An 8% Key Rate May Be in the Cards

|

Listen to this post

|

“Rate cuts, rate cuts, rate cuts!”… But here’s what to do if the chant doesn’t work… Jamie Dimon and JPMorgan Chase are prepared for 8% rates… Bitcoin breaks out (this time for good?)… Election year gets weird starting May 1…

By Michael Salvatore, Editor, TradeSmith Daily

Say it with me… “rate cuts.”

Now say it three times, like Geena Davis in Beetlejuice.

That’s how traders seem to be treating the idea of lower interest rates. Trying to will them into existence by talking about them over and over as a foregone conclusion.

But no matter how badly investors may expect and want interest rate cuts, and no matter what the Fed’s dot plot says, the bond market clearly disagrees that rates are coming down… at least in the short term.

10-year Treasury yields, after bottoming back in December, have steadily climbed higher and higher:

Meanwhile the shorter end of the curve – the 1-month, 2-month, and 3-month bills – have been stagnant around 5.3%.

That’s not the kind of thing you see when rate cuts are imminent. That’s the opposite. And we can see just how opposite reality it is in the same chart.

10-year Treasury yields topped out at the end of October, as the stock market bottomed and several weeks before the Fed put rate cuts on the table in December.

In other words, the bond market is ahead of the curve. Just like it started betting rates had peaked back in November, it’s now betting that rates won’t come down anytime soon.

And as we covered last week, Fed fund rates futures indicate traders have turned more hawkish than the Federal Reserve. The latest numbers Tuesday morning now show less than 50% odds of the first cut at the June meeting, down from over 61% just a week ago.

The phrase “higher for longer” came about for a reason. Rates are high, they’ll be high for a long time… and yes, they may go even higher.

How do you not just deal with, but take advantage of that?

❖ There’s a three-step plan that immediately jumps to mind…

- Eliminate high-interest debt. That’s everything but the mortgage, and especially the credit card.

- Sock away your savings in the risk-free, inflation-beating yield we’re seeing right now. Treasurys, high-yield savings, mutual funds – however you want to do it.

- Buy stocks in companies benefitting from high rates, not dying for lower rates.

The first two points are obvious, so let’s focus on No. 3.

As an example of companies benefitting from high interest rates, think banks. High interest rates can mean bigger banking profits – because they can simultaneously earn a higher return on their money in short-term interest rates and attract more deposits to make those returns with.

That’s assuming they have a good loan book, of course. Silicon Valley Bank showed us not all banks are run the same way. And all banks will suffer to some extent as dealmakers, as the cost of borrowing rises.

At the same time, there’s a class of stocks that’s begging for interest rate cuts and not getting them – small-caps.

Capital-starved small-caps are getting beaten down right now. And that’s directly correlated to high long-term interest rates.

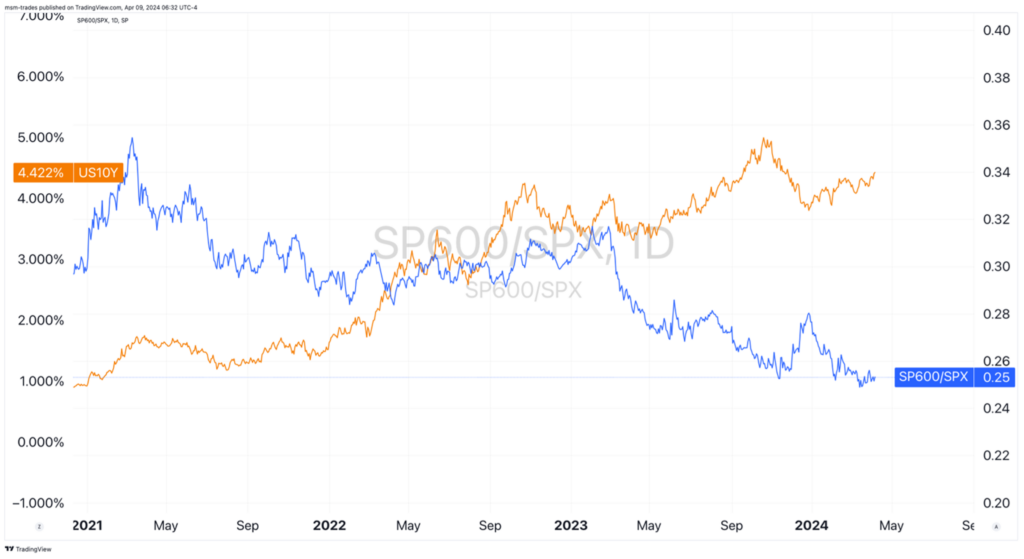

In the chart below, the blue line is the S&P 600 divided by the S&P 500. It shows you how poorly small-caps have performed against large-caps for the last few years.

