If Biden Drops Out, Do This

|

Listen to this post

|

Betting odds of a Trump win are surging… The market’s history agrees… How Democrats could “break the glass”… Another “betting odds” shakeup on inflation data… The latest Big Money Buys and Sells… Don’t get caught flat-footed in the next bust…

Politics are not our beat in TradeSmith Daily. We follow markets, analyze the data for opportunities other investors have overlooked, and trade them.

But we must admit two things before we dive into today’s dispatch:

- Politics are intertwined with financial markets, and the economy is the predominant issue this election season.

- We watched the debate on Thursday night just like you probably did, and it was hard to walk away from it confident that Biden will prevail in November.

Anything could happen. But as investors, we can only take the latest data in front of us and use it to our best advantage.

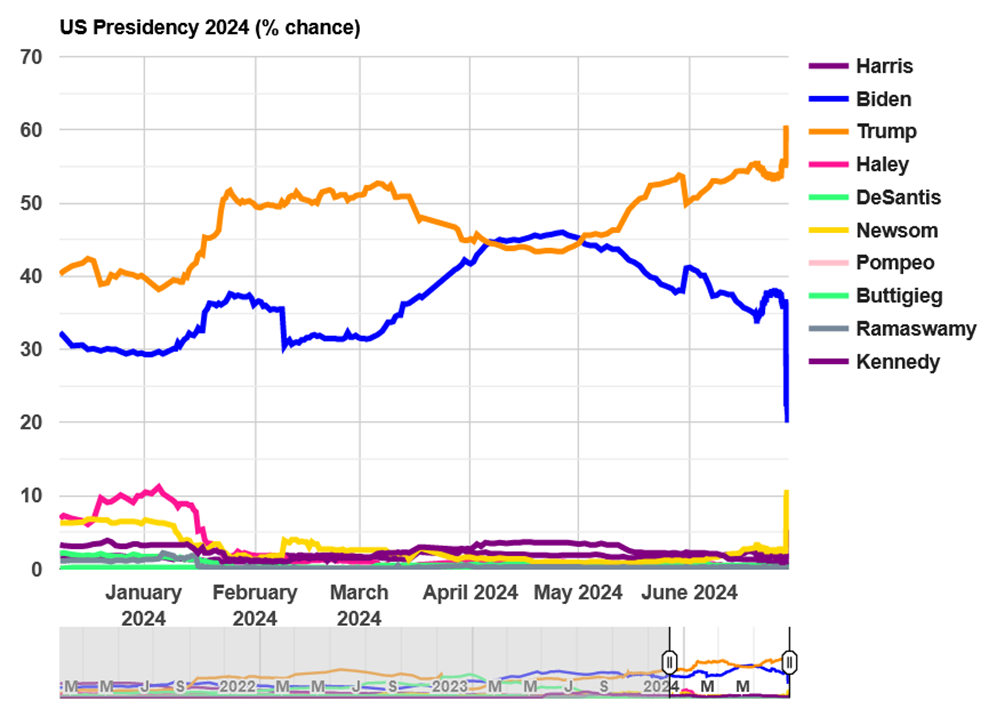

Right now, the odds on ElectionBettingOdds.com put former president Donald Trump at over 60% odds of winning in November. That’s up 5% in the last 24 hours (as I write on Friday morning.)

Biden’s odds are, conversely, at the lowest of the year. He’s currently sitting at an uncomfortable 21.6%.

That’s as much as we’ll see on the political side of the equation right now. (At least, until we address that yellow line surging at the bottom.)

So let’s ask the most impactful, relevant question that we’re best equipped to answer: How will this affect your investment portfolio?

Late last year in TradeSmith Daily, we took to the data to see how election outcomes impact the markets.

We observed then that, historically speaking, the stock market performs significantly better in years when it’s a Republican who will take office next. Stocks surge 15.27% on average during Republican-winning election years, where Democrat-winning election years see average returns of 8.48%.

Looking at the S&P 500’s return year-to-date of 15.93%, history agreed with the betting odds. We should give the edge to a Republican win.

❖ But will Democrats “break the glass,” as The Freeport Society has warned?

