How to Make the ‘Holy Grail’ Even Better

As the CEO of a financial software company, I get A LOT of questions about investing.

When most folks learn what I do, they want to know what our powerful TradeSmith tools say about this or that stock or even the market as a whole.

But I also get a question that’s a little more difficult to answer. It usually goes something like this:

“Wow, your software sounds great. But I’m not in a position to manage my own portfolio right now. What would you recommend for someone like me?”

Now, managing a portfolio with TradeSmith isn’t as difficult or time-consuming as most folks initially assume. And I’m proud we’re able to offer several different subscription levels to make our tools affordable for nearly any investor.

However, the reality is that not everyone has the time or desire to manage their own investments. Which typically leaves these folks with one of two not-so-great options.

They can dump their savings into mutual funds, or they can entrust them to a broker or money manager who rarely has their best interests at heart.

Each of these options tends to underperform the broad market. And each tends to charge excessive fees.

Fortunately, these folks can do better.

Over the past few weeks, I’ve shared a legitimate alternative to these terrible choices.

I’ve shown you how Ray Dalio’s “All Seasons” portfolio can allow any investor to earn solid long-term returns without the high fees and stomach-churning volatility that typically comes with a “buy and hold” approach.

But I’ve also shown you how TradeSmith subscribers can potentially do much, much better.

Last week, I unveiled a special edition of the All Seasons portfolio that combines Dalio’s powerful fundamental approach with our proprietary TradeSmith risk-management and market-timing tools.

And this week, I promised to explain more about the “ins and outs” of how I built this TradeSmith All Seasons portfolio and how you can manage it yourself.

So, let’s get right to it…

As a reminder, here is the complete TradeSmith All Seasons portfolio I introduced last week. I’ve also updated it with the sample share allocations for a hypothetical $100,000 portfolio.

Last week we provided a download link for a CSV file that you can upload to your TradeSmith Finance account. This week, we’re providing the exact same list, but with the dollar amount and number of shares for each position, based on a $100,000 portfolio. You can download that CSV file here. The file will make it easy to add this portfolio as a watch list in your own TradeSmith Finance account.

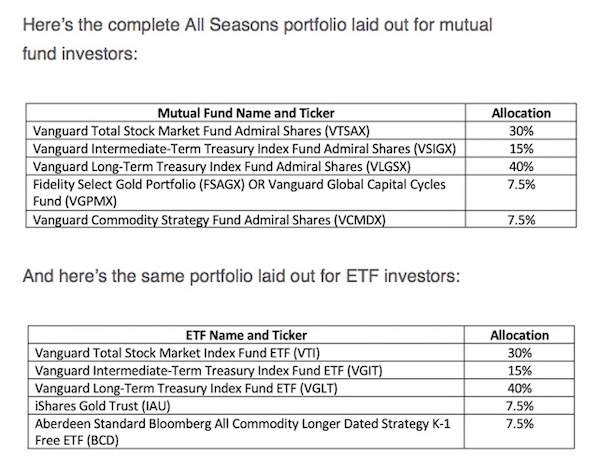

Now, let’s walk through each of the changes I made in this portfolio. As a refresher, here is the original version we shared in Week 2 of this series:

The most significant change is the addition of our TradeSmith Health Indicators.

The original All Seasons I shared with you was based on a simple “buy-and-hold” portfolio. But this version would buy and sell each asset based on its health status.

The benefits of this approach should be obvious.

While we’d still be holding the same diversified group of assets that should do well in different market environments, we’d only be owning those that are doing well at any given time.

For example, long-term bonds have recently been underperforming stocks and commodities as inflationary fears have risen.

This underperformance has created a “drag” on the original All Seasons portfolio, but not in our TradeSmith version. Because our long-term bond position is in the TradeSmith Health Indicator Red Zone, we’re holding that allocation in cash instead.

In other words, while cash typically weighs on the overall performance of a traditional stock portfolio, it can improve the returns of the All Seasons portfolio.

The next change involves the allocations to U.S. Treasury debt.

