Want Real ‘Sizzle’ With Your 2023 Stock Plays? Make This One Move Now.

I love bacon.

There, I said it.

You heard it.

And now you know.

I love bacon as a snack. On my burgers (can’t have a burger without it). As a breakfast or brunch “side” with my eggs. On breakfast sandwiches.

As a key element of a BLT.

On smoked meats.

Mixed in with the chopped sirloin on cheesesteak subs.

As a crumbly salad topper.

And – in a timely nod to the approaching holidays – as a “flavor” for traditional turkey stuffing.

Bacon has it all and does it all.

Which is why I’ll do just about anything to have a ready supply of it on hand.

When the pandemic hit – as hoarding consumers stampeded to the supermarkets for paper towels, toilet paper, and other sundries – I raced over to the nearby Graul’s Market and bought out the entire inventory of center-cut bacon. I didn’t care about the brands or the price – I just wanted to make sure I had bacon.

Here’s why I’m sharing this “slice of life” anecdote.

All those supply-chain kinks have been pretty much worked out. So, when you now make that trip to your local supermarket, you’ll mostly find a ready supply of all the things you want.

But thanks to that tenacious wallet parasite that we know as “inflation,” prices are now the big problem.

Including bacon prices.

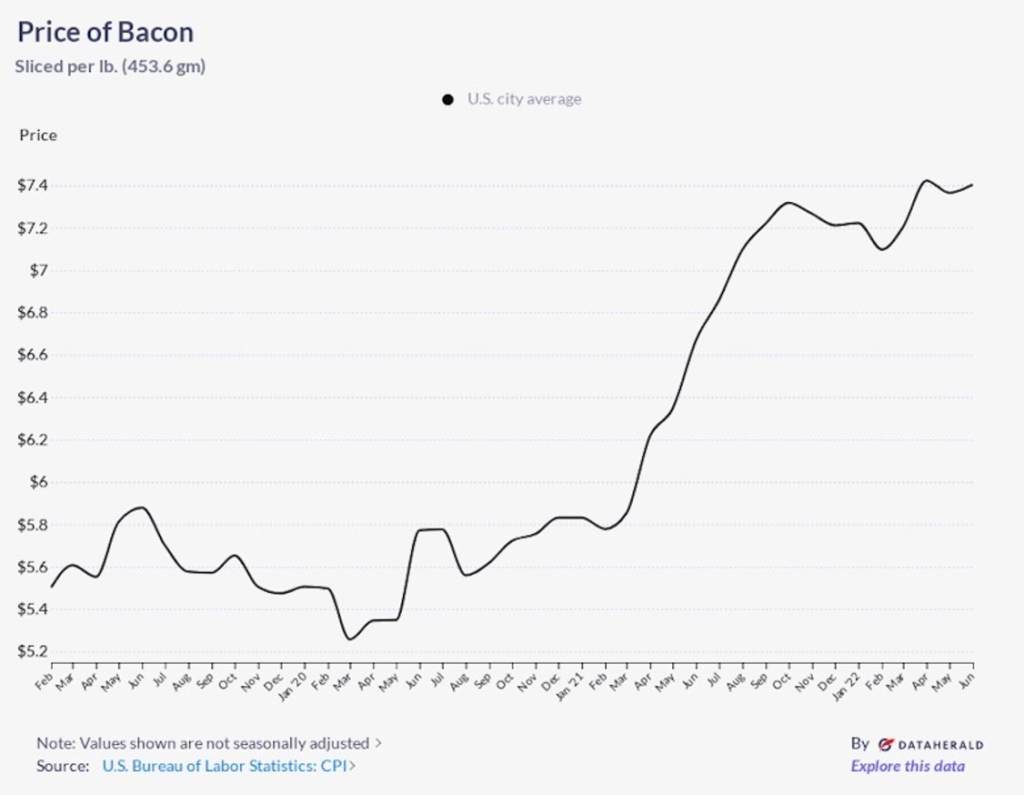

Between February 2020 and June of this year, the retail price zoomed from $5.50 a pound to $7.36.

According to the latest inflation report, prices are still advancing – but at a slower rate than expected. Indeed, the so-called “core” consumer price index (CPI) was up 6.3% on an annual basis. That core CPI backs out doesn’t include the impact of what you’re paying for bacon and other foods, or what it costs to gas up your car – because those prices are more volatile.

The real message here: All those inflation numbers the White House and our other elected leaders down in Washington toss around in such a cavalier manner absolutely do not reflect what it really costs us to live, work, and eat.

According to ShadowStats, a researcher that provides an “alternate” view of the economic statistics Washington gives us, the real inflation rate is double what our leaders would have us believe. According to the “official” numbers, the inflation rate eased from 8.2% in September to 7.7% in October. But ShadowStats says the “real” numbers were more like 16.4% and 15.9%, respectively.

With these numbers “still at four-plus decade highs, inflation problems are about to soar anew,” ShadowStats said in a research note.

That’s a dramatic statement. But it’s one that mirrors our thinking here at TradeSmith – and that meshes with our newest research and the assessments we’ve made during our latest strategic planning sessions.

Indeed – if you’ll permit me to “part the curtains” a bit to share what we’ve been working on for all of you – we believe we’re hurtling headlong into one of the most uncertain market stretches we’ve seen in decades.

This “Era of Uncertainty” (or “Age of Chaos,” as one of our top strategists has dubbed it) really was inevitable.

The “storylines” that we’ve accepted for decades are shifting – on a micro and a macro level. The “globalization” trend that’s driven so much of our investment thinking since the 1980s is reversing course. Worries about political schisms, global debt, interest rates, cryptocurrencies, the environment, education, and much more are creating previously unseen levels of uncertainty.

On the surface, it seems like there’s more data available than ever before – a flood of it, in fact. But the “shelf life” of that information has gone from days to hours to minutes to seconds – and now to milliseconds. That makes it tough to know what to act on – and what to ignore.

It seems like there are more places to put our money than ever before – but less clarity about what are the “right” opportunities for any given moment.

It seems like there’s more risk than ever before – but less guidance on how to manage that risk.

On its face, this sounds daunting.

But it doesn’t have to be that way.

If you look at this all the right way, it creates an opportunity – and a big one. In fact, if you’ll pardon my use of some business jargon, I believe this gives retail investors like you a true “competitive advantage” over the institutional players who invest and trade for a living.

To grab that “competitive advantage” for yourself, you must make two very simple moves.

First, you have to dispense with investing based on emotion. In other words, you can’t make moves based on “hunches” or “gut instinct.” And no more high-risk plays based on the rationalization that “It’s only a few bucks, so I’m taking a flier on this stock.”

Second, you need a “system.” One that’s based on proven, back-tested analytics. Like the software tools that TradeSmith’s global analytics team puts at your fingertips – tools that are updated with new data and new research each day.