At the end of last year, Charles Sizemore over at The Freeport Society stuck his neck out with a bold prediction.

He believed – and still does believe – that Democrats will throw a Hail Mary and switch out President Biden for an alternative candidate: California governor Gavin Newsom.

Not only that, but that such a move would actually lead to a Democratic victory.

After last Thursday’s debates, the odds of that occurring seem much more likely. Looking again at the chart above, we can see that the yellow line – representing Newsom’s odds to win the presidency – shot straight up to the highest level all year. That’s pretty impressive for a candidate who’s not officially running.

At this point, it would be a “break glass in case of emergency” situation for Democrats. But let’s say it works… what then?

This runs directly into what The Freeport Society calls its “Californication” thesis . This refers to the gradual-but-sure influence of Californian economic and social policies on the rest of the country. Things like:

- The banning of internal combustion engine cars and natural gas appliances;

- Billions of dollars spent to address worsening homeless problem, only for more tent cities to pop up, and;

- Artificially inflated wages for entry-level service jobs could ripple across the country.

All this, and more, could lead the U.S. into an Age of Chaos that we haven’t seen in decades.

That’s why Charles Sizemore’s research is increasingly focused on this potential outcome. He recommends high-yield, tax-free income plays…high-quality oil and gas stocks which will unexpectedly surge as the green energy gambit falls apart…and ways to inflation-proof your portfolio.

If you haven’t already, I’d highly recommend taking a look at this research presentation from Louis Navellier, who partnered with The Freeport Society to deliver this message.

And in case you missed it, here’s a link to my recent interview with Charles all about his method for trading in the Age of Chaos.

❖ Another kind of betting odds saw a surge last week…

Lower-than-expected inflation data in the U.S. personal consumption expenditures (PCE) price index brought the “doves” out of the woodwork to bet on interest-rate cuts.

First, the data. The core PCE rose less than 0.1% over the last month – the smallest rise since 2020. We also saw a positive change in inflation-adjusted consumer spending, which was negative last month.

This comes among pockets of deflation in certain goods and services. While food prices aren’t calculated in the core PCE, they’re where we’re seeing some of the biggest deflationary trends. Staple food categories like milk, coffee, cheese, fresh seafood, and ham were all down more than 2%. Apple prices notably fell more than 13% last month – something I’ve personally noticed as I load up on honeycrisps every couple of weeks.

So consumers are spending more, and inflation is coming down at the same time. That’s a great thing.

It also means we should slightly raise our expectations for rate cuts this year. While it’s likely we’ll still only see one rate cut in 2024 against the Fed’s own expectations for three, the timeline for that cut could be much sooner.

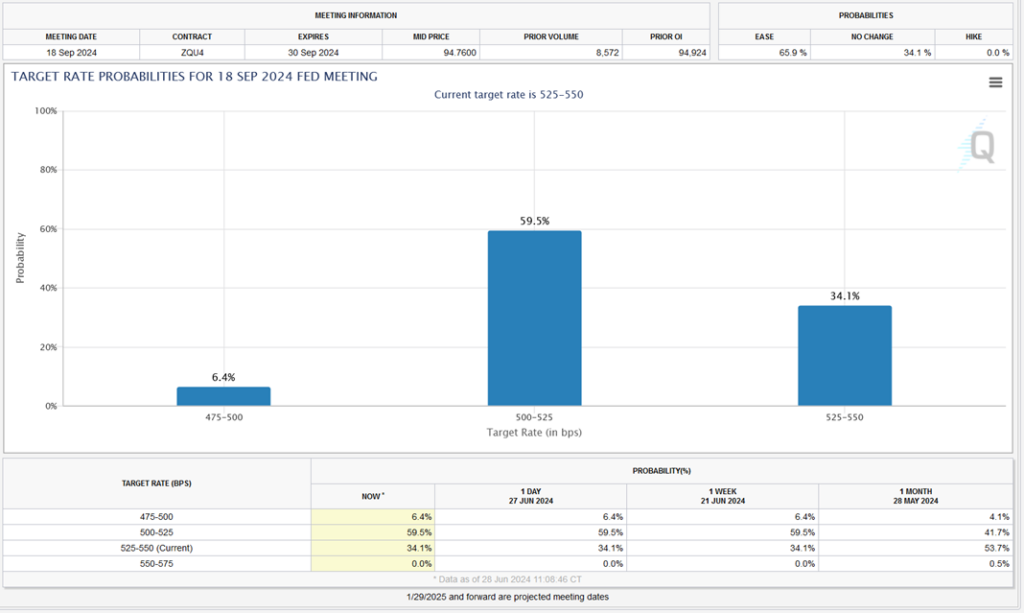

Take a look at the chart below of the FedWatch tool:

