These ‘Red Flag’ Charts Show the Economy Is in Trouble. Get Ready for What’s Next.

I know what you’re thinking…

The economy is in trouble.

I don’t have to tell you to be worried about the rising prices because you’re seeing them with your own eyes at the grocery store, your favorite retailer, and the gas pump.

The consumer insights data coming in right now tells me that you’re right in believing that almost everything seems more expensive.

In fact, I’ve never seen anything like this.

Let me show you what I’m seeing through these five “red flag” charts that tell me something very, very wrong is happening in the economy.

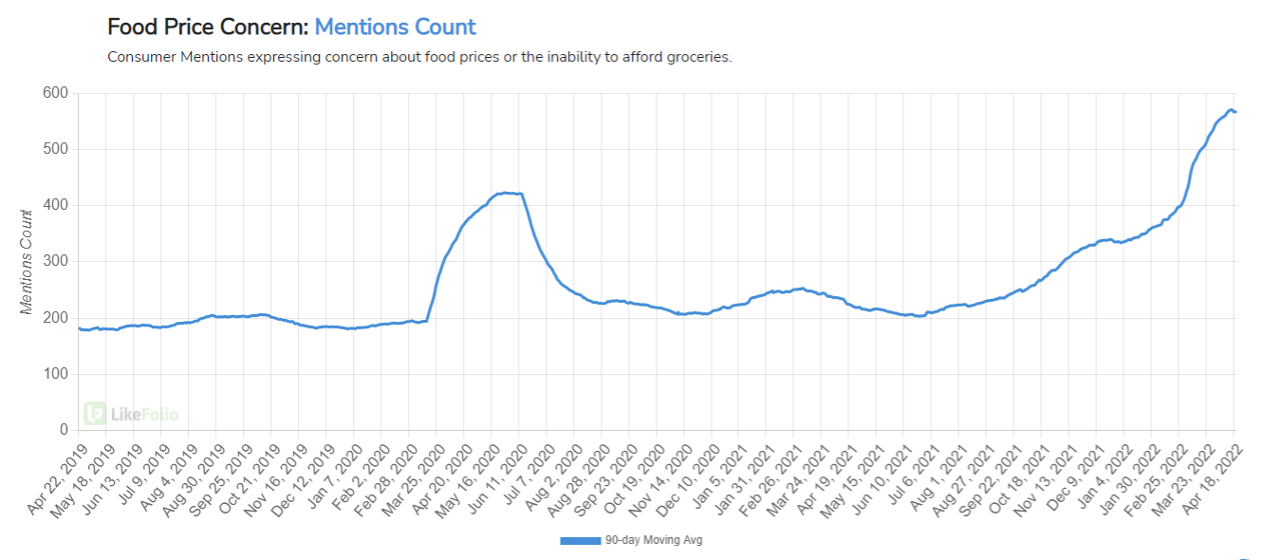

1. Food price increases are dominating the consumer psyche.

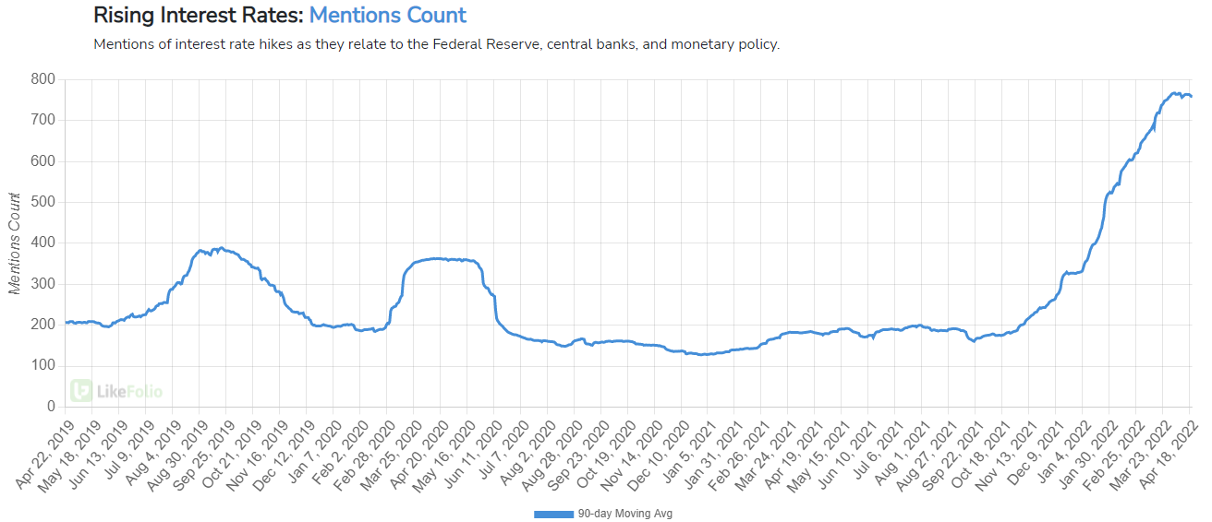

2. Rising interest rates are scaring consumers away from big-ticket purchases.

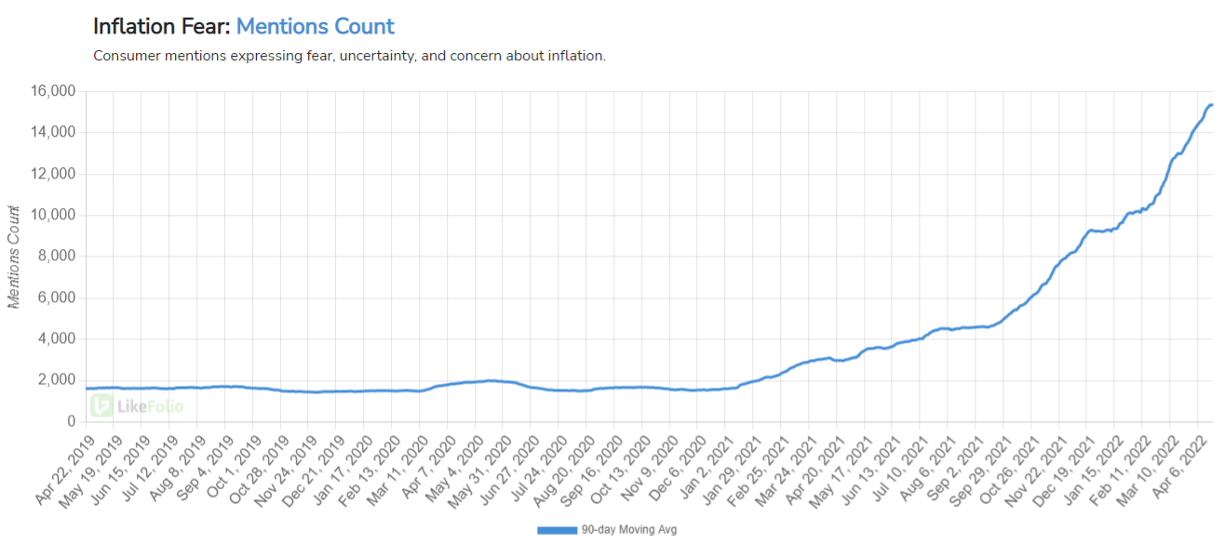

3.Overall inflation fears are accelerating out of control.

