This Company Is Tesla’s Biggest Threat

People are buzzing about electric cars. Maybe it’s their eco-friendly appeal. Maybe it’s the skyrocketing gas prices. Maybe it’s the growing variety of EV offerings.

But one thing is clear: When most people talk electric vehicles, it’s usually about Tesla.

Elon Musk is a meme hero at this point, and much of the brand’s draw is attributed to his leadership and innovation.

And consider, you’re reading from someone who not only owns a Tesla, but has never bet against Elon Musk.

So this is a tough take for me.

But now there are more players in the game… and one of the players on my radar is Rivian.

And not just because I saw a Rivian truck in the parking lot the other day…

Here’s why Rivian may be the stiffest competition Tesla has faced so far.

Electric Vehicle Demand Is Not a Fad

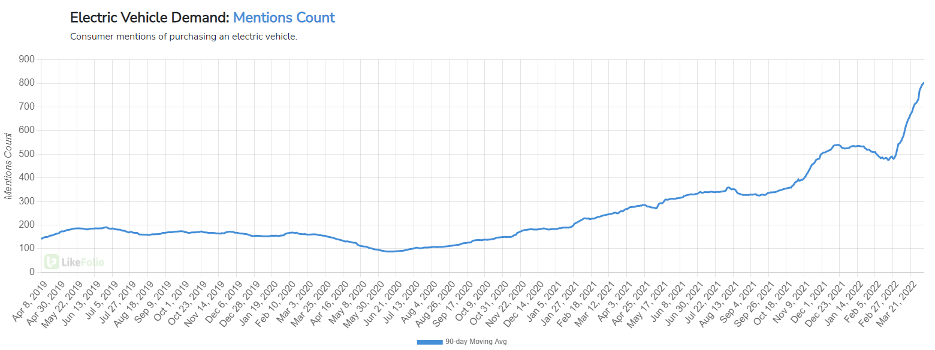

Electric vehicle demand is not slowing — at all — and I have the LikeFolio data to prove it.

Mentions for purchasing an electric vehicle are +189% year-over-year (YoY) on a 90-day moving average.

All. Time. Highs.

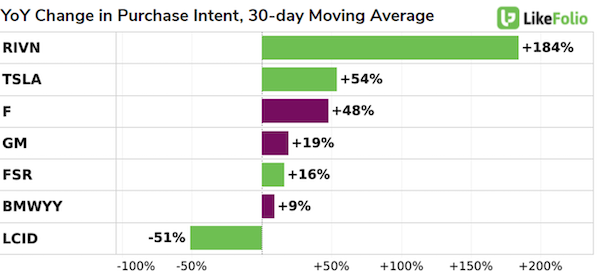

And this rising tide of demand growth lifts many boats.

But it seems to be lifting Rivian’s at a higher multiple.

This makes sense; Rivian doesn’t have to grow by much to catapult its growth metrics.

After all, Rivian’s actual production numbers can’t touch those of Tesla.

Rivian recently confirmed production of 2,553 vehicles in Q1, putting it on target to meet its production goal of 25,000 EVs this year.

Meanwhile, Tesla produced more than 305,000 EVs in 22Q1.

These companies aren’t operating in the same universe… yet.

But this LikeFolio consumer demand — especially in this industry — is extremely forward-looking.

And it shows that consumers are excited about Rivian.

Perhaps that’s why Rivian’s IPO was one of the closely followed public debuts in 2021.

The Rivian IPO Rollercoaster

Rivian’s IPO was something of a Wall Street darling — it debuted and quickly became one of the most valuable carmakers in the world. In fact, for a short time, it was more valuable than Ford and General Motors.

But that didn’t last long as reality sunk in — as it tends to do with hot IPOs.

A key element caught my eye that may prove more substantial on a long-term basis.

Rivian had interest from two major companies: Ford and Amazon.

Amazon not only ordered 100,000 cars for delivery for 2030 but also had a 20% stake in the company.

And Ford took a 12% stake in the company and planned to develop a new EV in collaboration with Rivian (a plan that has since been abandoned).

Consumers Want Large, Electric SUVs

While support from Amazon and Ford is noteworthy, consumers care about performance and pricing.

Initial preorder data suggests Rivian has set this threshold well. The company logged 71,000 preorders for the R1T pickup and the R1S SUV.

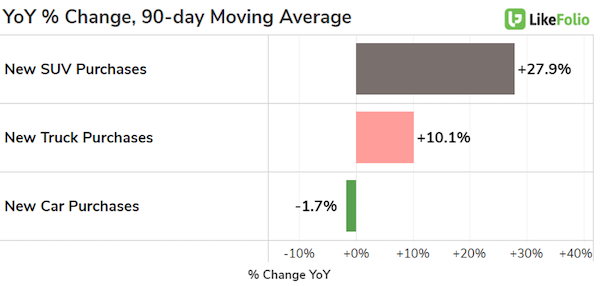

It’s no surprise to LikeFolio members that demand for an electric SUV or truck would be so high. Across the board, consumers want more room:

New SUV purchases lead all other types of new vehicle splurges.