As shown above, the original All Seasons portfolio held 40% in long-term Treasury debt (Treasury bonds) and 15% in intermediate-term Treasury debt (Treasury notes).

Our TradeSmith All Seasons portfolio still has this same 40% allocation to long-term Treasury bonds. However, it no longer holds any Treasury notes. There are a couple of reasons for this.

First, while the original All Seasons has performed well over the past 90-plus years via backtesting, there’s no question it has benefited tremendously from the relentless decline in interest rates over the past 40 years.

Because interest rates and bond prices move inversely, this has acted as a massive tailwind for bonds.

Today, interest rates are near record lows. And while they may not necessarily move significantly higher immediately, it simply isn’t possible for rates to continue to fall as they have for the past several decades.

So, I think it makes good sense to scale back on our bond allocations a bit.

Second, intermediate-term Treasury debt also plays something of a “cash-like” role in the original All Seasons portfolio, helping to lower its overall volatility.

However, since our Health Indicators automatically ensure we’re holding more cash when and where appropriate, this allocation to intermediate-term Treasuries isn’t necessary.

So rather than cut back on both our long-term and intermediate-term Treasury positions, I simply removed the latter altogether.

Next, you’ll notice the allocations to our inflation hedges – commodities, gold, and Bitcoin – are higher now than they were previously.

Our “buy-and-hold” All Seasons portfolio held a total of 15% in these assets. It had 6% each in commodities and gold, and 3% in Bitcoin.

In this portfolio, I’ve doubled that allocation to 30%. And I then used our Risk Rebalancer tool to divide the risk equally among these three assets based on their Volatility Quotient (VQ). (If you’re not familiar, this is our proprietary TradeSmith measure of an asset’s risk.)

I increased our total allocation to inflation hedges for two reasons.

First and foremost, because our Health Indicators will ensure we only own these traditionally volatile assets when they’re doing well, we can afford to hold a bigger percentage without hurting our long-term performance.

Second, as I mentioned with our bond positions earlier, I believe the probabilities of experiencing specific market environments or “seasons” are shifting. While much of the last 40 years saw falling interest rates and inflation, I think the next several decades are likely to see significant periods of rising rates and inflation.

We’re still holding a balanced portfolio; we’re just “tilting” our allocations a bit to account for this likelihood.

Last but not least, you’ll notice I swapped out the two stock market index funds in favor of a diversified, risk-balanced portfolio of 20 high-quality stocks created with our Pure Quant portfolio-builder tool.

Longtime TradeSmith readers shouldn’t be surprised by this change. As I’ve explained many times, I just don’t like stock mutual funds.

The vast majority of these funds charge ridiculous fees that destroy your long-term gains. But even the low-cost stock funds like I chose for our buy-and-hold portfolio are less than ideal.

Now, low-cost funds are acceptable for assets like Treasury bonds, gold, and commodities, which aren’t always easy to own directly and are more or less interchangeable.

But by definition, when you buy a stock mutual fund, you’re getting exposure to hundreds or thousands of stocks, many of which are terrible businesses you’d never choose to buy on your own.

Why own these kinds of stocks when our TradeSmith tools make it just as easy to hold a diversified portfolio of high-quality stocks instead?

Again, I built this particular portfolio with our Pure Quant tool using one of my favorite Ideas by TradeSmith strategies, known as the “Best of the Billionaires.” This strategy identifies healthy stocks owned by one or more legendary investors in the TradeSmith Billionaire’s Club.

Every stock in the TradeSmith All Seasons portfolio is a favorite of at least one of our billionaires, and most are owned by four, five, six, or more. And each one is a high-quality business I expect to do well for years to come.

Of course, you don’t have to own this exact portfolio of 20 stocks. You can always build your own diversified stock portfolio based on your preferred sources.

Finally, once you’ve settled on your final portfolio, you’ll follow our TradeSmith Health Indicator rules to make your initial investments, if you haven’t already. As I mentioned last time:

- Positions that have a Green Health status are considered a “buy.”