As you can see, the odds of the first rate cut at the Sept. 18 FOMC meeting are at nearly 60%. That’s up from nearly 42% just a month ago.

Just as key is the estimate that rates will hold at the meeting. A month ago, the consensus odds of a rate hold in September were at 53.7%. That’s now down to just over 34%.

We may see a rate cut before the summer is done – and as we’ve been saying all year long, that would be a huge boon for under-capitalized small-cap firms… especially those in the real estate sector.

If you’ve been putting off getting your small-cap buy list together, don’t delay.

❖ And let Jason Bodner’s Quantum Edge Hotlist take some of the work off your plate…

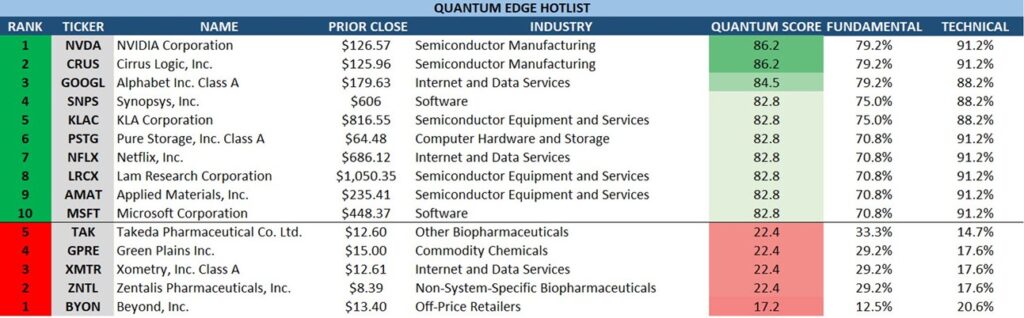

Each Monday here in TradeSmith Daily, we share you the previous week’s rankings on Jason Bodner’s Quantum Edge Hotlist.

Regular readers know that this list contains the hottest and not-test stocks on Wall Street, as seen through the eyes of major big money institutions.

The stocks at the top of the list have a strong fundamental picture, solid technical momentum, and most important, a lot of evidence of Big Money buying. Here’s last week’s list…

The takeaway on the buy side is simple. The Big Money is going absolutely nuts for large-cap tech right now. Semiconductors, internet companies, software companies, and datacenter companies are the overwhelming favorite of the moment.

On the sell side, we’re seeing a few familiar faces like Green Plains Inc. (GRPE) and Beyond (BYON) – aka Overstock.com. 3D printing firm Xometry (XMTR) is a new and noteworthy face for the list, too, showing us that 3D printing has still not caught a bid 10 years out from its heyday.

