If There’s a ‘Holy Grail’ of Investing, This Could Be It

The numbers are almost too shocking to believe.

Between 1977 and 1990, Peter Lynch did the impossible.

Fidelity Investment’s flagship Magellan Fund produced an incredible 29% average annualized return for 13 years under his management. That’s enough to turn every $1,000 invested into more than $27,000.

This long-term track record is among the best of any professional investor in history. And it’s practically unheard of in the mediocre world of mutual funds.

Given this performance, you’d probably assume that most folks who were wise (or lucky) enough to invest in this fund made a killing.

But you would be wrong.

Fidelity itself found the average investor in the Magellan Fund during those years didn’t make anywhere close to 29% a year. In fact, they didn’t make anything at all.

That’s right. The average Magellan investor lost money during a time the fund was doubling every two to three years.

Unfortunately, this wasn’t an anomaly. Several later studies have shown a similarly dismal result.

Most individual investors earn far less than the “average returns” of the markets, funds, or individual stocks they own.

Why? Because they aren’t able to stomach the volatility required to earn those returns.

Rather than “buy low” and “sell high,” as the old Wall Street proverb goes, most folks end up doing the opposite.

They panic and “sell low” when stocks fall. And they experience “FOMO” (fear of missing out) and “buy high” when stocks move higher again.

But what if I told you there was an easy way to get off this emotional rollercoaster forever?

What if I told you there was a simple investment approach that has returned nearly 10% a year on average for the past 100 years with surprisingly little volatility? And yet could manage this portfolio in only a few minutes a month at most?

You’d probably think that sounds too good to be true.

But I’m here to tell you it’s possible. And over the next few weeks, I’m going to show you exactly how it works and how you can put it to use for yourself.

If you’re a conservative investor who doesn’t want to spend any more time than necessary managing your investments, this approach may be all you ever need. But I’ll also show you how TradeSmith subscribers can use it to make even better returns, too.

It all has to do with an idea called “portfolio thinking.”

Portfolio thinking looks at how different assets and asset classes work together to create an overall investment portfolio.

But to understand how this idea can help us, we must first look at what most investors get wrong.

The concept of portfolio thinking dates back to the 1950s. That’s when U.S. economist Harry Markowitz showed that investing in a combination of different asset classes — like stocks and bonds — can produce better risk-adjusted returns than investing in either one alone.

(The definition of “risk-adjusted return” is just what it sounds like… a measure of how much risk you’re taking to achieve a given amount of return.)

Markowitz’s research ultimately led to the so-called “60/40” portfolio that’s still recommended by many investment managers today. The 60/40 portfolio allocates 60% of its capital in stocks and 40% in bonds.

Again, this portfolio is generally an improvement over owning either one of those assets alone. It produces far better average returns than a portfolio of 100% bonds, with less risk than a portfolio of 100% stocks.

But it does have some severe shortcomings.

First, the 60/40 portfolio is still riskier than most investors can comfortably manage.

Because stocks are historically about three times riskier than bonds, this portfolio still has the majority of its risk concentrated in stocks. If the stock market tanks, this portfolio is likely to suffer a significant drawdown, too.

Second, this portfolio assumes that stocks and bonds are always “inversely correlated.” That’s a fancy way of saying that they generally move opposite of each other. When one does poorly, the other tends to do well, and vice versa.

However, this isn’t always true.

Stocks and bonds have been highly correlated many times throughout history, moving up and down together. And sometimes, they’ve behaved as though they do not correlate at all.

At best, we can say that the correlation between these assets is dynamic over time. And if bonds don’t behave as expected, this portfolio could do even worse when stocks fall.

In short, despite its “balanced” reputation, the 60/40 portfolio tends to outperform when stocks do well, and it tends to underperform when stocks struggle.

Here is where a man named Ray Dalio comes in.

Dalio is probably the best investor most folks don’t know. He’s the founder of Bridgewater Associates, the largest hedge fund on the planet with more than $150 billion in assets under management (AUM).

Dalio is also one of the first investors to examine the problems with traditional portfolio strategies closely. And he made some fantastic insights that have greatly influenced our work here at TradeSmith.

One of his most important contributions is the idea of risk parity. He showed that the most successful investors don’t allocate their portfolios based on the amount of money invested in each asset or position. Instead, they allocate their portfolios based on the amount of money at risk in each asset or position.

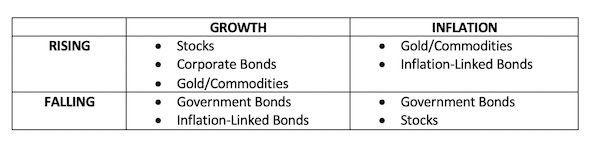

Dalio also identified four primary market environments or “seasons” that move asset prices. These are:

- Higher-than-expected inflation

- Lower-than-expected inflation (or deflation)

- Higher-than-expected economic growth

- Lower-than-expected economic growth

He then mapped out the major asset classes by the season in which it performs best, like so:

Dalio combined these ideas of risk-parity and seasons to create what he called the “All Weather” strategy. He designed it to manage his family’s investments but eventually opened it up to his wealthy hedge fund clients as well.

This strategy consists of a diversified, global portfolio of up to 40 different investments, with risk spread equally among the four quadrants above.

In other words, while it may own different numbers and types of assets in each of the four seasons, it risks an equal amount of capital (25%) in each of them.

The idea behind the strategy is as simple as it is brilliant.

If there are only four primary seasons that drive asset performance — yet it’s difficult (if not impossible) to predict when any particular season is likely to arrive — a well-balanced portfolio should be able to perform well in any of them.

Dalio designed the All Weather strategy to do just that. And it has certainly delivered so far. Since its inception in 1996, this strategy has generated close to 10% average annualized returns.

That’s virtually identical to the returns of a conventional 60/40 portfolio over the same period. But it has done so with roughly half the volatility and with significantly smaller drawdowns than the traditional portfolio.

Unfortunately, folks like you and I can’t invest directly in Ray’s portfolio. Bridgewater is no longer accepting new investors in the All Weather strategy, but you needed to have at least $100 million in investable assets to qualify even when it did. And the specific asset allocation used in the strategy has never been made public.

However, several years ago, in an interview for Tony Robbins’s book Money: Master the Game, he did reveal a simple, “Do It Yourself” version of the All Weather strategy that any investor could follow.

The performance of this “All Seasons” portfolio, as it has since become known, has been impressive as well.

As I mentioned earlier, it has also returned nearly 10% a year on average, going back to 1927. Yet, it has done so with significantly less volatility and smaller drawdowns than either the market or a conventional 60/40 portfolio.

For example, over those 93 years, the All Season portfolio suffered just 17 losing years (18%) versus 25 losing years (27%) in the S&P 500. And the average loss in those years was less than 4%, compared to more than 13% in the S&P 500.

Next week I’ll show you exactly how this portfolio works, how you can put it to use for yourself, and how our TradeSmith tools can make it even better.

In the meantime, I’d love to hear what you think about these ideas at [email protected]. As always, I can’t personally respond to every letter, but I read them all.