Another Warning Sign in The Market?

The Federal Reserve has canceled its in-person meeting this week in Jackson Hole, Wyoming.

The ongoing spread of the coronavirus delta variant not only threatens the U.S. economy and schools heading into the fall, it is now preventing our central bankers from getting together in ritzy resorts.

The central bank is poised to start the process of tapering its balance sheet. This means it will start to reduce the amount of purchases it makes each month in bonds and mortgage-backed securities.

The central bank has been purchasing $120 billion in these assets since it launched its plan to support the U.S. economy in the wake of COVID-19.

However, the market doesn’t seem to be reacting negatively to the news.

But I want to highlight yet another warning sign flashing red for the market.

Let’s talk about the Fed, and then highlight this “alternative” signal for investors.

Economic Weakness In Sight

The Fed’s decision to move its event to a virtual session is a sign of how seriously the Fed is taking the delta variant. The recent surge of delta cases has been stunning. In early July, the seven-day average of cases hit 13,000.

Last week, that average was 132,000 — and rising.

So one must ask: Is the Fed taking delta’s impact on the economy seriously?

After all, cutting its bond purchasing program would signal it believes that the economy will eventually be healthy enough to stand on its own. Right now, however, there are numbers that suggest concerns not only about the market but the strength of the economic recovery.

Remember that we were going to have a big summer for travel. But an uptick in COVID-19 cases has impacted air travel. The number of people who have gone through Transportation Security Administration checkpoints has fallen by nearly 500,000 daily travelers since early July.

Meanwhile, large financial institutions have slashed their GDP estimates over the last few weeks. Goldman Sachs slashed its Q3 GDP forecast to 5.5%. The bank said that spending on travel, dining, and other sectors that were expected to recover has weakened in August.

Goldman Sachs isn’t alone. Citigroup came in at 4.5% for Q3, with annual GDP projected at 5.9%.

But the Federal Reserve Bank of New York is even more bearish. The N.Y. Fed projects Q3 numbers to come in at 3.5%. That is a cut of about 0.3 percentage points from its previous forecast.

Now, keep in mind that the stock market is not the economy, and the economy is not the stock market. But when the Federal Reserve starts taking action and reducing its balance sheet, many investors are nervous that a reduction in support will be bad for the market.

The expectation is that if the Fed cuts its support, stocks will more closely reflect the state of the economy and rely more on fundamental analysis.

We’ll continue to monitor that sentiment.

A Warning Sign from the “Alternative Space”

I have shown you various warning signs of a stretched market in recent weeks.

But there’s another one that our team recognized last week.

You’ll recall that I’ve written about closed-end funds in TradeSmith Daily. At the time, I showed a way to buy Warren Buffett’s favorite stocks for 85 cents on the dollar.

I noted that closed-end funds resemble a forgotten relative of mutual funds or traditional exchange-traded funds (ETFs). They have a unique quality that you’ll find in very few places in the public market.

Unlike mutual funds, closed-end funds do not mark to their net asset value (NAV) at the end of the trading day. The net asset value is effectively the true financial value of the fund’s total assets.

So, if there are 100,000 shares and the net asset value is $1,000,000, a fund that does mark to the NAV would be worth $10.

But closed-end funds don’t mark to the true value of the assets. That same fund with 100,000 shares and a NAV of $1,000,000 could trade at $11 per share.

If shares traded at $11, it would mean that the shares traded at a 10% premium to the net asset value.

This phenomenon exists because the shares traded on true behavioral psychology of the market.

Sometimes, closed-end funds trade at a premium, while others trade at a discount. I already pointed out the Buffett stocks trading at a 15% discount.

But let’s point out why a closed-end fund might trade at a premium — and more importantly, what that means for the broader market.

Turning to the Utility Space

In this case, I want to point out three different funds in the utilities space.

Two of the largest utility-focused closed-end funds are trading at a premium to their net asset value.

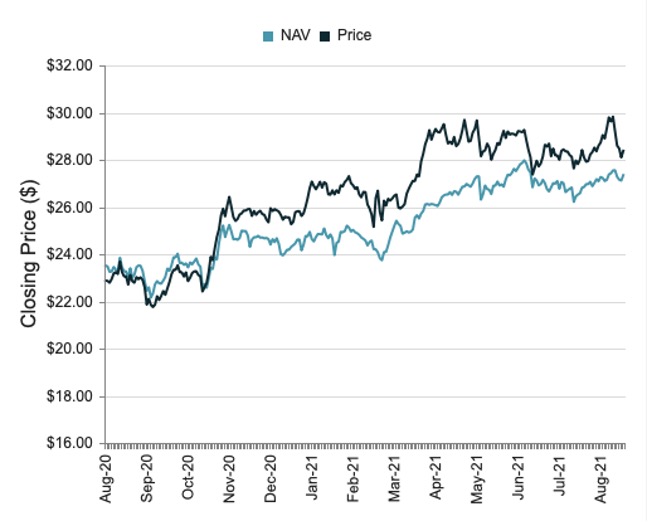

The Cohen & Steers Infrastructure Fund (UTF) is a portfolio of utility companies in the energy, infrastructure, and water space. It owns shares of big firms like NextEra Energy, American Tower Corp., and Enbridge. Right now, the fund is trading at a 3.77% premium to its NAV.

Source: CEFConnect

UTF is in the TradeSmith Finance Green Zone and is in an uptrend with a medium risk VQ of 20.07%. Our Ratings system shows it as a solid bullish opportunity.

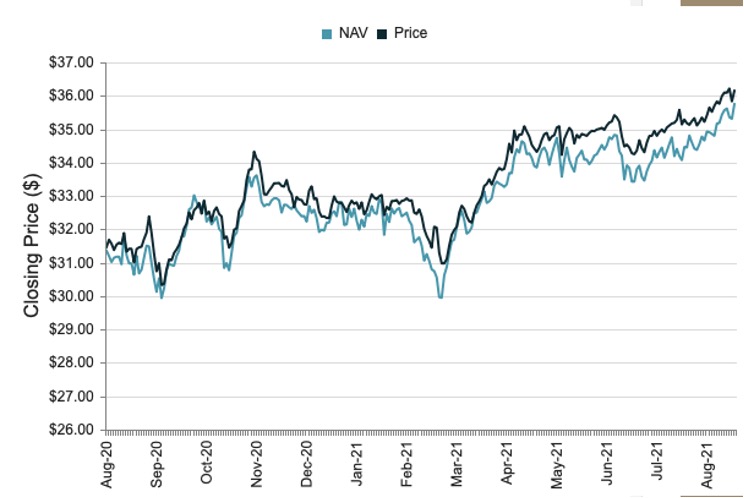

The Reaves Utility Income Fund (UTG) is a utility closed-end fund that owns big stakes in companies like Charter Communications, American Water Works, Verizon Communications, and BCE Inc. This utility fund trades at a 1.14% premium to its NAV.

Source: CEFConnect

UTG is also in the TradeSmith Finance Green Zone, but is currently in a side-trend with a medium risk VQ of 16.94%. It is also solidly bullish within our Ratings system.

The fact that these assets trade at a premium to their net asset value is based on the belief among their investors that the underlying assets will rise in value in the near term.

And what would be a reason why those assets would increase?

Because in times of economic turmoil and stock market turmoil, we see a lot of money shift from blue chip giants and growth stocks to safer sectors like utilities. As we know, everyone needs water, electricity, and now telecommunications in any economy.

The investors who are piling into these funds seem to suggest that they anticipate these moves in the near future.

This could be another important signal to monitor in the markets. I’ll be back tomorrow to talk more about earnings and a few potential rebounds this quarter.