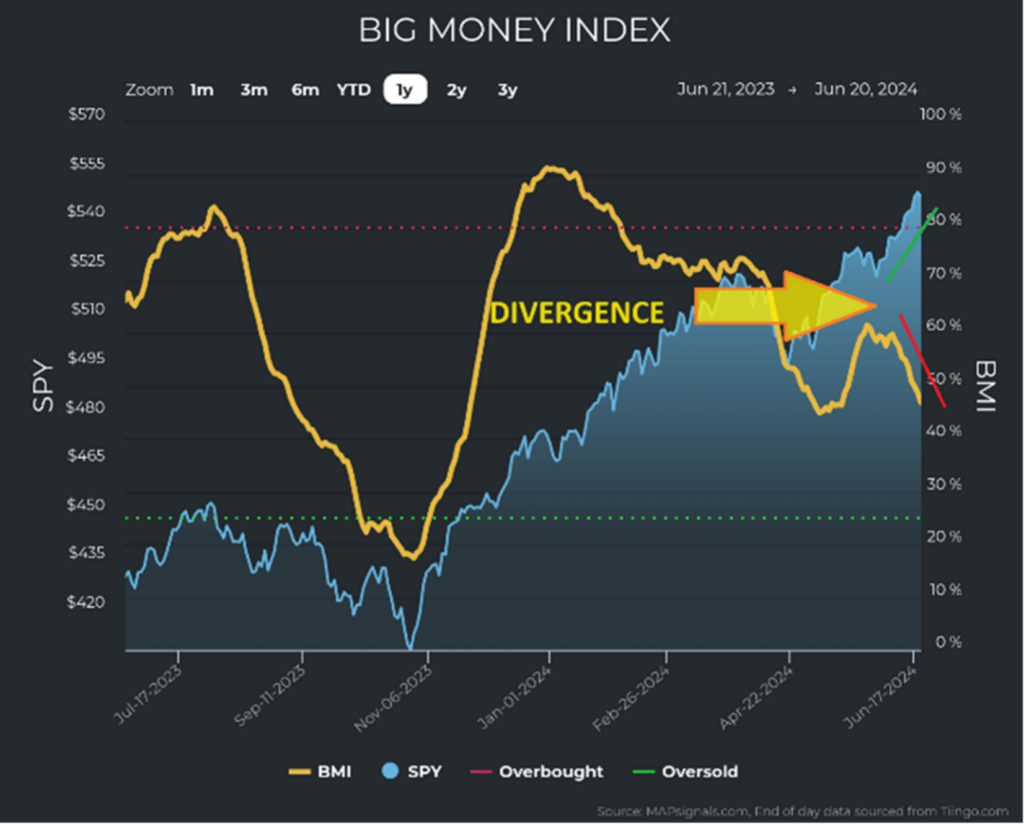

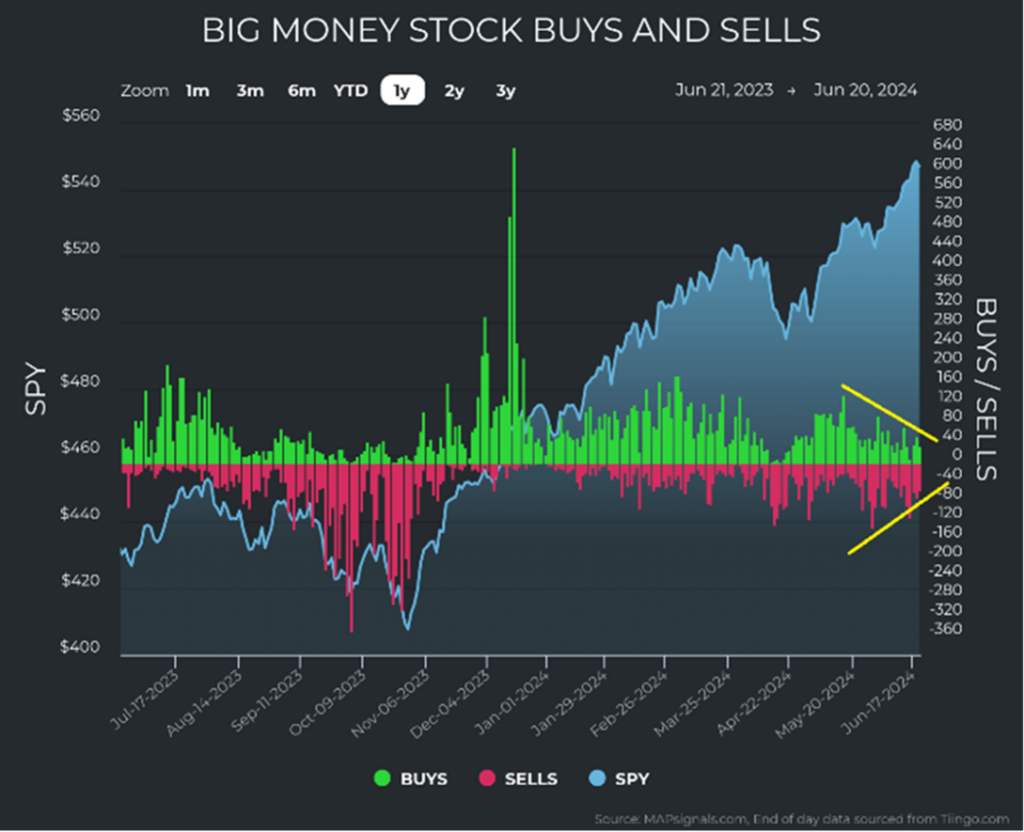

As a bonus, here’s the latest look at the Big Money Index – Jason’s composite of big money buy and sell signals in the market. As we can see below, the price (blue line) is running away from the activity of institutions (yellow line):

As Jason sees it, the unique market conditions we see today mean this isn’t as much of a warning sign as it normally would be.

First off, while Big Money buying is drying up, so is the selling. It’s a drop in activity across the board:

Second, summer months tend to come with summer bumps, as Jason puts it. But because of how few stocks are participating in the bullish trend right now, they’re set to play catch-up through the rest of the year once the seasonally weak period ends in September.

Jason’s subscribers get access to this list every Monday afternoon, highlighting the latest Big Money buy and sell signals, along with a broader market and portfolio overview. The next such update should land in inboxes later today.

If you’d like to join them to get first access to these names, along with Jason’s curated model portfolio, go here for more info on a Quantum Edge Pro subscription.

❖ AI stocks may be hot, but if the music stops playing, don’t get caught without a chair…

You might remember last week how Louis Navellier called this year’s craze in AI stocks just the start of an investment mania – the first true mania since the dot-com bubble.

In markets like this, you have to dance as long as the music is playing. Sitting on the sidelines means missing out on the massive profits that manias can provide.

But as the dot-com crash showed us, once the music stops, the rush for the chairs is fierce and unforgiving. If you’re going to play, you need to have a plan that won’t leave you standing in the silence with your pockets empty.

Knowing when to exit a red-hot trade is never easy. Talk to all the folks who failed to sell their SPACs in 2021… or their NFTs the same year… or their real estate and banking stocks in 2008… and on and on.

That’s why it helps to have a different kind of strategy in your toolkit that helps you capture the big moves in investment manias – but doesn’t trap you in the trade at the worst possible time.

