Don’t Screw This Up; Four Volatility Tips for You!

|

Listen to this post

|

About a week ago, I wrote about volatility and the opportunities it presents for us as individual traders. I heard a lot of great feedback – and some questions – from readers.

If you missed that article, please go read it now. It explains volatility and how to leverage it.

Volatility is a hot topic because most people fear it. But I think you can leverage it — and there’s a right way and a wrong way to do it.

As a quick refresher, we can tell that volatility is high by checking the CBOE Volatility Index (VIX).

We track this ticker within TradeSmith Finance, but there are other places you can find it too. In general, a VIX reading of 20 or higher indicates a period of higher volatility, and anything lower than 12 indicates a low-risk environment.

As of this writing, we’re at 18.74 – just shy of the “high” volatility range.

Yes, high volatility does create investing and trading opportunities; my favorites are in trading options, which is why I talk about them so much (and why I wanted to create an options-based product in the first place).

But we still need to manage our risk, just like we do with every other investment. So today, I want to share with you four tips for trading options when volatility is high.

1. Don’t chase premium.

Never, ever chase premium. If you see that you can make $500 by selling a risky naked put versus $100 by selling a lower-risk put … I’d take the $100 bet.

The S&P 500 started September at $4,545.85 and – except for five days – spent the entire month moving down. The index finished the month at $4,307.54. If you had $20,000 invested in the S&P during that time frame, you would have lost roughly $1,050.

But instead of putting money directly into the stock market, I traded weekly naked puts and covered calls. Thanks to increased volatility, I could go further “out of the money” to take on less risk and still collect nice premiums.

Even though the market trended down, I was able to make a lot of money by trading options for income.

The trick, though, is to do it without putting myself at unnecessary risk.

As we’ve discussed, naked puts have the potential to be extremely risky.

Let me show you what I mean on a high-risk stock, Tesla. I’m choosing Tesla because

the company recently announced that it delivered 241,300 cars worldwide last quarter, blowing past analyst expectations. And that was during the worldwide chip shortage and supply chain nightmare.

That’s a great sign for the company as we head into earnings.

As a stock, Tesla has sky-high risk in our system with a Volatility Quotient (VQ)% of 51.28%, so it’s highly volatile even without considering the state of the market. With that in mind, I’m reducing the amount of premium I’d normally get from my puts in favor of a higher probability of profit (POP).

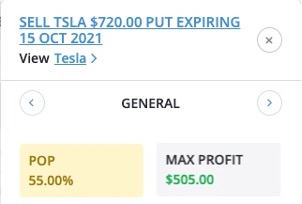

Check out the options tickers below, as shown in our CoPilot by TradeSmith system.

I could trade the put with the $720 strike with a 55% chance of making $505 per contract. That’s a tempting return on investment for one week’s time, but the low POP makes this too risky for me.

Tesla was trading at $798.11 at the time of this writing. With its VQ% being 51.28%, I’m just not comfortable with a strike price that is less than 10% below the current price, even for a weekly option.

In times of normal volatility, I’d look for a POP of around 80% to maximize my potential gain – something closer to that middle contract, which represents a stock price decrease of about 15% before expiration.

But with market volatility so close to the high range (and coming off a very volatile September), I prefer to sacrifice the amount of premium I get and target a probability of profit of 95% or more.

With a weekly strike price at $620, I’m essentially betting that the stock will not drop more than 22% in one week. It’s a bet I’m willing to make, based on the positive headlines I’ve seen from Tesla lately.

Am I being too risk-averse here? Maybe, but I would rather make less money than chase high premiums and sacrifice my probability of success.

2. Use volatility to your advantage.

OK, this one can be a little counterintuitive because, normally, volatility and the price of assets are at odds. High volatility means higher risk, and people don’t like risk, so stock valuations are naturally lower when volatility is on the rise.

But call and put options gain in value when market volatility increases.

The benefit here boils down to the old rule of “buy low, sell high.”

In short, an options buyer – someone who has bought a call or put contract – paid a price (the premium) for that contract. And when volatility rises, the price of that contract is going up – regardless of whether the contract is a call or a put.

And the reverse is true as well. If volatility in the market is high and dropping, guess what will happen to options contract prices? They will also be high and dropping. So that is a good time to reverse the order and sell high, buy low.

3. Be cautious about trading options around earnings.

As I just explained, volatility can be beneficial for trading options if you’re on the right side of the trade.

