Low-Risk Strategies Part 3: Get Paid for the Stocks You Want to Own

Last week, I outlined two of my favorite ways to squeeze every penny from the stocks in your portfolio.

But what about the ones you WANT to own, but don’t yet have in your portfolio? Is there a way to use leverage to enter positions of great companies with limited risk?

Of course. I want to show you one of the most exciting ways to own some of the strongest, lowest-risk stocks.

You get paid to pick your entry price. And you play a simple waiting game.

If the stock never hits that target price, you get to pocket the cash.

If it does, you get the stock at the price you chose.

You will do this by selling something called a cash-secured put, and it’s one of the easiest ways to trade options successfully.

Let’s dive right in.

Another Way to Play Low Risk Runners

This morning, I logged in to TradeSmith Finance and looked at the latest stocks in the Low Risk Runners strategy.

Here are the criteria that qualify a stock as a Low Risk Runner:

- Its Health Indicator recently moved from the Yellow Zone back to Green

- The position has an average VQ of less than or equal to 40%

- The stock is trending up or sideways, which means that momentum has been rising

A company that jumped out at me was Teradata (TDC).

Today, it’s trading just under $48.81. That isn’t a terrible price for the company.

According to our signals, the stock is in the Green Zone, is in an uptrend, and it only has medium risk.

If I want to buy 100 shares of Teradata stock, I’d have to pay $4,880.

That’s a hefty price.

But with a cash-secured put, I could get paid – today – to purchase the stock at $45 per share.

Seriously.

Another Way to Trade Low Risk Runners

In simple terms, a cash-secured put allows you to make money on stocks that you want to buy at the price you’re willing to pay.

Sounds too good to be true, right?

Let me say one thing upfront.

You will need to contact your broker to ensure that you have clearance for this opportunity.

You’ll need Level 1 options clearance. This is the lowest level of approval and ensures that you have the proper margin to trade (more on this in a moment).

Now, let’s quickly go over a few key elements of puts. I am going to be using some personalities to explain this. Mark is our put seller, and Bob is our put buyer.

- Put Option: This option allows Bob to sell 100 shares of stock for every put contract that he owns. The strike price and expiration date define the contract (see below). Mark would be selling Bob a contract that allows Bob to sell his stock to Mark at a specified price if the stock goes lower.

- Strike Price: The strike price is the price at which the options contract can be exercised by Bob. In our Teradata example today, the strike price would be $45.00. Since we are working with a put option, the stock would need to drop to or below $45 for Bob to execute the contract.

- Expiration Date: This is the date that the put contract expires. The stock must trade under the strike price of $45.00 by the expiration date for Bob to execute it. If the stock falls under that level, Bob may execute the contract at any time and sell his shares to Mark. However, if it never falls under the strike price, the contract will expire worthless. In that scenario, Mark, as the seller of the contract, gets to keep the premium; However, Bob keeps the stock.

- Premium: This is the amount of money that Bob pays Mark for the right – but not the obligation – to sell the stock to Mark in the future at the strike price.

In this scenario, Mark agrees to buy 100 shares if Bob executes the contract.

Now, the “secured” part of this trade is simple.

When Mark sells the contract, his broker will require him to post a margin.

This is like a security deposit.

Mark will need enough money in his account to buy Bob’s 100 shares of the stock if it falls under the strike price. Those margin levels will fluctuate depending on the value of the stock.

This margin also significantly reduces the amount of money that Mark could lose.

So, let’s look more closely at Teradata.

Here’s a Great Example of How to Sell Cash-Secured Puts

I am looking at the options chain for Teradata.

The September 17 $45 put trades between $3.00 and $3.20 currently.

Let’s say that Mark sells one $45 put on this expiration date.

This means that Mark will sell a contract that gives Bob the right to sell 100 shares on or before that date. If Mark sells the put for $3.10 per share, he will pocket $310 (the premium times 100 shares).

If the stock does not fall below that level and/or Bob doesn’t execute the contract by that date, Mark will keep all of that premium.

If the stock does fall to or below that level, Mark will get to purchase 100 shares of Teradata for $45 per share. So again, Mark has picked his preferred entry price.

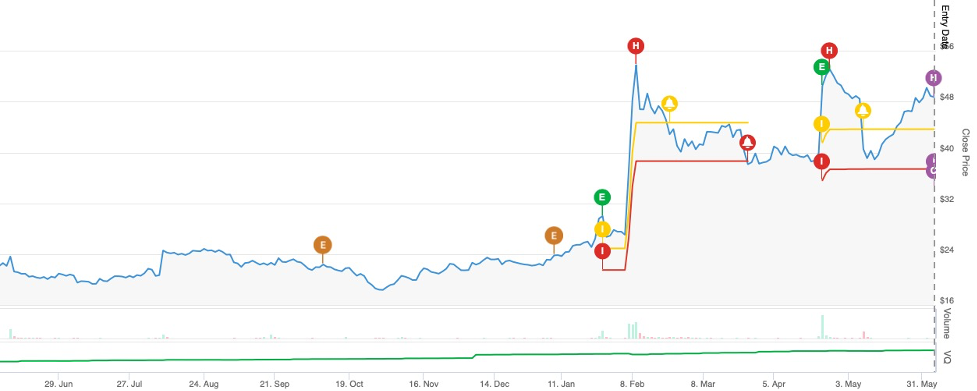

And, as you can see in the chart below, the options contract price is still in the Green Zone.

But here’s the best part. Mark gets to keep that premium no matter what.

So, if the stock falls to $44.00 and Mark buys it for $45, you might think that Mark is down on this trade.

Not so. Subtract the premium from the stock price. Let’s do the math.

$45.00 minus $3.10. This gives Mark a breakeven trade price of $41.90.

Mark will be up $2.10 per share if the stock is at $44.00.

At $3.10 right now, if Bob chose to execute the contract at $45, Mark would have also generated about a 6.8% return on his money over the next 102 days. That’s quite a deal and one worth consideration.

And speaking of opportunity. I’ll be back tomorrow to talk about treasure.

Yes, real treasure that you can spot on a map and profit from immediately.