But there is just one problem.

In December, CEO RJ Scaringe emailed customers letting them know that deliveries of vehicles with the larger battery pack option would be delayed until 2023.

Since then, the stock has really come down to earth.

In fact, shares just hit 52-week lows.

But this may prove to be the ultimate opportunity for investors who believe in the company.

Consumers Love the Brand

Sure, Rivian may have only produced 2,553 trucks in Q1 and delivered only 1,227 of them, at least according to Electrek.

But people love them.

When I saw that Rivian truck in the parking lot, I did the same thing: I took about 10 pictures and sent them to almost everyone who was a car person like me. To get consumers to consider an electric vehicle, it needs to have curb appeal.

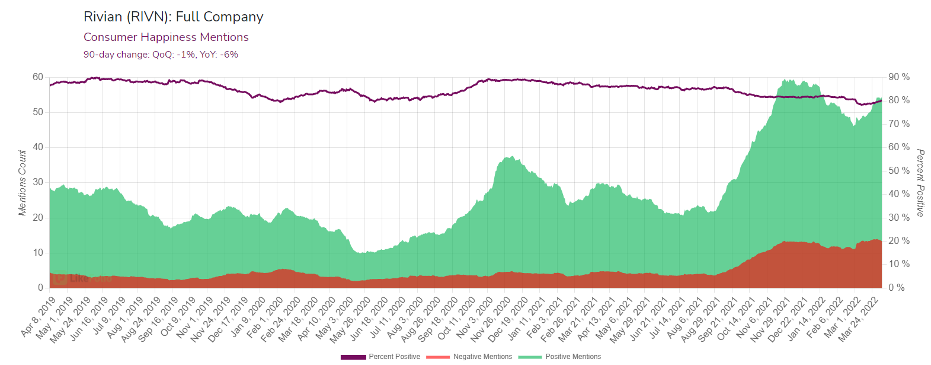

Consumer Happiness mentions are down slightly at -6% YoY, and this is mostly attributable to production delays.

However, the overall sentiment rating is extremely high, at 80%.

If Rivian Can Execute, the Sky’s the Limit

First, Rivian needs to work on production and delivery.

In 2023 it aims to produce 150,000 vehicles. And with the addition of its new factory in Georgia, this production capacity is expected to rise.

Once ramped up, the Georgia facility will be capable of producing up to 400,000 vehicles per year. Construction on the facility is expected to begin in summer 2022, and the start of production is slated for 2024.

But before that happens, keep your eye on an important company event scheduled for next month.

On May 9 comes Rivian’s IPO lock-up expiration, the point at which company insiders will be permitted to sell their shares if they wish. That means a lot of shares could be sold at once, quickly driving down the price of the stock. Because insiders may own shares at a cheap price, they may be willing to sell those shares well below the market price in order to make a quick profit.

This is something to pay attention to because we’ll see if Ford and Amazon stay put. Back in January, Ford CEO Jim Farley said his company hasn’t ruled out selling its stake in Rivian.

If Ford and Amazon stay in, then that’s a serious vote of confidence.

The Bottom Line

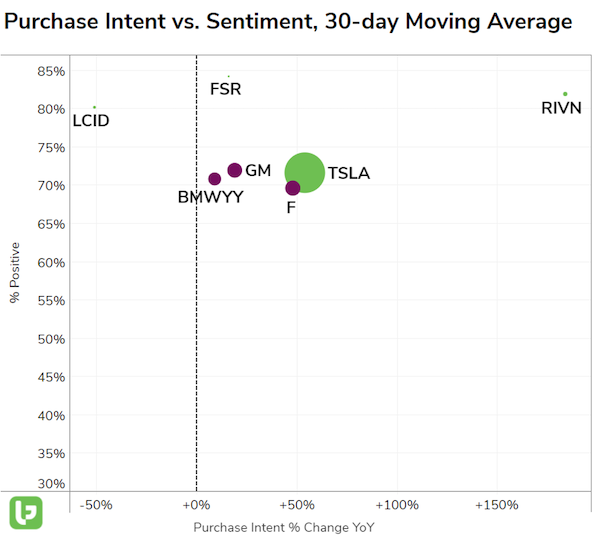

Rivian is crushing peers when it comes to demand momentum and sentiment – and not just by a little.

Yeah, it is plagued with delivery issues and delays, but most of these companies are.

I mean, at least it got a truck to actually work without pushing it down a hill like Trevor Milton did with Nikola.

The truck and SUV are real and they’re out there already with massive demand. I mean, who knows, maybe the lack of supply makes people want them more.

That truck made me do a double take when I saw it.

If the data has anything to say about it, then there’s a bright future ahead for Rivian… if the company can execute.

And like any long-term investment, especially in a start-up, it might take time.

But with this data and where the stock is trading now, I absolutely like the situation it presents.

Andy Swan

Founder, LikeFolio