And there is undeniably a lot of volatility around an individual stock (and its options contracts) leading up to the company’s quarterly earnings reports. There is always uncertainty of what the company executives may report in their forward guidance.

But guess what happens to volatility after earnings are released?

You guessed it: The questions are all answered, and volatility comes plummeting back down.

Now, that may be less of a concern if you have some strong indicator of what the earnings report will mean for the stock – like the analysis from our friends over at LikeFolio.

But let’s be honest; even with the best indicators, nobody can predict the future.

And even when consumer sentiment is clearly indicating one thing, sometimes there is no accounting for panic in the market or larger looming issues that may impact a stock’s underlying price.

The key thing to remember when it comes to options is the volatility for the option itself.

So remember that while volatility is high leading up to earnings, it’s sure to plummet right afterward, and you should manage your risk accordingly.

4. Plan what you will do if call or put options that you’ve sold get executed.

First, if you have a sell call or sell put contract and it gets executed, you don’t necessarily need to take any action – unless you want to – as long as your position was covered.

If you have 100 shares of stock to cover your short call and it gets executed, no issues there. If you have the money to pay for 100 shares and you are fine owning 100 shares at your strike price, again — no problem.

Your plan worked. Mission complete. Great job!

But if you are selling naked puts or uncovered calls, you need to know what to do.

For naked puts, which is where I prefer to make trades (see Tip No. 1), you can simply hold those shares and follow the stock’s underlying price to sell at a profit.

As always, I recommend you use a trailing stop to avoid further unnecessary losses, whether you use a standard 25% trailing stop or one of the TradeSmith indicators like VQ% or Health. Regardless of what happens, always know your exit strategy before you enter the position, and then follow it. That means knowing what you might want to do before you wind up with 100 shares.

In the case of the Tesla options I highlighted above, TSLA is currently in the TradeSmith Finance Green Zone and the lowest strike price is only about 20% below the current price, so TSLA could fall another 30% below my purchase price before getting stopped out.

A reminder here that you shouldn’t sell naked puts at a price where you wouldn’t be comfortable buying 100 shares of that stock. And as always, I prefer to only buy stock for great companies. So I factor that into my decisions.

If you’re more interested in trading options for premium and you want to sell puts for Tesla, but you’re not comfortable with the risk or don’t have the buying power with your broker, another consideration might be options spreads.

These will lower your overall risk and lower your required buying power, but in exchange, they will also lower your potential profit. That’s because while you are collecting the premium for one contract, you’re also paying the premium for the other contract that is offsetting your risk.

The good news here is that if your sell put falls into the money and your contract gets exercised, giving you 100 shares, you can then exercise the buy put option to turn around and sell those shares, preferably at a higher strike price, and still make a little bit of money.

Before I wrap up today, I wanted to respond to a few readers’ questions.

“You all talk about options as if everybody knows what put, call, naked, cover, strike, etc. means. I for one — you might as well talk to me in Chinese. Maybe I’ll have a better chance understanding you. So instead of wasting our time with long emails about options why don’t you just … explain what each word means in plain English, so that we can better understand your emails and techniques.” — TradeSmith subscriber R.A.

Keith response: Thanks for the feedback, R.A. We have definitely added a lot of options content to our editorials in the past few months; as you can tell, I’m really excited about the possibilities with trading options. But I understand that the lingo can take some time to learn. Here is an “options basics” explainer that I wrote in July that may be useful. It reviews the fundamentals of trading options and includes a glossary of frequently used terms.

“Where do you find [the implied volatility rank (IVR)] and then compare it to the historical one-year rate? Thank you for all your posts. I’ve learned a lot!” — TradeSmith subscriber A.M.

Keith response: Great to hear from you, A.M. And thanks for the kind words. You should be able to view the IVR for any options chain within your broker’s platform. But you may be confusing implied volatility (IV) with implied volatility rank (IVR). While they’re related, they do represent different things. Implied volatility is the current state of the contract’s volatility, while the IVR is the comparison of current volatility to a 52-week range. So, if you have both numbers, you don’t need to go looking for the one-year rate; it’s built in to the IVR for you.

Have you had a great options trade pay off thanks to volatility’s impact on the contract’s price? What options questions – or any other questions, for that matter – would you like me to cover here? I’d love to hear your feedback. I can’t respond to every email personally, but I do read them all.