3 steps to spotting a MegaTrend

|

Listen to this post

|

Editor’s Note: Today we’re sharing a guest editorial from Andy Swan, founder of LikeFolio. The value of LikeFolio’s consumer-driven research is unmatched, and we’re proud to have the company as our only third-party partner. Enjoy Andy’s insights on how to spot the strongest emerging investing opportunities.

Unfortunately, most stock market media coverage is focused on the companies that have already won.

It’s like trying to drive down the highway while only looking in the rearview mirror. That won’t do me any good, and it could cause a nasty crash!

Fortunately, through my company, LikeFolio, I have access to consumer data that shows me what’s happening on Main Street right now… before major trends and spending patterns become news on Wall Street.

And when all those consumer metrics line up in the same direction, it’s a powerful phenomenon. It’s as if each metric serves as a multiplier of the others… turning good consumer data into an incredible investing opportunity.

I call this phenomenon a MegaTrend. It can be the ultimate opportunity for savvy investors to jump into a stock before it takes off.

Here are the three criteria I use to spot emerging MegaTrends:

1. A Consumer Macro Tailwind Underway

You’ve heard the phrase “a rising tide lifts all boats.” Well, a Consumer Macro Tailwind has the same powerful effect on company revenues, and ultimately stock prices.

That’s why the first thing I look at when trying to spot MegaTrend opportunities is “what consumer behaviors are absolutely popping?”

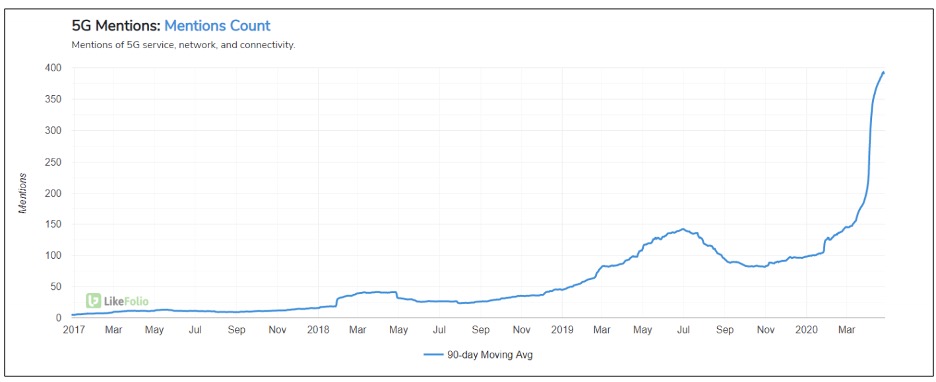

A great example came in our “5G Providers & Beneficiaries” MegaTrends report that we sent to clients in spring 2020.

That chart shows LikeFolio’s data on consumers talking about wanting or using 5G technology, which provides extremely fast connections and incredible video-streaming experiences to users without the need for WiFi connections.

Obviously, 5G demand was popping… as consumer mentions of the technology went nearly vertical on the LikeFolio chart.

From there, we identified five companies set to benefit the most from this trend (I’ll get into this process next): UBER, QCOM, NVDA, MRVL, and AAPL.

Since the publication of that report, those five stocks have AVERAGED a gain of more than 113%. That’s more than doubling investors’ money, simply by recognizing and acting on a MegaTrend.

While spotting a Consumer Macro Tailwind is extremely powerful on its own, it’s just the first step in the process of identifying a MegaTrend stock.

Next, we drill down to the company level.

2. Growing Consumer Demand for a Company’s Products

Now that we’ve identified the Consumer Macro Tailwind, it’s time to start looking at which companies are set to benefit most from the surge.

To do that, I like to look for companies with growing levels of consumer demand for the products and services they provide.

