Get Off the Stock Market ‘Rollercoaster’ Forever

It’s the dirtiest little secret on Wall Street.

It’s bad enough that most retirement funds charge ridiculous fees and underperform the market.

But financial advisors really don’t want you to know that the majority of folks who own these funds don’t come anywhere close to even those underwhelming returns.

That’s because most of the options available in 401(k) plans and similar vehicles — even those that claim to be “balanced” and “conservative” — are heavily exposed to the stock market.

This stock-centric focus makes them far more volatile than most investors can stomach over the long term. As a result, investors often panic and sell when markets suffer big declines and then rush to buy back in long after they recover.

Worse, Wall Street’s “solution” to this problem is based on little more than make-believe and hope: Try to ignore this volatility as though it doesn’t exist… and hope stocks continue to do well in the years leading up to your retirement.

But there is an alternative for passive investors who aren’t willing to leave their retirement to chance.

This unconventional strategy has returned nearly 10% a year on average over the last 90-plus years.

That’s better than the long-term historical returns of most mutual funds. But this strategy has produced those returns with just a fraction of the volatility of most mutual funds and the market as a whole.

For example, going back to 1927, this strategy suffered just 17 losing years (18%) versus 25 losing years (27%) in the overall market. Even more impressive, the average loss in those years was just 4%, compared to more than 13% for the market.

And today, I’m going to show you how it works.

As I mentioned last week, the “All Weather” strategy is the brainchild of Ray Dalio — the legendary founder of the $150 billion hedge fund Bridgewater Associates and one of the “godfathers” of portfolio risk management.

Dalio shared a more “user-friendly” version of the All Weather strategy with performance coach Tony Robbins a few years back.

This version — dubbed the “All Seasons” portfolio — is simple enough for even a novice investor to follow. Yet, backtesting shows it has performed nearly as well as the original. (The historical returns I mentioned earlier are actually for this version of the portfolio, not the original.)

So, what exactly is in the All Seasons portfolio? It’s relatively simple…

The portfolio holds just five different assets in specific percentages:

- 30% in stocks

- 15% in intermediate-term (7–10 year) U.S. Treasuries (Treasury notes)

- 40% in long-term (20–25 year) U.S. Treasuries (Treasury bonds)

- 7.5% in gold

- 7.5% in commodities

The first thing you’ll probably notice is this portfolio holds a significantly lower percentage of stocks — and a higher percentage of bonds — than most “balanced” portfolios you’ve probably seen.

Again, this is by design. Remember, as we learned from Dalio last time, stocks are historically three times riskier than bonds. The larger allocation to bonds helps to counteract the risk in the stocks. That’s a big reason this portfolio is significantly less volatile than most funds and the overall market.

However, a balanced portfolio of stocks and bonds alone is still not enough. As I mentioned earlier, neither of these asset classes has historically performed well in times of rising inflation. So, he rounded out the portfolio with a 7.5% position in both gold and commodities.

You might be skeptical that these relatively small allocations could make such a difference. But history shows they do.

During the 1970s — the last time we saw surging inflation and rising interest rates — this portfolio averaged 9.68% average annualized returns with just one losing year.

By comparison, the S&P 500 averaged less than 2% annualized returns over this time… and suffered three losing years with maximum drawdowns of 17%, 29%, and 12%, respectively.

Which of those returns would you have preferred?

Dalio didn’t recommend specific vehicles to invest in these assets. Instead, he generally recommended using the most efficient and cost-effective index funds or exchange-traded funds (ETFs) available to you.

With that in mind, below are some excellent, low-cost options — including both mutual funds and ETFs — to get you started.

Stocks

- Mutual Fund: Vanguard Total Stock Market Fund Admiral Shares (VTSAX)

- ETF: Vanguard Total Stock Market Index Fund ETF (VTI)

These funds provide exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks with rock-bottom fees.

Intermediate-Term U.S. Treasuries (Treasury Notes)

- Mutual Fund: Vanguard Intermediate-Term Treasury Index Fund Admiral Shares (VSIGX)

- ETF: Vanguard Intermediate-Term Treasury Index Fund ETF (VGIT)

As the name implies, these funds provide exposure to intermediate-term Treasuries. And they have some of the lowest fees available without buying bonds directly from the U.S. Treasury.

Long-Term U.S. Treasuries (Treasury Bonds)

- Mutual Fund: Vanguard Long-Term Treasury Index Fund Admiral Shares (VLGSX)

- ETF: Vanguard Long-Term Treasury Index Fund ETF (VGLT)

These funds provide exposure to long-term Treasuries with low fees.

Gold

- Mutual Fund:

- Vanguard Global Capital Cycles Fund (VGPMX)

- Fidelity Select Gold Portfolio (FSAGX)

You can buy a fund with low fees but only partial exposure to gold, like the Vanguard Global Capital Cycles Fund. This fund’s fees total just 0.38% a year, and it aims to invest at least 25% of its assets in gold and precious metals stocks.

Your other option is to select a fund with more gold and precious metals exposure, but that also charges significantly higher fees. The Fidelity Select Gold Portfolio (FSAGX) is one of the better options in this category.

This fund invests at least 80% of its assets in physical gold and gold stocks, but charges 0.79% in fees. That’s a lot higher than any other funds I’ve mentioned here, but still well below the fees charged by most other gold-focused mutual funds.

- ETF: iShares Gold Trust (IAU)

Commodities

- Mutual Fund: Vanguard Commodity Strategy Fund Admiral Shares (VCMDX)

Like other commodity mutual funds, this one provides exposure to the broad commodities market via “derivatives” (sort of like options on commodities futures) rather than buying the commodities directly through the futures market.

Derivatives add another layer of potential risk to this fund. But again, this is standard for commodity mutual funds, and this particular fund charges significantly lower fees (0.20%) than most.

- ETF: Aberdeen Standard Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF (BCD)

Here’s the complete All Seasons portfolio laid out for mutual fund investors:

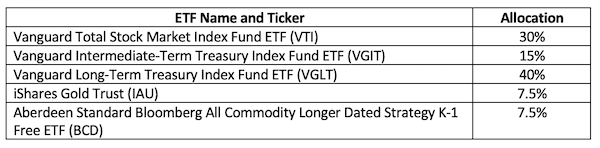

And here’s the same portfolio laid out for ETF investors:

That’s all there is to it.

Dalio recommended monitoring this portfolio monthly and “rebalancing” at least once per year. Rebalancing consists of two simple steps.

First, you’ll sell a portion of those positions that have risen above the recommended allocations. Then you’ll redeploy that capital into the funds that have fallen below their recommended percentages.

When you finish, your portfolio will once again have the same overall allocations mentioned above.

If you’re a conservative investor who doesn’t want to spend any more time than necessary managing your investments, this portfolio may be all you need. It should allow you to earn a solid long-term return while sleeping soundly, no matter what’s going on in the markets.

But if you’re willing to take a few more steps, I think you can do even better. And next week, I’ll show you how to use TradeSmith tools and some simple tweaks to potentially make even better returns without taking more risk.