Over the past few weeks, I’ve been sharing the work of Tom Gentile with you. He’s a self-taught master of the markets who built and sold his own trading education firm.

Tom’s specialty is seasonality – the study of when individual assets are most likely to rise or fall. And he’s constructed an entire trading strategy down to a period of 30 days or less, down to each individual stock and when they’re most likely to rise and fall.

With this strategy, there’s always something to trade with high odds of success. And in fact, he tracks all of these trades on a calendar, highlighting the best trades to make every single trading day.

But one of the biggest trading opportunities Tom’s seen all year is approaching fast.

On Wednesday, July 10, one massive pattern is set to commence. And he’s busy preparing everyone he can for the opportunity set to come.

As you might’ve guessed, this opportunity is likely to come from the AI trend. And Tom thinks it’s imperative that you learn to trade AI stocks so you can capture most of the upside while avoiding most of the downside.

He’s hosting a free educational summit that’s all about his 30-day profit cycle strategy on Tuesday, July 9. Sign up for it right here to make sure you get everything you need to know to trade on July 10. Tom plans to reveal his top 10 AI stocks during this free event.

To your health and wealth,

Michael Salvatore

Editor, TradeSmith

P.S. If you haven’t yet, make sure you check your Portfolio Grade…

Over the weekend, I wrote you about Louis Navellier’s free Portfolio Grader tool. It helps you quickly highlight the weak spots in your portfolio you should consider trimming… and even shares some high-quality alternatives for you to reroute your cash into.

I also used the tool to highlight the top and bottom stocks in the S&P 500, and the top stocks in Warren Buffett and Bill Ackman’s portfolio.

Analyzing stocks this way gives you a huge leg up on the market. And Louis, the inventor of this tool, is using it right now to uncover the best AI plays for the rest of the year and beyond. Go right here to learn all about that, and do it soon – his urgent presentation comes down tomorrow night.