A Rare and Powerful “Bearseye” Signal Has Been Triggered — Here’s What That Means

As a brutal week comes to a close, the Dow Jones industrial average has endured its worst stretch of losses since the 2008 financial crisis. The S&P 500 has completed its fastest correction (a 10% drop from the highs) in history. And the yield on the 10-year treasury note, a “flight to safety” barometer, has hit new record lows.

Our indicators also show a “bearseye” signal has been triggered via SPY, the bellwether S&P 500 ETF.

What is a bearseye signal? Think of the well-known “bullseye” concept — the center of a target — but applied to bearish market conditions instead of bullish ones.

Here are the conditions that trigger a bearseye:

- At least 40% of the stocks in a major index (the Dow, S&P 500, Nasdaq composite) are stopped out as determined by our trend and volatility indicators (Stock State Indicators and Volatility Quotient).

- The index itself is also stopped out.

When bearseye conditions apply, the forecast is for more downside ahead.

Below you can see the average decline percentages for the Dow Jones industrial average (DJIA) after a bearseye trigger, dating back 20-plus years to 1998.

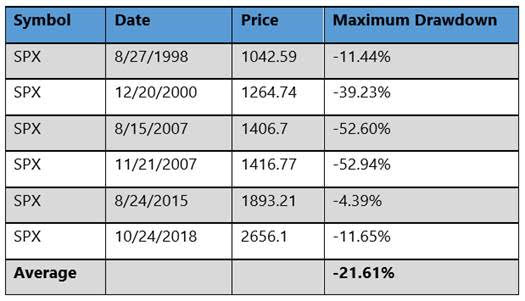

And here are the bearseye results for the S&P 500 index, again dating back to 1998.

When a bearseye condition triggers, it takes a while to get past it. Since 1998, the average length of a bearseye drawdown period has been one to three years.

So, what does it mean for markets to be in this state? First and foremost, it means risk management is more crucial than ever.

Being aware of downside risk is incredibly important in any market environment. But especially now, with bearseye conditions upon us, it’s critical to manage your stop losses and exposure levels.

This doesn’t mean “panic,” which implies acting in haste rather than having a plan. Instead, it means having a sound plan and remembering to stick to it.

If you have stock positions in the Red Zone, for example, you may want to part ways with those names. And if you see an attractive stock to buy, you want to be sure and apply risk management rules.

The good news is that “this too shall pass,” as the old saying goes.

Bearseye market conditions don’t last forever, and there are excellent gains to be had on the other side.

Within our software, the same indicators that flag bearseye conditions can also identify “bullseye” conditions — where markets are poised for an extended run upward.

Managing risk in bearseye periods is more than just good investment discipline. It is crucial to preserving mental and financial capital in down markets, so you can be fully prepared to exploit bullseye conditions when they return.

Then, too, within our software we’ve developed a suite of strategies that can perform well in either market condition — bearish or bullish.

These strategies, available through Ideas by TradeSmith, can identify stocks and options plays suited to the market environment at hand, whether bearseye or bullseye conditions apply.

Our team is putting together an important briefing, so keep an eye out for more on this topic next week.