Is $2 Trillion Worth of Stimulus a “Nuclear Bomb” — or a Mattress in a Volcano?

|

Listen to this post

|

A $2 trillion emergency relief bill passed in the U.S. Senate by unanimous vote on Thursday. The bill is likely to pass in the House, and the president is likely to sign it.

The final ink is not dry as of March 26. And yet we can say, with a high degree of confidence, that roughly $2 trillion worth of aid is coming — the biggest fiscal stimulus in history. But will it be enough?

Many are impressed by the “shock and awe” of such a massive spending effort. Investors are cheering the bill, exactly as we thought they would.

“Investors can take heart that we’ve counteracted this existential shock with the greatest fiscal, monetary bazooka,” legendary hedge fund manager Paul Tudor Jones told CNBC.

“It’s not even a bazooka,” Jones added. “It’s more like a nuclear bomb.”

It’s true that, in comparison to 2008, the government and the Federal Reserve have moved with hypersonic speed. There is hope that this gargantuan stimulus — $2 trillion from the government, with trillions more in monetary support from the Fed — will save the day. But is it enough?

Well, that depends on how you look at it.

On the one hand, $2 trillion certainly looks like a “nuclear bomb.” On the other hand, we have to consider the size of the problem.

U.S. gross domestic product (GDP) was estimated at $21.4 trillion last year. A big chunk of that activity has been vaporized. One question is, how big a chunk?

Just as a hypothetical, let’s say 25-33% of activity will be lost. That would run somewhere from $5.4 to $7 trillion — many multiples of the $2 trillion stimulus.

To offer another visual, an alternate framing is “throwing a mattress into a volcano.”

As in, imagine you need to plug a volcano — so you try dropping a mattress into it. What would that actually do to fix the problem? Nothing at all.

The #1 5G Company On Silicon Valley Insider Jeff Brown’s Watchlist

This company is very small…

Yet it’s the world leader of a key 5G technology… And it already counts many of the biggest network operators in the world as clients — AT&T, Vodafone, SoftBank, and many more.

It’s a perfect play for the 5G trend…

In this framing, an effort that seems large on its face (the mattress drop) is actually laughably, ridiculously small in comparison to the size of the problem being dealt with (the volcano).

Then, too, the real calculation is nowhere near as simple as “how much GDP needs to be replaced.”

When whole industries are frozen or shut down, you can’t just start them up again. Large areas of the economy are more akin to a gigantic copper mine or oil refinery, in the sense that once they are shuttered, they can take months or even years to restart.

Worse still, lost jobs and lost industries have a cascading domino effect as chains of activity disappear.

Consider what happens, for example, when thousands of Las Vegas casino dealers making $40,000 to $70,000 a year lose their jobs.

Those dealers all had mortgages, car payments, grocery budgets, doctor and hairdresser visits, local spending habits, et cetera — all supported by their gaming industry income, which means all of it disappears. When good-paying jobs disappear en masse, the economic multiplier effect goes into reverse. A single government check, arriving on a delayed basis, doesn’t bring that back again.

The reality is that the economic carnage we are dealing with now — as an inevitable side effect of the pandemic fight — has no historical precedent. It could potentially dwarf the 2008 financial crisis, and even go toe-to-toe with the Great Depression of the 1930s.