The orange line is 10-year Treasury yields again. It’s a mirror… and the relationship has only gotten stronger with time.

As long as 10-year Treasurys are rising, small-caps are going to underperform the broad market. Avoid them – especially highly indebted ones – until it becomes clear that the interest rate picture is changing.

Taking it back to the banks…

❖ JPMorgan Chase CEO Jamie Dimon sees rates much higher…

In his annual letter to shareholders, Dimon wrote that, because of worsening global conflicts, government spending, and health care costs, inflation will be a persistent problem that may need even higher interest rates than we see today.

Here’s Barron’s with some highlights:

“Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world and the restructuring of global trade—all are inflationary,” he wrote.

Economies have also never experienced central bankers hiking interest rates at this scale and he remains “more worried” than peers about their “unknown effects,” he said.

“Small changes in interest rates today may have less impact on inflation in the future than many people believe,” Dimon explained. “Therefore, we are prepared for a very broad range of interest rates, from 2% to 8%, or even more.” His prediction contrasts with that of Federal Reserve Chair Jerome Powell, who signaled last week that interest rate cuts this year are still on the table.

JPMorgan Chase, being the biggest bank in the U.S., makes Dimon’s words carry weight. His position offers a helpful perspective on the world’s biggest economy.

So when he says the bank is prepared for a world where interest rates are anywhere between 2% and 8%, we should pay attention.

Lower rates are not a a guarantee. If a bank with trillions in assets on its books is preparing for such a range, so must we.

❖ Bitcoin broke out again…

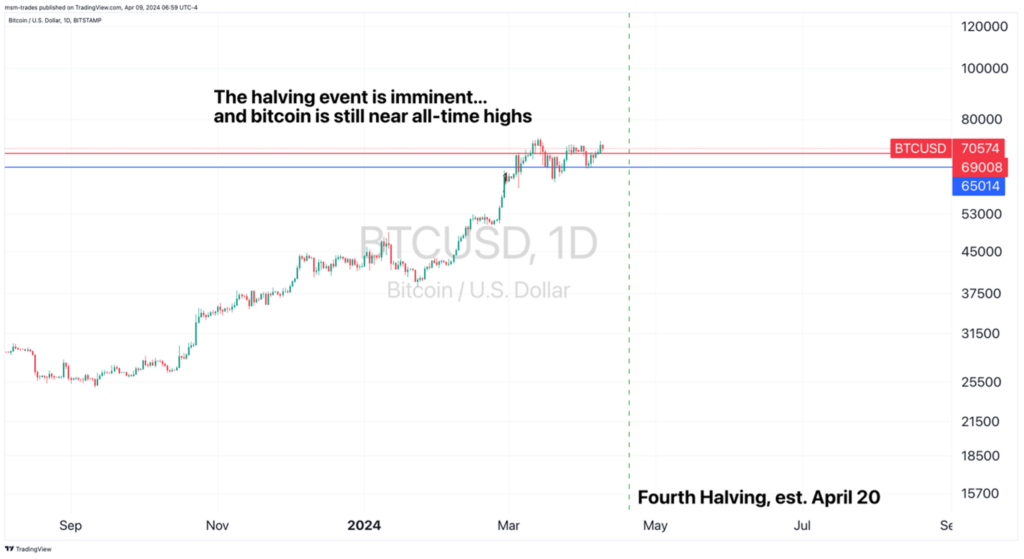

And maybe for good, this time. Let’s take a look at the chart:

Latest estimates have the next bitcoin halving – a regular reduction in the supply of bitcoin that miners receive – to occur on April 20 – just 10 days from now.

And as we pointed out not too long ago, bitcoin made a new all-time high ahead of this event – which hasn’t happened since the first halving more than 10 years ago.

The blue line in the chart above is bitcoin’s April 2021 high, which it hit before entering a monthslong correction. The red line is the previous all-time high set later in the year. Bitcoin trading at these levels for the past month has helped consolidate the price action, normalizing it, and setting the stage for another leg higher.

