Here’s How To Target Oversold Stocks

|

Listen to this post

|

Yesterday, we talked about how to squeeze every single cent possible out of our long-term stock positions. We can use a technical indicator called the Relative Strength Index (RSI) combined with the tools of TradeSmith Finance.

When the RSI is north of 70 for Green Zone and uptrend momentum stocks, it is a good time to sell one out-of-the-money call for every 100 shares you own.

This trade strategy allows you to generate additional income from your position. If the stock moves through the price target by the expiration date, the worst thing that can happen is you sell your shares at this higher price, close the position, and buy back the stock all over again.

If the stock’s price does pull back, you’ll be able to keep the premium from the sold call option.

You can buy back the call to close the position and pocket your gains.

But what about when the RSI is at 30 or lower — a range we called “oversold?”

Let’s dig in.

How RSI Tracks Lower

The Relative Strength Index measures price movement and momentum over a defined period of time. On a scale from 0 to 100, we can measure oversold conditions (at 30 or lower) or overbought conditions (at 70 or higher).

This morning, I used TradeSmith Finance to identify stocks that had an RSI below 30. I filtered to focus only on stocks trading on the Dow 30, the S&P 500, the S&P 600 (which covers small-cap stocks), the S&P 400 (which covers mid-cap stocks), the Nasdaq 100, the Russell 1000, and the Russell 2000.

I only found one company that remained in the Buy zone: Lancaster Colony (LANC). Remember, if you own a stock that trades in the Green Zone, you let it run and don’t touch it.

I found only three stocks that are trading in the Yellow Zone: Aerojet Rocketdyne (AJRD), Western Union (WU), and Casper Sleep (CSPR).

With stocks that are trading in the Yellow Zone, you hold but do not buy new shares.

Stocks in the Red Zone? 31.

Yes, 31 stocks with an RSI below 30 are in the red.

When a stock trades in the Red Zone, you sell it after it stops out.

These numbers are evidence that fast-slumping stocks that see their RSI fall to 30 typically lead to a stop out.

And this is, again, very good news for investors who use TradeSmith Finance to avoid massive sell-offs.

Remember — the RSI is a behavioral tool. So, when many investors exit in a flurry, you want to have your trailing stops in place. Rather than monitor the RSI, you can simply use TradeSmith Finance’s custom screeners to know the exact exit point for every stock you own.

But what about that lone stock that is trading in the Green Zone with an RSI below 30?

Let’s try a new strategy.

Selling Puts on Lancaster Colony

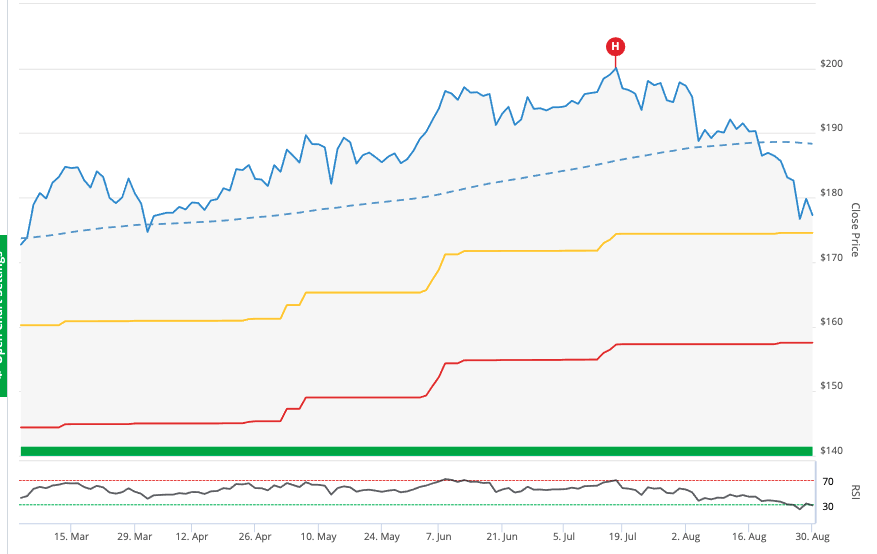

LANC has pulled back sharply over the last two weeks.

The company manufactures specialty retail and food service products. Its brands include Marzetti, New York Bakery, Sister Schubert’s, and Flatout.

The stock has plunged from north of $200 per share in mid-July to about $177 as we closed out August.

Despite this downturn, the company had very strong earnings in its fiscal fourth quarter. It reported that net sales increased by 20.2% year-over-year and hit a record $385.6 million. The company said that its retail segment increased sales by 11.4% for the quarter, while its food service sales surged by 33.3% year-over-year. The company also said its profits increased by 8.5% to $96.7 million.

These are positive numbers. Yet the stock sold off recently due to profit taking and concerns about the delta variant’s impact on the restaurant and retail sectors.

According to TradeSmith Finance, the stock is still squarely in the Green Zone, signaling that it remains a buy.

With the stock trading in the green and the RSI trading under 30, this creates an interesting opportunity to buy the stock and try to seek a rebound while it remains in the Green Zone. Despite the recent sell-off, the stock received a price target of $210 from an analyst at Sidoti just six days ago.

If you buy the stock while it’s in the Green Zone, we might see other investors view LANC as an oversold stock with its RSI under 30. We can ride the momentum wave if capital pours into the stock.

If that wave never comes, we can hold the stock and keep our trailing stop of $157.52 in place, according to the Health Indicator Red Zone on TradeSmith Finance.

Remember, you can profit from overbought and oversold stocks in TradeSmith Finance every day.

I’ll be back to talk about a major warning around cryptocurrency and what to do now.