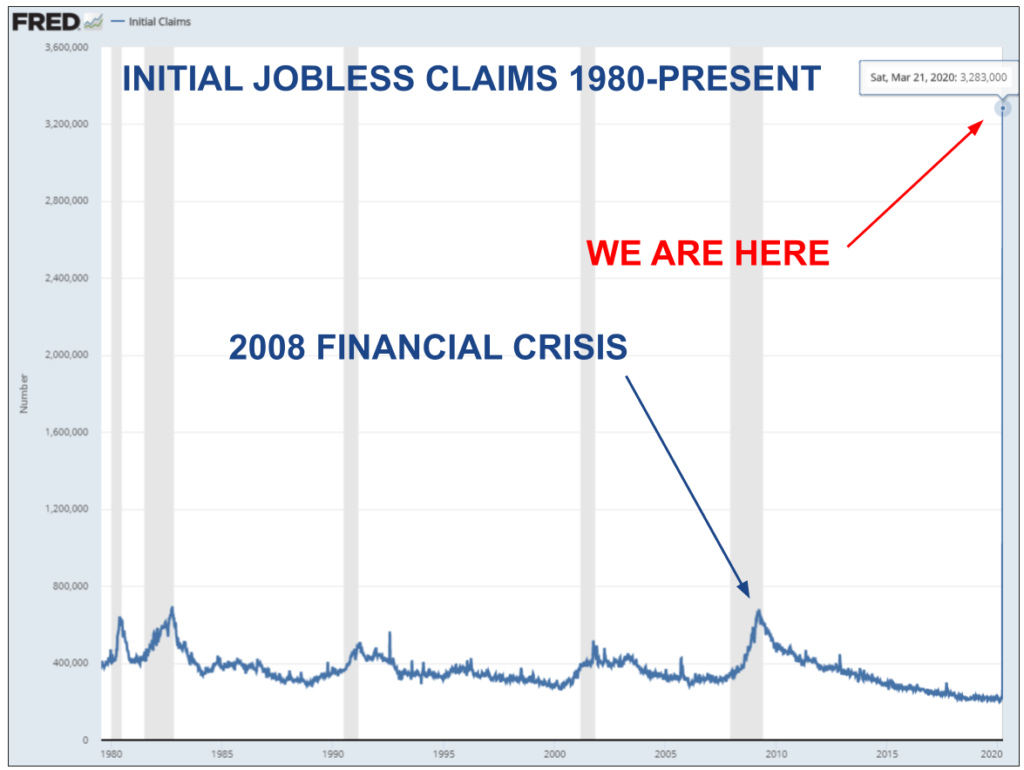

If that sounds extreme, take a look at the March 21 initial jobless claims chart as shown below, and keep in mind this is just an appetizer.

Every week, a tally is collected of all the Americans who file for unemployment benefits. This is known as the initial claims number, also known as unemployment claims or initial jobless claims.

The below chart, via the St. Louis Federal Reserve, shows weekly initial jobless claims dating back 40 years, from 1980 to the present. The added notations are ours.

The “WE ARE HERE” notation and red arrow points to the initial jobless claims number for the week ending March 21. The crazy vertical line is not a rendering error. If you compare last week’s jobless claims to the last 40 years, we haven’t just left the building. We’ve left the stratosphere.

The prior record for initial jobless claims was 695,000. That was set in 1982, near the peak of a horrible recession with interest rates in the teens.

In the depths of the 2008 financial crisis, initial jobless claims hit 665,000 in their worst week — not quite as bad as the worst week of 1982.

But now, at the beginning of the coronavirus pandemic — and make no mistake, it is still early — we just saw a jobless claims number of 3.3 million.

That is almost five times what was seen in the 2008 financial crisis. It blows away the data set.

The number of Americans filing for unemployment last week was so high, phone lines had waiting times measured in hours and multiple state websites crashed under the traffic load.

Nor does a week of initial jobless claims capture the whole picture.

A great many working Americans — like gig workers, students, the self-employed, and those on the job for less than six months — are not eligible to file for unemployment benefits.

Another large contingent of workers still have official employment, but no job to show up for because their place of business is closed. For millions of businesses, the picture is murky as to whether they’ll survive, which means many of those workers are headed for jobless status, too.

Millions of small-business owners are also faced with an agonizing choice. Do they keep paying idle workers in hopes of weathering this shutdown, and potentially run through their savings in doing so?

Or do they throw in the towel early to save what precious cash they have — knowing that a prolonged shutdown, or worse yet a follow-on shutdown in the fall, would wipe them out?

There is a lot more math that goes into it, and a whole range of incalculable unknowns.

But our general feeling, looking at the picture from multiple angles, is that $2 trillion is just a down payment. It is more or less a starting gun effort.

All told, we are looking at an economic battle on par with pulling the United States out of the Great Depression in the 1930s.

And that battle will have to be waged simultaneously alongside “World War V,” as in “V for Virus.”

With regard to the fight ahead, we’re reminded of a Winston Churchill quote: “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”