What to Make of the Cannabis Bear Market

Right now, there is a lot of chatter about a potential market downturn in the wake of the Federal Reserve’s decision to taper its assets later this year.

But investors in certain sectors have already witnessed an extensive sell-off in the markets. Right now, more than 69% of all publicly traded stocks are trading below their 50-day moving average. This suggests that even though the S&P 500 is sitting near all-time highs, there has been an onslaught of selling in nano-cap, small-cap, and micro-cap stocks.

If you’re looking for an industry that has been hammered in recent months by a sell-off, look no further than the cannabis industry.

Cannabis stocks have plunged since February highs, and there doesn’t appear to be any support among buyers in sight.

If you’re a buyer and holder of cannabis stocks in recent months, you need to read what’s happening in this industry.

The Excitement Has Faded… For Now

In July, the U.S. Senate released the draft of a bill that would federally legalize cannabis. The Cannabis Administration and Opportunity Act was supposed to be a massive catalyst for broad legalization in a nation of nearly 330 million people. Most enthusiasts expected that this bill would be the key catalyst that would transform the cannabis industry and make investors rich.

What went wrong for cannabis stocks?

Buried under the headlines was the truth about this sector. Sen. Charles Schumer (D-NY) noted that, despite the all-out approach for this revolutionary bill, Congress might not have enough votes to pass a deal.

Sen. Cory Booker (D-NJ) opposed separate banking reform for cannabis companies, a sticking point for many other politicians.

In addition, the law would have heavily regulated interstate trade and would have included a 25% federal sales tax on cannabis. Finally, President Biden hasn’t endorsed the deal and reportedly prefers slow-but-steady decriminalization instead of a blanket reform.

This was a classic case of “selling the news” by professional traders.

Cronos Group (CRON) shares have fallen from north of $8 to $6.40 over the last 30 days.

Shares of Trulieve Cannabis Corp. (TCNNF) have slumped from above $36 to roughly $28 since the Senate introduced the bill. The pain looks much worse when you see that Trulieve stock traded as high as $53.73 in March 2021.

And Tilray (TLRY)? Hold your nose.

The Canadian cannabis producer’s stock experienced a remarkable short squeeze in February. Shares climbed as high as $67 that month. Today, they’re trading around $13.25. That’s an 80% drop from the 52-week high.

As we always note, it’s critical that you use trailing stops if you’re actively trading and investing in these stocks.

The Breakdown in Cannabis Stocks

The cannabis industry can be an incredible place for investors to make money in the future. After all, the U.S. cannabis industry alone is expected to be worth $100 billion by 2030. This would be a massive surge from the industry’s value of $13.76 billion in 2019, when it was illegal.

Americans are more tolerant and supportive of legalization than ever before. Roughly 67% of U.S. citizens supported legalization last year. That is up from 31% in 2000, according to Pew Research.

But it’s important to note that any new industry — particularly one that is expected to grow at such a breakneck pace — will experience volatility.

Not every cannabis stock had a decline as significant as Tilray.

But if you want to know the health of cannabis investments, look no further than the ETFMG Alternative Harvest ETF (MJ).

