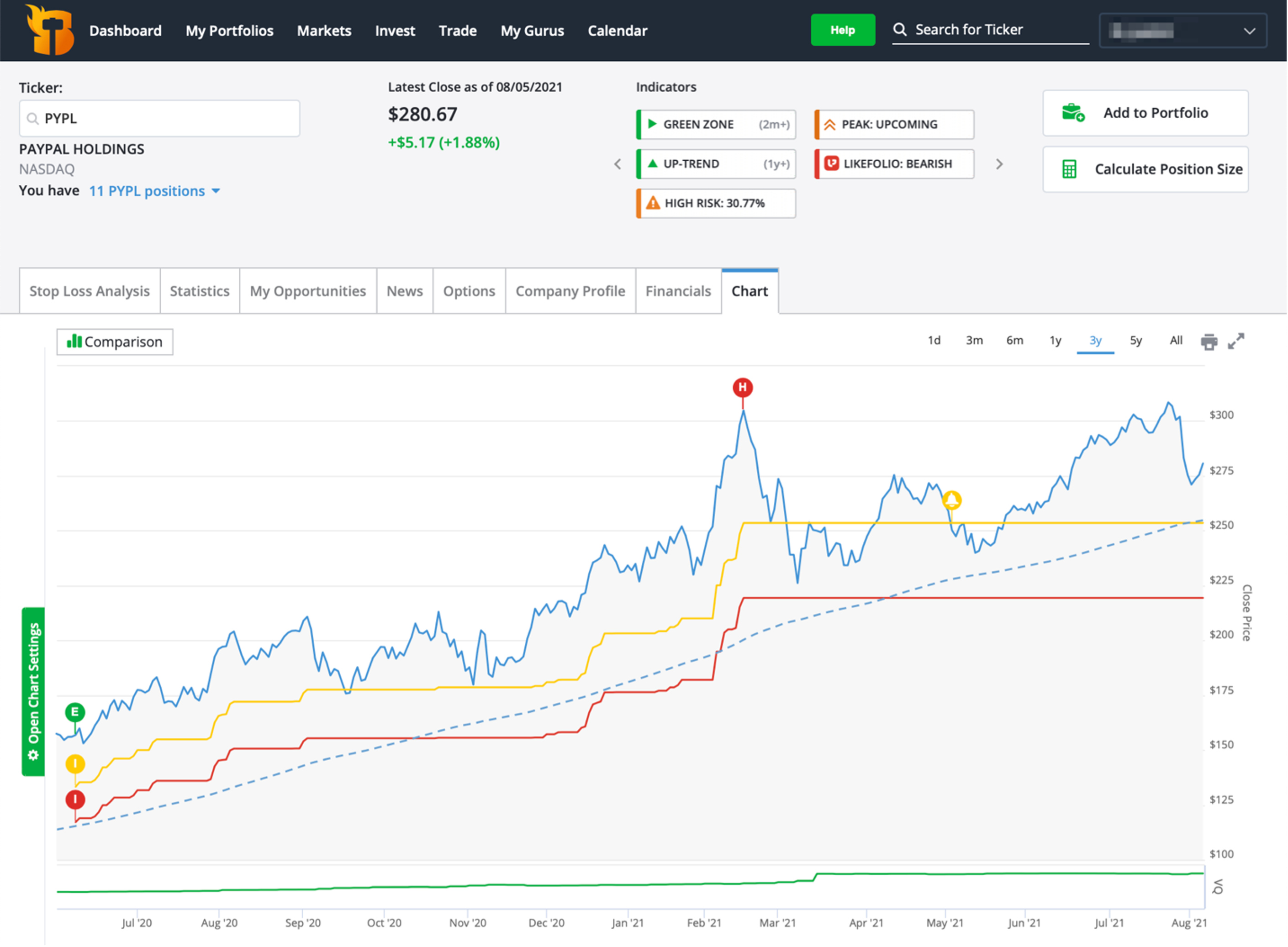

PYPL is currently trading around $280 a share and has been in a healthy uptrend since triggering a TradeSmith Entry Signal back in June 2020. We would be happy to own shares at today’s price.