- Positions with a Yellow Health status are a “hold.” If you already own them, don’t sell them. But you shouldn’t buy them today.

- Positions with a Red Health status are a “sell” or “do not buy.” Allocations to these positions should remain in cash. And any position that moves from Green or Yellow to Red (i.e., triggers its Health Indicator Stop Loss) should be sold.

Three of our positions are Red right now: long-term Treasury bonds (VGLT), gold (IAU), and Bitcoin (BTC/USD).

These first two allocations (40% and 11.30%, respectively) should remain in cash today.

However, as I mentioned last week, depending on the size of your portfolio, you may prefer to simply buy and hold your Bitcoin rather than follow our Health Indicator signals. In that case, you can allocate 5.75% of the portfolio to Bitcoin despite its current Red Health status.

As a side note, some of our TradeStops readers wrote in this week to ask how they would know to exit BTC/USD if they do not want to subscribe to our Crypto by TradeSmith tool for tracking its performance. In this case, I would actually argue (and have in the past) that a buy-and-hold approach to Bitcoin may be not only viable, but preferable.

This week, one of our stocks – PayPal (PYPL) – also moved from Green to Yellow. That makes it a “hold” for now. If you don’t yet own it, keep that allocation (1.05%) in cash, too.

Once you’ve invested in all the Green positions, I would recommend managing the portfolio as follows:

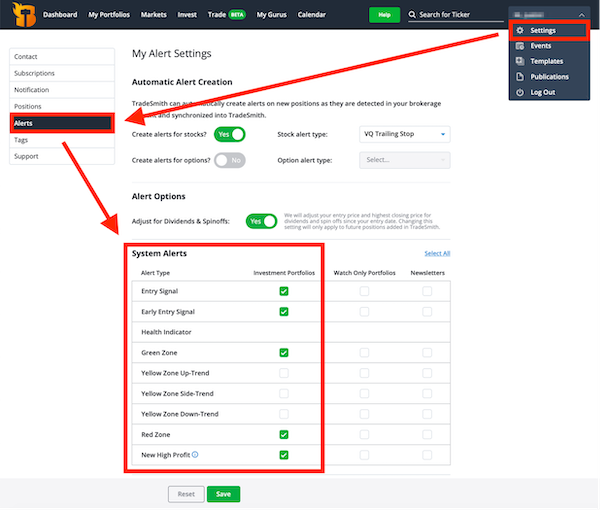

- First, go to the “Settings” tab on your TradeSmith Finance platform and make sure you’ve set up System Alerts to notify you of changes in our Health Indicators. At a minimum, you’ll want to know when any of your positions move into the Green or Red Zones.

- Whenever a position moves into the Red Zone or triggers its Health Indicator Stop Loss, sell that position the next day and hold the proceeds in cash.

- Reinvest that same amount of capital (which may be more or less than the original allocation percentage) when that particular asset moves back into the Green Zone or triggers a new Entry Signal.

- Rebalance your portfolio to the original allocations at least annually, just like you would in the buy-and-hold All Seasons portfolio

The only potential exception to these recommendations has to do with the stock portion of the portfolio.

When one of your stocks hits its stop loss, you might prefer to reinvest the proceeds in a new stock rather than wait for the original stock to re-enter the Green Zone. In this situation, you have two options:

- You can reinvest the proceeds of the sale into a new stock with a similar VQ.Because the new stock has a similar risk profile, you can do this immediately after selling and don’t need to make any other changes at that time.

- You can reinvest the proceeds of the sale into a new stock with a different VQ.In this case, you’ll need to use our Risk Rebalancer to re-equalize the risk among the stock portion of your portfolio. Because this will likely involve buying and selling parts of multiple positions, I would recommend making these purchases on a regular schedule of no more than once per month.

That’s all there is to it.

I hope today’s explanation was helpful.

Next time, we’ll wrap this series up with a “Q&A” of the best questions I’ve received on the All Seasons approach over the past several weeks.