Is the Tide Turning for Airbnb?

Airbnb (ABNB) was an undeniable beneficiary last year as consumers shifted their travel plans away from crowded hotels in big cities in favor of private — and sometimes non-traditional — units located in more rural locations.

I mean, can you book a tree house for the weekend through Hilton?

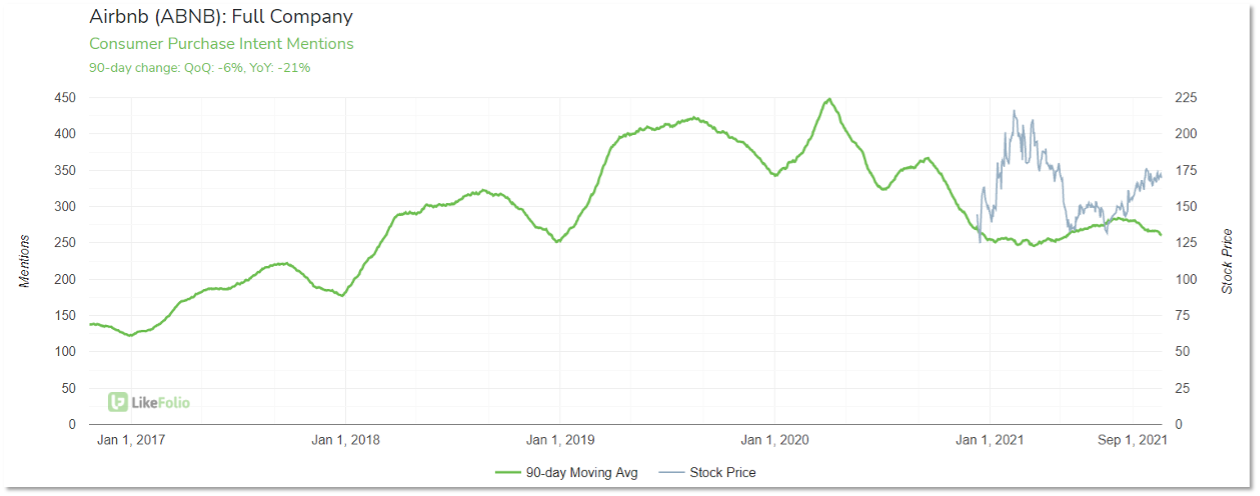

On the chart below, you can see mentions of booking a reservation via Airbnb gain momentum leading up to the start of the pandemic. These mentions (the green line) even sustained relative resilience as many consumers ditched travel plans altogether in 2020.

But now, the tides are turning.

ABNB booking mentions are losing ground with consumers, dropping 21% on a YoY basis.

At LikeFolio, we listen to consumers to understand what drives major changes in behavior… especially when these changes are related to money spent, and thus company revenue.

We’ve noticed three major trends that could be bad news for ABNB… but good news for another group of publicly traded companies.

1. COVID-related travel fears are dissipating.

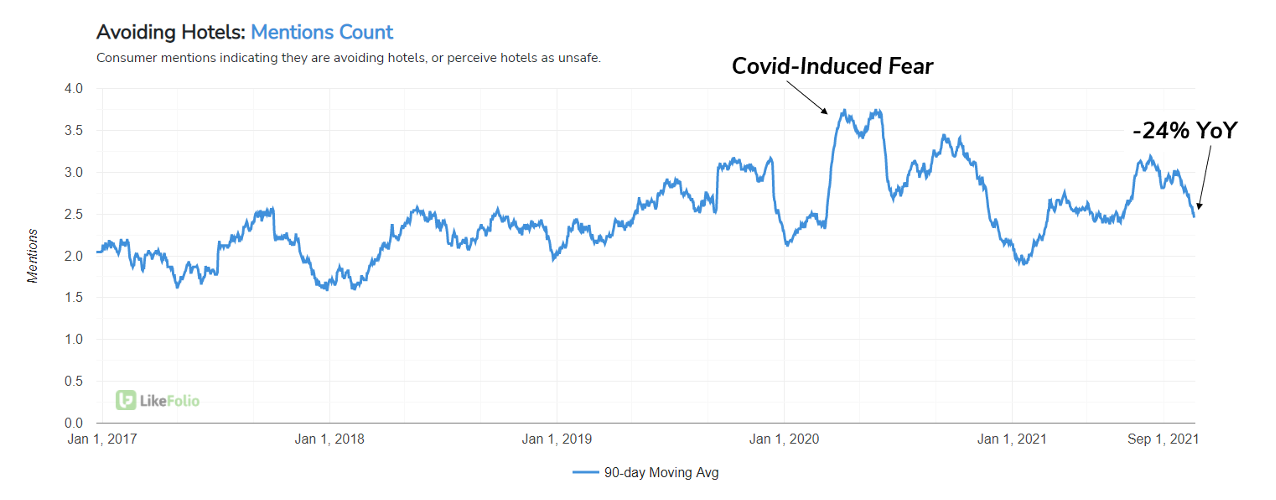

Just look at this chart of consumers discussing avoiding hotels… i.e., opting for more non-traditional lodging, like what is provided by Airbnb.

Mentions have dropped -24% YoY, and the trend continues to weaken.

In general, consumer travel fears related to COVID-19 are fading.

One survey of U.S. consumers conducted in mid-October found that the proportion of consumers reporting “strong feelings of excitement” for travel increased to +75%, more than 10 points higher versus the week of Oct. 4. And 82% of U.S. travelers defined their travel state of mind as “ready,” a return to early summer levels.

2. Airbnbs are getting more expensive.

Consumers are increasingly reporting increases in the cost of Airbnb rentals alongside rental unavailability: +25% YoY.

These consumers aren’t mistaken.