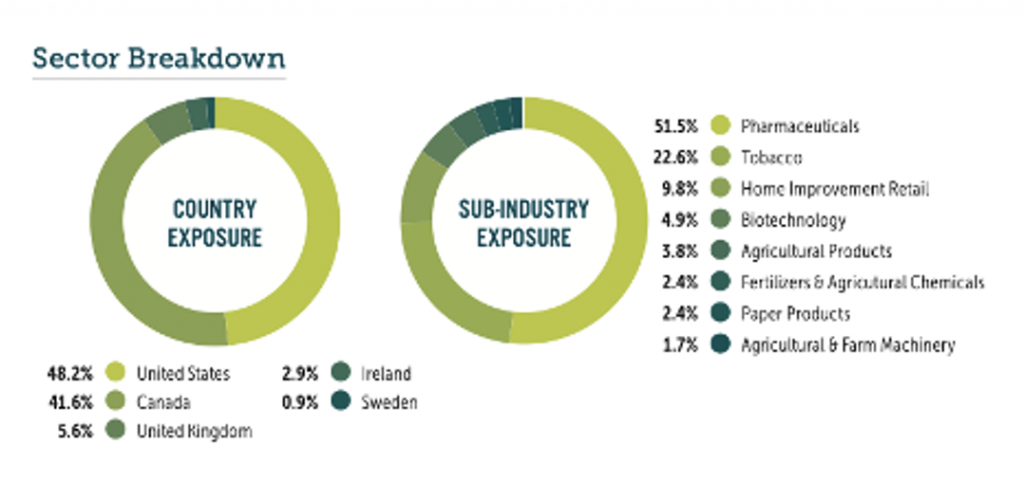

This ETF holds shares of 31 companies that would benefit from the ongoing expansion of cannabis consumption in the United States. These include cannabis growers, tobacco producers, greenhouse companies, and many more. Here’s the breakdown of the fund and its exposure to nations with increasingly more liberal policies around cannabis.

And — of course — you’ll see the usual suspects of growers like Tilray, Canopy Growth, Aurora Cannabis, and Cronos Group.

Now, as you know, there has been a significant amount of excitement around cannabis stocks over the last year. Investors continue to celebrate the ongoing legalization of marijuana across the United States.

However, the MJ ETF hasn’t exactly been a source of growth in recent months.

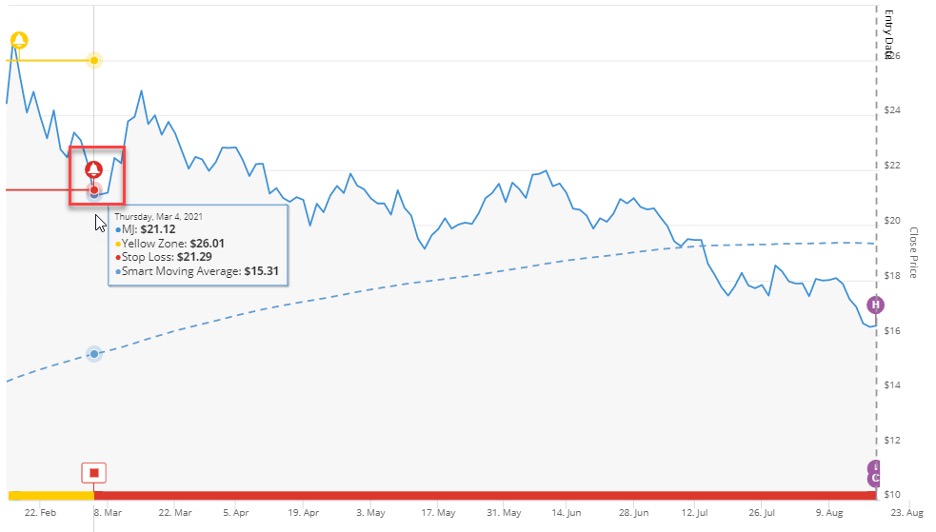

Shares of the ETF are off more than 50% from their 52-week high of $34.58 on Feb. 10. We witnessed a lot of people chase this ETF higher that month, only to be left holding the bag today at lower prices.

And the ETF hit its stop loss in TradeSmith Finance on March 4, 2021.

This is a reminder, as always, that TradeSmith Finance can act as your guide on when to buy and sell stocks.

The cannabis sector will be a high-growth industry over the decade. But we have to be rational and protect our principal in places where speculation is rampant.

As I noted with Alibaba, many people think that cannabis stocks might be very cheap. But the MJ ETF, like Alibaba, is in the Red Zone of TradeSmith Finance and squarely in a side-trend for momentum.

We would want to see shares rise, institutional investors pour into the space, and stronger momentum before buying into cannabis stocks again. I’ll continue to monitor this trend and write more about any opportunities as they emerge.