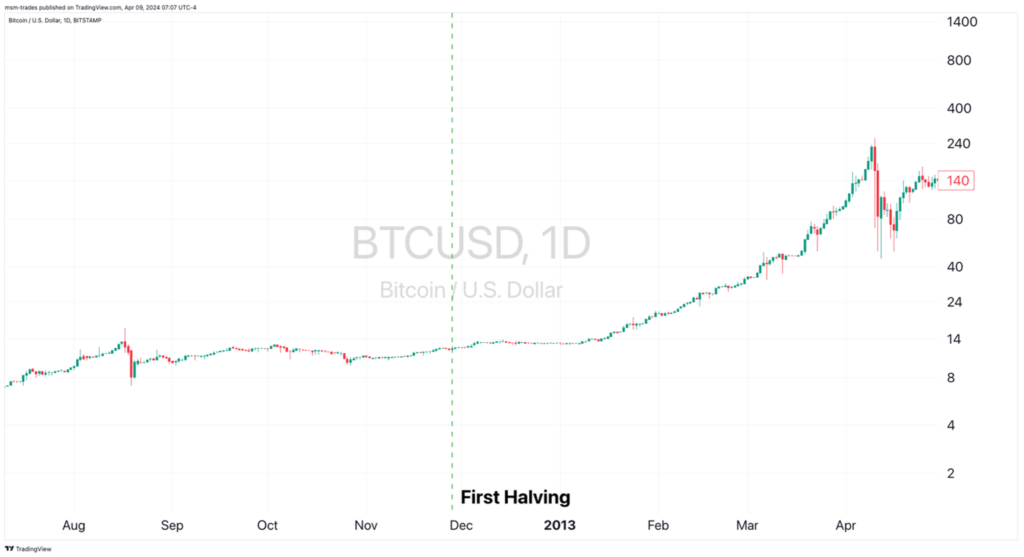

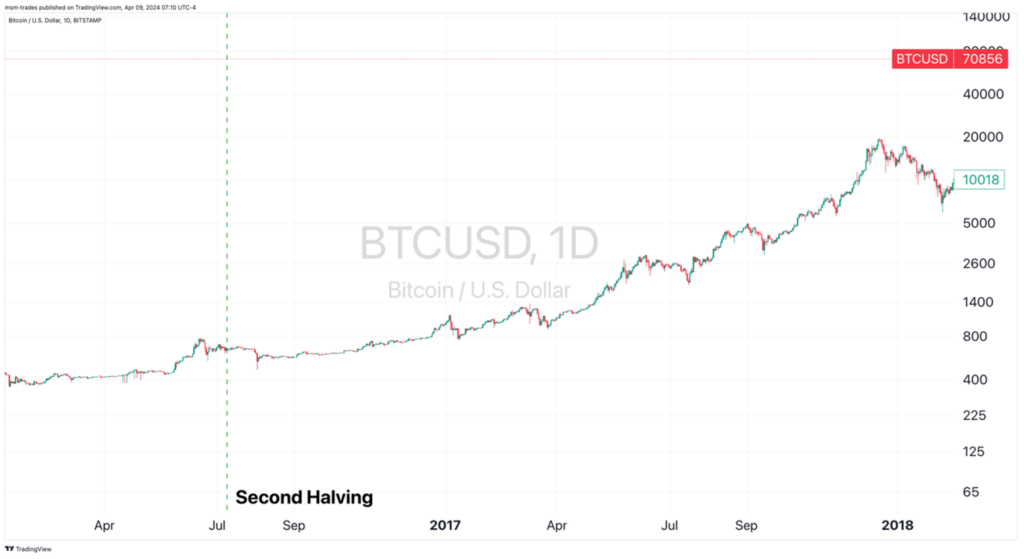

Will that next run come right on the heels of the halving? Maybe. But if history is any guide, the halving itself is a bit of a non-event in terms of price. Take a look at these quick snapshots of the bitcoin price action after the 2012, 2016, and 2020 halvings:

In 2012, bitcoin prices rose into the halving event and stalled out for a while afterward. But that flat price action set the stage for a move that ultimately took bitcoin almost 100x higher a year later.

The 2016 halving similarly saw a bit of selling pressure before the bull run began and prices shot up to nearly $20,000.

And the third halving, smack in the middle of the COVID recovery, was another nothingburger event… until prices surged almost 10x higher in the next year and a half.

Long story short, halving events themselves don’t tend to instill much excitement. But they have a perfect track record of acting as the starting gun to bull markets.

It’s worth noting – the coming halving event could act as a “buy the news” event just as the ETFs were.

❖ In three weeks, election-year weirdness could truly kick off…

And it’s all thanks to a suspected six-word announcement set to come out of Washington, D.C.

This announcement simultaneously relates to what’s happening in financial markets, the Fed’s interest rate campaign, and the presidential election.

All of these things are intimately related, in ways the powers that be would prefer weren’t public.

Regardless, after this announcement you should expect MORE chaos throughout the rest of this year… not less. And that means it’s imperative for you to consider changing your investment strategy.

Where before most folks could get by buying and holding the market through thick and thin, that may not be the case moving forward. Escalating conflicts overseas, an uncertain monetary policy, and what’s sure to be a nasty election cycle all but guarantee it.

All of this constantly trickles through the economy and markets, as traders adjust to the latest headlines. Knowing what to buy and hold to make money over the next 10 years, five years, even just one year gets harder and harder.

The counter to this is simple: Reduce your time frame.

Making trades that take advantage of the next month, week, or even a single trading session can help reduce your risk to events out of your control… and increase your potential to compound profits and grow your account balance faster.

To your health and wealth,

Michael Salvatore

Editor, TradeSmith Daily