Airbnb’s average daily rate was about $161 a day in 21Q2, +41% versus the same quarter a year prior.

Short term, this could actually be a positive driver of ABNB revenue. But long term, it may weigh on consumer happiness. ABNB sentiment levels have dropped 5 points versus pre-COVID levels.

As the cost gap between hotels and Airbnb narrows, travelers are faced with a decision: embrace the “live-like-a-local” mindset, or opt for the convenience and amenities provided by hotels.

And it looks like consumers are keeping their options open…

3. Traditional booking sites are getting their groove back.

Remember that Airbnb chart showcasing double-digit YoY decline?

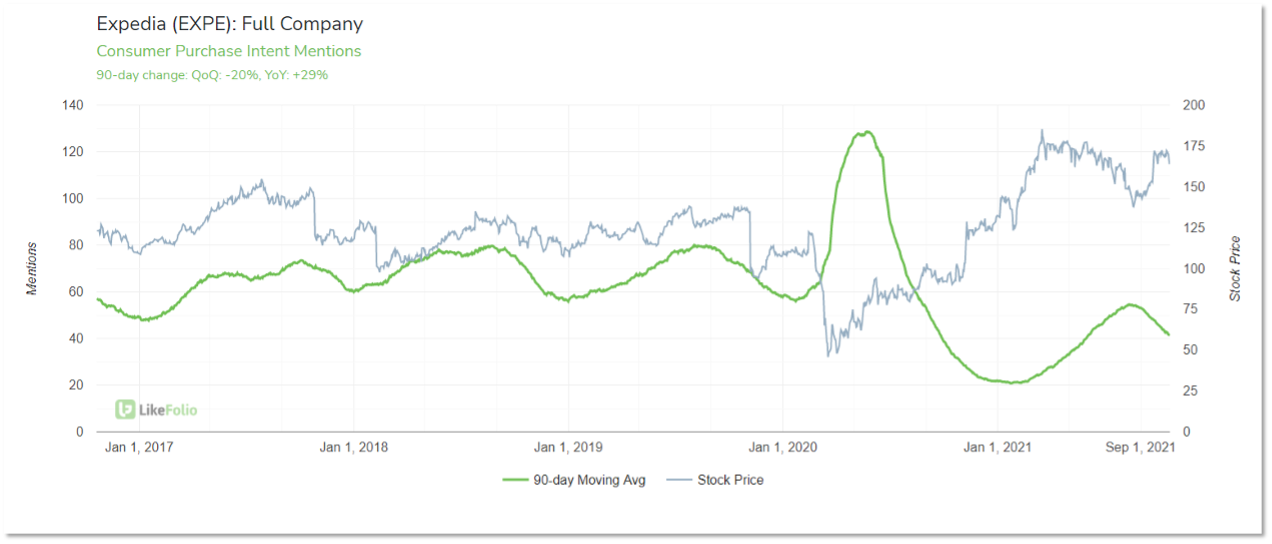

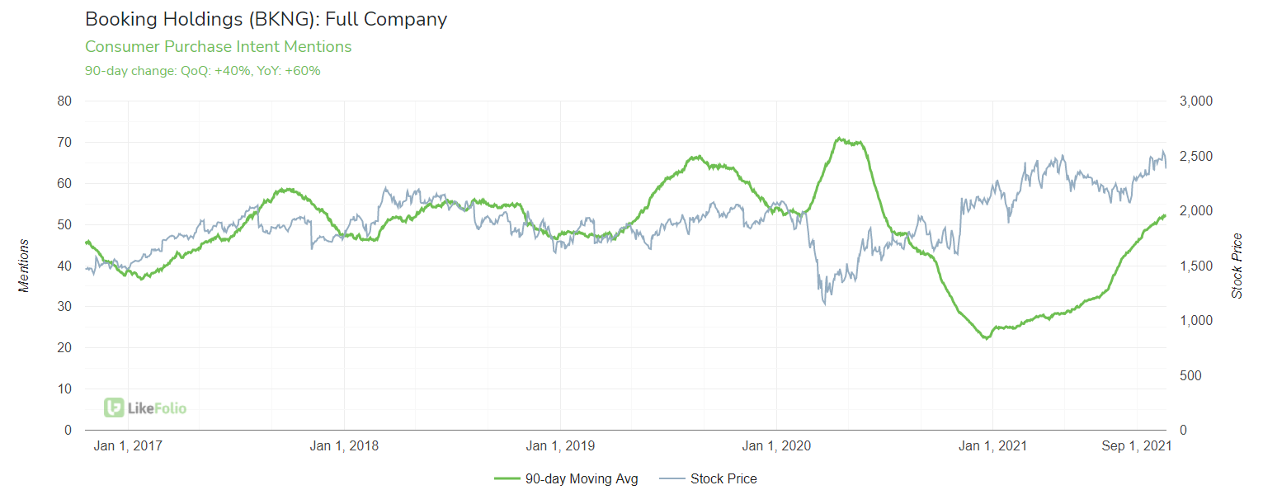

Now take a look at demand for the two major players in the travel booking game: Expedia Group (EXPE) and Booking Holdings (BKNG).

Expedia demand, capturing mentions for brands like Hotwire.com and Travelocity, has increased +29% YoY. And Booking Holdings demand, parent company of Booking.com and Priceline, has increased by even more: +60% YoY.

While both companies DID suffer more from COVID-related shifts in behavior last year, the underlying momentum is undeniable.

And this holiday season may be one of the busiest times for travel we’ve seen in some time.

Keep an eye on the major players in this space, as well as key consumer trends.

For now, traditional booking sites (and even hotels) are likely to continue to gain momentum as travel restrictions and fears ease.

Will ABNB rise alongside other hospitality peers?

LikeFolio members will be the first to know.

Megan Brantley

Head of Research, LikeFolio