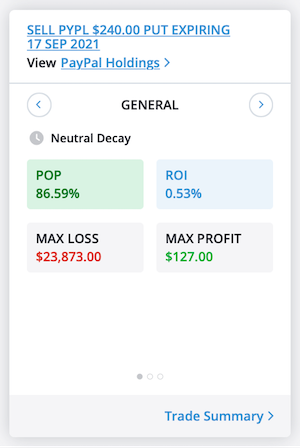

As you can see below, we can currently sell one PayPal (PYPL) $240 put option expiring on Sept. 17 and collect around $127 in premium up front.

That’s a potential ROI of 0.53% on the capital at risk in a little over a month. And according to our CoPilot by TradeSmith algorithms, it has a probability of profit (POP) of 86.59%.

In other words, there is a better than 86% chance this option will expire worthless, and we’ll get to keep all the premium we collect as profit, free and clear.

Of course, if you aren’t a CoPilot subscriber, you won’t have access to our proprietary POP metrics. But as I explained in our covered call trade example a couple of weeks ago, you can still do just fine without them.

Again, the most important point to understand is that POP and ROI tend to move inversely. All things equal, the higher the chance that a particular option will expire worthless (POP), the lower the premium (ROI) is likely to be, and vice versa.

That means your goal is to find the sweet spot that offers sufficient reward while still offering a good enough chance of success.

Like before, there’s no one right way to do this. But the guidelines I mentioned for covered calls are applicable here as well.

First, I like to focus on options expiring no more than a few months out. As you go further out, your likelihood of success (POP) tends to drop dramatically.

Second, I generally target strike prices somewhere between 5% and 20% below the stock’s current price. The more volatile the underlying stock, the more room you’ll want to give it.

And finally, I like to aim for a premium (ROI) of somewhere between 0.5% and 1.5% on my capital at risk in most situations. Less than that is generally not worth the risk, in my opinion, and more than that typically comes with a significantly lower chance of success.

The only exception is for very short-term trades with a very high POP of 98% or more. I’ve personally had a lot of success selling put options expiring in two weeks or less.

OK, so we’ve decided to sell one PayPal (PYPL) $240 put option expiring on Sept. 17.

Now let’s look at how this trade could play out.

If we’re right and PYPL is trading at or above $240 on Sept. 17, we win our bet. We get to keep the $127 in premium we received up front.

If we’re wrong, and PYPL is trading below $240 on Sept. 17, we lose our bet, and one of two things can happen.

First, if we close the trade before the option expires, we will have to settle our bet in cash.

If PYPL is trading below $240 but above $238.73, we won’t actually lose money on the trade. That’s because the $127 in premium we collected gives us a buffer of $1.27 per share. Instead, we’ll simply be required to give back some or all of that premium to close the trade.

If PYPL is trading below $238.73, we will be required to pay an additional amount out of pocket.

(In either case, if we’re still bullish on the stock, we could also consider rolling this trade forward by selling another out-of-the-money put option with a later expiration date.)

Second, if we hold the trade through expiration — or if the option holder (buyer) decides to exercise the option prior to expiration — we’ll be “put” the shares. We’ll have to buy 100 shares of PYPL at $240 per share for a total cost of $23,873 ($24,000 minus the $127 in premium).

We could then turn around and sell those shares in the market at their current price for a (likely) loss.

But again, because we were bullish and willing to own shares at $280, we may decide to hang on to our shares and wait for prices to move higher. In the meantime, we might also choose to sell covered calls on those shares to recoup some of our losses.

That’s really all there is to it. I hope I’ve shown you why selling puts is my favorite options trade. When done correctly, it’s a fantastic way to generate consistent returns, month after month (or week after week), without taking huge risks.

As always, if you have any questions or comments about this series, I’d love to hear from you. You can reach me directly at [email protected]. I can’t necessarily respond to every email, but I personally read them all.