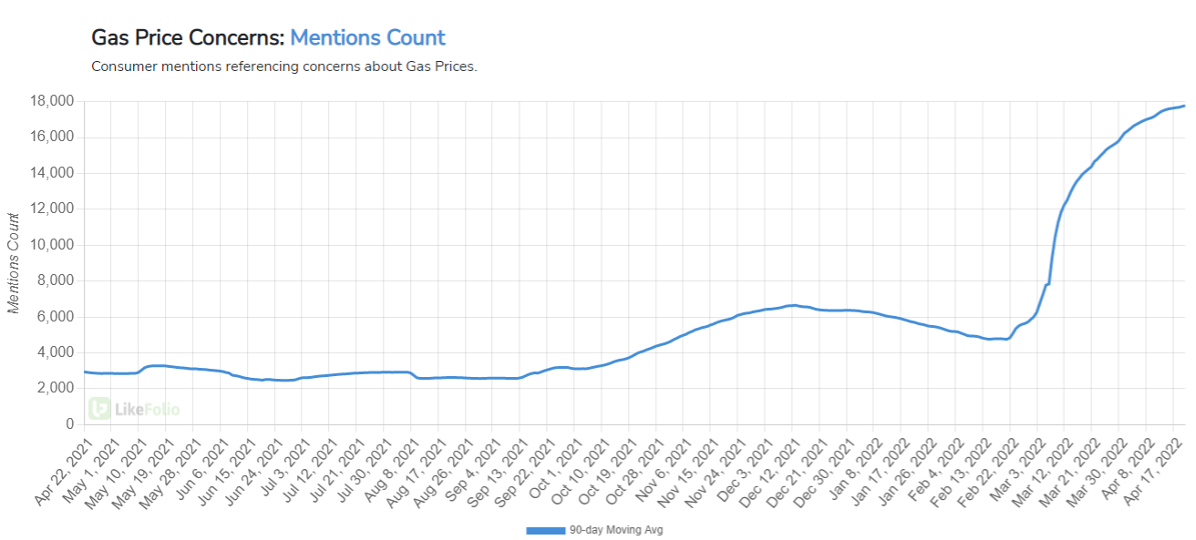

4. Gas prices are crushing the consumer.

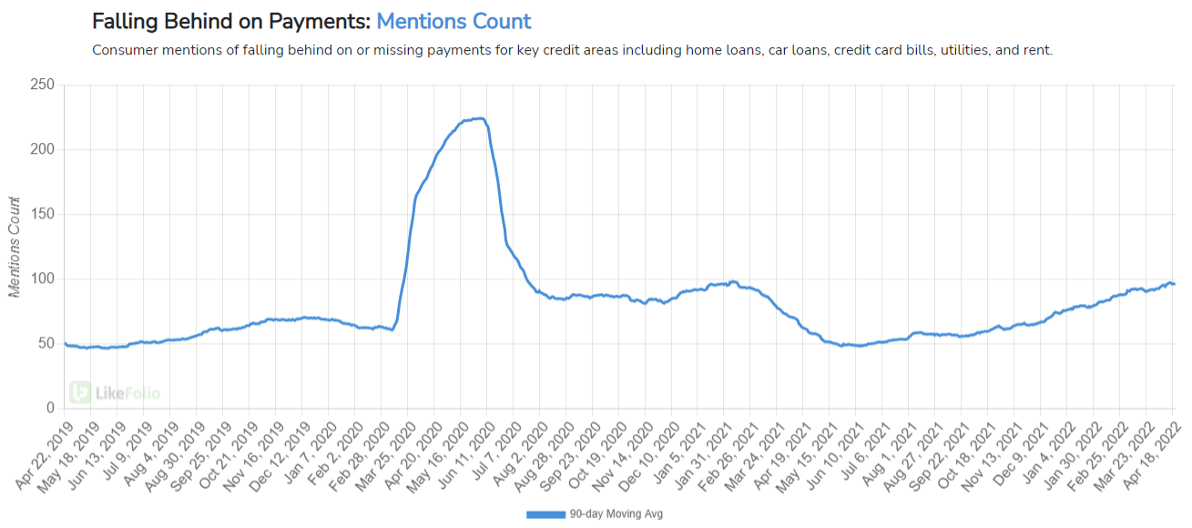

5. Consumers are starting to fall behind on their payments again.

What Can Investors Do?

The knee-jerk reaction to this amount of negative data is to sell stocks and get out of the market.

But with inflation increasing every month, reducing the buying power of your cash day after day — is that really an option?

I think not.

Now is not the time to get out of the market; it’s the time to get into the right stocks.

Stocks of companies with consistently growing consumer demand for their products.

Stocks of companies that are making their customers happy every day.

That is how you find recession-proof winners.

Just as LikeFolio data is showing us the fear and uncertainty of the consumer, it will also continue to reveal to us which companies are not just surviving in this economy, but thriving.

And in a market like this, thriving companies are the only places we want to invest.

Andy Swan

Founder, LikeFolio