Ford Launches Artificial Intelligence Subsidiary – Here’s How to Know if the Carmaker Is a Buy

|

Listen to this post

|

Microsoft Corp. (MSFT) and Alphabet Inc. (GOOGL) have received the most attention lately in the race to harness artificial intelligence (AI) for their respective search engines, but there’s a bigger world out there where AI can be used.

Like in the auto industry.

Ford Motor Co. (F) announced on March 2 the creation of Latitude AI, a wholly owned subsidiary that will develop automated driving technology that focuses on a “hands-free, eyes-off driver assist system for next-generation Ford vehicles.”

The automaker says that the average driver spends 100 hours a year sitting in traffic, and through Latitude AI, it wants to make that experience a little less stressful, tedious, and unpleasant.

Ford believes that this technology will give customers “some of their day back,” as a hands-free and eyes-free driving experience could allow people to get work done in their car, read a book, or do anything else that feels more productive than crawling through traffic at a snail’s pace each morning and night. The automaker also emphasized throughout its press release that safety is a top priority when building out this technology.

Enabling the eyes-free and hands-free driving experience is going to be a big opportunity for Ford and its rivals, as the autonomous vehicle market was valued at $22.22 billion in 2021 and is expected to climb 241% to $75.95 billion by 2027.

Now, with so much news out there about AI, many folks could have already seen this announcement from Ford, thought it sounded interesting, and then quickly forgotten about it because they didn’t know how to use the information as investors.

At TradeSmith, we are all about looking beyond the headlines to help you know what to do with your investable dollars.

Today, we’re going to do exactly that.

What to Make of Ford as an Investment

In the TradeSmith Daily series Buy This, Not That, we highlighted in August 2022 how Ford was not a company to own.

That still holds true today, as the news about the AI division alone does not move the needle to make it an automatic buy.

Right off the bat, we can start out with our Health Indicator, which places F in the Red Zone — a warning to stay away.

We can also look to our Volatility Quotient (VQ), which presents the risk level associated with any given investment. It designates an investment in Ford as being “high risk.”

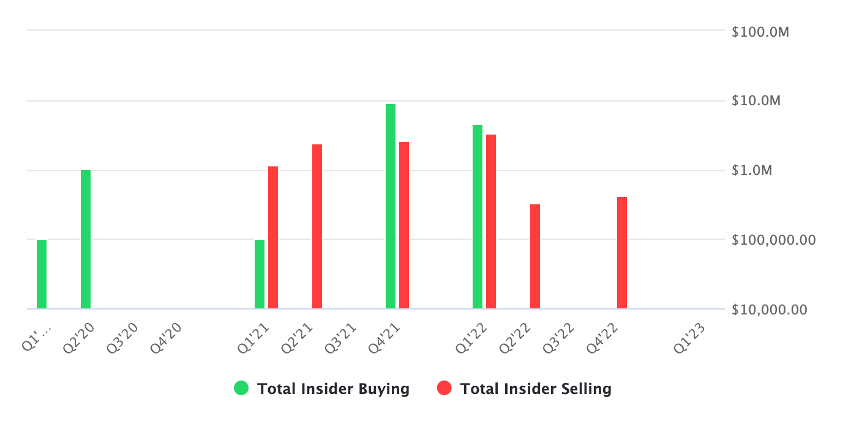

Then, we can turn to our Money Movers tool to see what insiders are doing with their shares. There are a lot of reasons to sell a stock, but there’s generally just one reason to buy a stock: You think it’s going to go up.

There was roughly an equal amount of buying and selling in the first quarter of 2022, but as you can see in the image below, insiders have mostly been selling their shares since then.

Finally, we can turn to our newly launched Business Quality Score, which ranks every company based on a composite of four broad quality metrics:

- Growth: This metric measures changes in a company’s metrics such as sales, profit, return on equity (ROE), return on assets (ROA), and cash flow over the past five years.

- Profitability: This metric measures a company’s current level of profitability relative to its assets, sales, and shareholder equity.

- Safety: This metric measures a company’s financial strength (debt burden, credit risk, etc.) and its stock’s historical volatility versus the overall market.

- Payout: This metric measures how much of what a company earns benefits shareholders via dividends, net share buybacks, and debt repayment.

Our algorithms first calculate the current quality score for each stock compared to its history and all other stocks in our database. They then average those scores for each stock and rank them from the highest quality (100) to the lowest quality (0).

Ford is near the bottom of the barrel with a score of 6.

As you’ve seen today, using these tools can help you separate the news from what really matters and give you the bigger picture of whether a company deserves your money.