My Three ‘Rules’ for Winning with Options

Longtime Money Talks readers know I’m a huge fan of options.

In fact, as I mentioned in my year-end note to you, if I had just $5,000 to invest in the markets in 2023, I wouldn’t invest it at all.

Rather, I would use options trading strategies to generate consistent gains of around 1% on that money each week.

As I mentioned, those kinds of returns don’t sound particularly exciting – until you consider they can add up to as much as 50% a year.

That’s roughly five times better than the long-term annualized return of the stock market. And better yet, it’s possible to earn these returns in any market environment. The best options strategies work in bull markets, bear markets, and everything in between.

I’ve explained the basics of options trading in a previous Money Talks series, so I won’t rehash it all today. (If you missed it, you can catch up here, here, here, and here.)

Instead, I want to share three ”rules” I’ve found critical for consistent options-trading success.

Rule 1: Focus on selling rather than buying options

This one should be pretty obvious.

As I explained in my earlier options series, the vast majority of options end up expiring worthless.

That means the odds of success are generally tilted overwhelmingly in favor of options sellers versus buyers.

You can think of the options market as a casino.

Folks who buy options are like gamblers. They might get lucky and hit it big occasionally, but most people end up losing most of the time.

On the other hand, folks who sell options are like the “house.” They’re mathematically guaranteed to come out ahead in the long run.

That means you’re much more likely to be successful using strategies such as selling covered calls or cash-secured puts than you are simply buying calls and puts.

Rule 2: Aim for ‘singles,’ not home runs

Of course, even casinos lose money occasionally. And sometimes those losses can be significant.

The same thing applies to selling options.

So, I generally like to reduce my risk even further by selling short-term options – those expiring within a week to a month – with a very high probability of expiring worthless or “out of the money” (OTM).

To use a baseball analogy, this approach is aiming to hit “singles” rather than “doubles,” “triples,” or “home runs.” Your potential returns will be smaller, but your chances of success will be much higher.

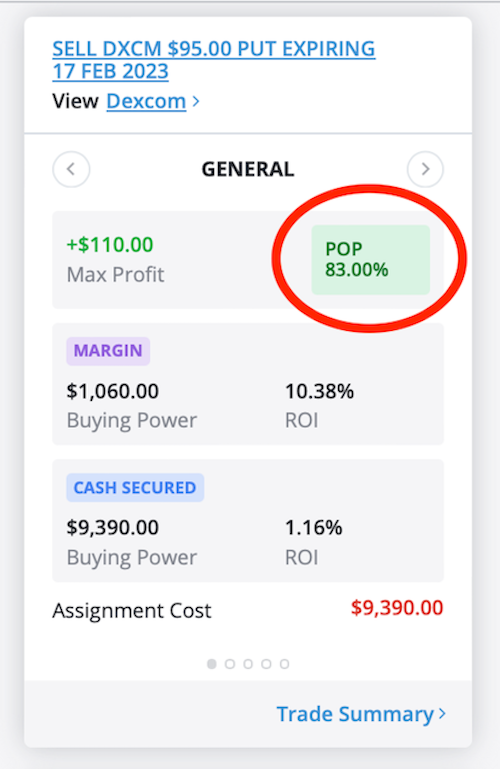

That is one of the areas where CoPilot by TradeSmith – our powerful suite of options-trading tools – really shines. Specifically, CoPilot’s proprietary “Probability of Profit” (POP) metric provides the most accurate assessment of how likely a trade is to succeed that I’ve ever come across.

When selling options, the POP indicates the probability that a particular option will expire OTM (worthless).

I generally look for trades with at least an 80% POP, but 90% or greater is ideal.

However, if you’re not a CoPilot by TradeSmith subscriber, you’re not entirely out of luck.

Some online brokerage and trading platforms provide their own version of this metric.

One thing to be aware of is these are typically stated as a probability that the option will expire in the money (ITM) rather than OTM. They also tend to be less conservative than our POP metric.

That means you’ll generally want to target options with a probability of expiring ITM of no more than 10% to 15%, as these should roughly equate to a POP of 80% to 90% in our system.

Finally, if you don’t have access to either of these metrics, you can use an option’s “delta” in a pinch.

If you’re unfamiliar, delta is one of the five so-called “greeks” – along with theta, gamma, vega, and rho – that measure various aspects of an option’s price.

Delta measures how sensitive an option is to changes in the price of its underlying stock. However, you can also use it to estimate a short-term option’s probability of expiring ITM.

Specifically, you’ll generally want to target short-term options with deltas between 0 and 0.10 when selling covered calls, and 0 and -0.10 when selling puts. Again, it’s not perfect, but these ranges should roughly equate to a POP of 80% or better in our system in most cases.

Rule 3: Stick to high-quality companies for an extra measure of safety

However, even if you strictly follow the first two rules, there is always a tiny chance the option you sell will expire in the money.

That isn’t necessarily a problem when selling covered calls. It just means the underlying stock may be “called away” from you, and you’ll be forced to sell.

But when selling put options, you may be “put” (required to buy) shares of the underlying stock.

So, my third rule is to sell options on high-quality companies that you would be happy to own for a time if necessary.

These stocks tend to perform better and be less volatile, which means you’re less likely to suffer a significant, permanent loss of capital even if you’re required to buy shares for more than their current price.

That’s it for this week.