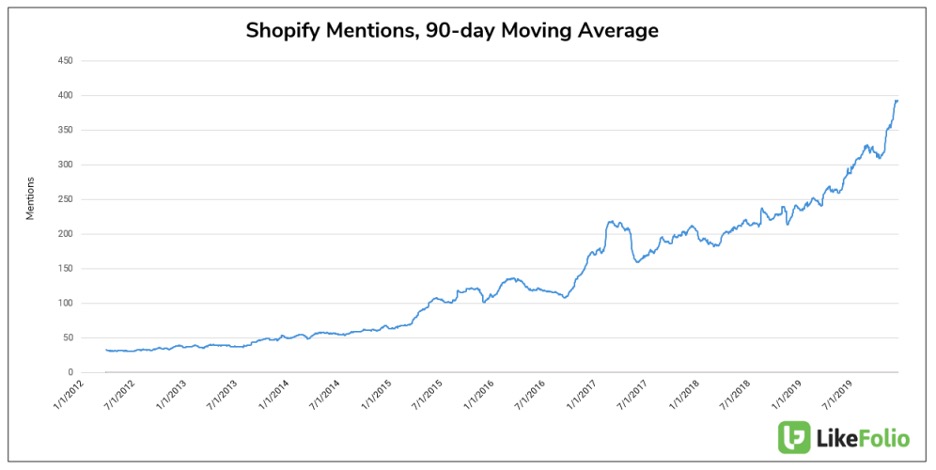

For example, in December 2019 we published our now-famous “e-commerce” MegaTrends report to take advantage of the boom in online retail.

Here’s what I saw at the time when I looked at consumer demand levels for Shopify (SHOP), a company focused on providing software, services, and marketplaces to e-commerce sellers:

Up, to the right, and accelerating.

Exactly the kind of consumer action I want to see. More and more people talking about the company at a faster and faster pace.

And it paid off.

When we published that MegaTrends report, Shopify stock was trading just under $390/share.

As I type this today, shares of SHOP are trading well over $1,500/share — that’s multiplying your money by 3.8x in less than two years!

All because we were able to spot the Consumer Macro Tailwind and combine it with surging consumer demand data at the company level.

So powerful.

But there’s one more metric I want to see to determine a MegaTrend.

3. High or Growing Consumer Happiness Levels

Let’s face it… a macro tailwind and surging demand are great, but if the company is disappointing consumers, any benefits won’t last long.

And with MegaTrends, I want to find stocks that will make big profits for a long, long time.

That’s why I insist on investing in companies that are making their customers very happy, or at least are showing that they’re improving on this critical metric.

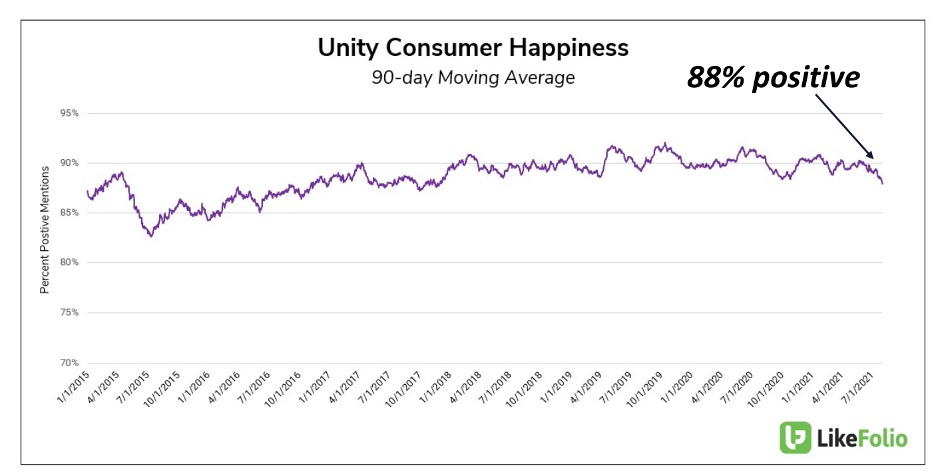

A fantastic example of this is Unity Software (U), a company that produces software and tools to help video game developers make better products.

Just look at this LikeFolio Consumer Happiness score:

Clearly, Unity’s clients love its products and services.

In fact, that’s the primary reason we included Unity in our most recent MegaTrends report, “Welcome to the Metaverse.”

Again, in that report we highlighted five stocks we think could be huge long-term winners from the booming metaverse trend.

It’s only been in MegaTrends members’ hands for a few weeks, but even the early indicators are looking good, with Unity already surging and turning skeptical analysts into believers due to its impressive technology stack.

Putting it All Together: 1-2-3

Obviously, it’s extremely powerful to have access to real-time consumer data. Any one of these metrics gives me a big advantage over Wall Street.

But when all three are combined… a Consumer Macro Tailwind, growing consumer demand, and high Consumer Happiness… well, that’s the best setup I’ve seen so far in more than 20 years of investing.

That’s a MegaTrend. Powerful, indeed.