I Do Not Envy This Man

I’m starting to feel sorry for Federal Reserve Chair Jerome Powell.

Don’t get me wrong. A lot of our economic problems start and end with the U.S. central bank.

Powell has been testifying before Congress. He’s given speeches after each central bank meeting.

And he’s giving interviews and speaking at economic conferences.

He’s regularly downplaying the threat of inflation, never raising serious concerns about the stock market or rampant speculation.

He’s been talking about the need for more stimulus and monetary support like low-interest rates to ensure a stable recovery.

Yet almost every time he turns around, someone undercuts his message.

This week, many of his allies offered serious contradictions to the Fed’s plans for the economy.

I want to talk about what this means for your money.

And I’ll show you why we are not panicking.

Spooky Statements

In March, Powell spoke after the Fed’s two-day meeting on monetary policy.

He offered a very dovish take on interest rates and the central bank’s vision for the U.S.

At the time, the U.S. 10-year bond’s interest rate was rising fast.

Despite ongoing concerns about inflation and a red-hot economy, Powell didn’t flinch. The Fed chair recommitted to keeping interest rates near zero into 2023.

The markets cheered the decision. Stocks continued to rally through April. And Powell continued to show his commitment to maintaining current policy.

But other people have different opinions. And those opinions matter. One very important voice is Treasury Secretary Janet Yellen.

This week, Yellen, the previous Fed Chair, suggested that rates should rise sooner. At an economic forum hosted by The Atlantic, she said the following:

“It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat. Even though the additional spending is relatively small relative to the size of the economy, it could cause some very modest increases in interest rates.”

Talk about a contradiction. The markets listen to Yellen. She oversees the money supply. Her agency advises Congress on fiscal policy (taxes, trade, and domestic and international finance.)

And, did I mention that she was the previous Fed Chair?

Stocks tanked after her statement.

And Yellen, perhaps realizing that she might have overstepped, quickly changed course. A day later, she told The Wall Street Journal that higher rates were not “something I’m predicting or recommending.”

The damage was done, though. You probably won’t hear her talk about interest rates again in public this year.

Yellen is only one person who has contradicted Powell’s messaging. It’s happened among other members of the Fed. Warren Buffett talked about the threat of inflation at length last weekend.

No one believes Powell right now about interest rates and inflation. Still, he continues to parade his message. How long can he hold this fairy tale together? That remains to be seen.

But behind the scenes, the Fed has just issued a huge warning sign. It offers a staggering view of what may come if the central bank has to raise rates sooner than later.

Stability In Tough Times

Yesterday, the Fed released its semiannual Financial Stability Report. This report analyzes asset prices and sentiment in the market. The Fed says that the markets are stable.

However, the bank is worried about valuations.

Investors have been buying everything hand-over-fist since last March. They’re buying stocks, corporate bonds, non-fungible tokens, and cryptocurrencies. We’ve also seen a huge run on special purpose acquisition companies (SPACs).

The trillions of dollars pumped into the economy over the last year have fueled rampant speculation.

Powell admitted that valuations are high. He says they remain justified in times of low-interest rates.

But Fed board member Lael Brainard’s statements about the report should raise red flags. Brainard talked about the importance of safeguards and the need for banks to increase capital requirements.

These are the types of things that central bankers said while the house was burning down in 2008.

This report suggested that a “repricing event” could occur – meaning that stocks would radically rise and fall.

Repricing would better reflect the company’s fundamentals and the reality of their debts and vulnerabilities to the pandemic.

And we know right now that the market is extremely frothy.

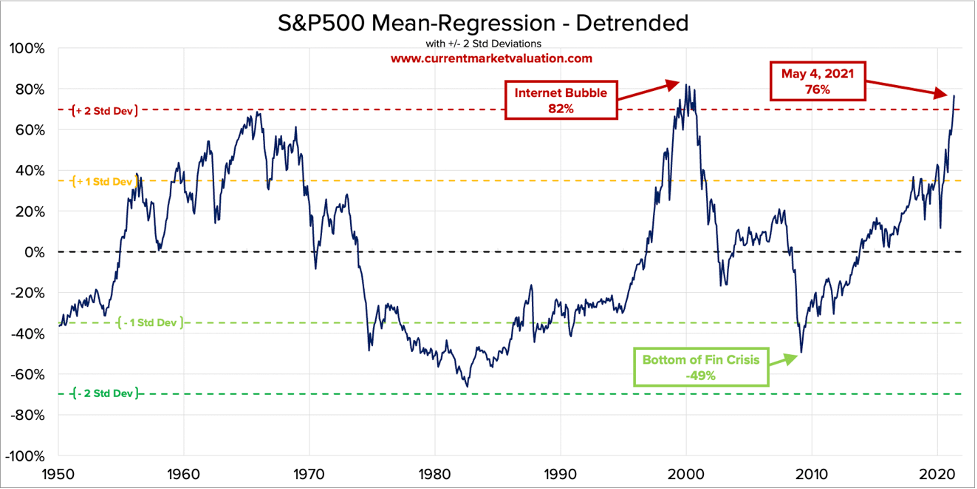

I have shown this chart before. It bears repeating.

Historically, the S&P 500 P/E Ratio is trading at 88% higher than its historical mean. This is the highest level since the dot-com bubble.

It is also two standard deviations away from its mean. The possibility of a snapback and massive shift in valuations could come anytime.

That’s why we’re prepared.

Here is Our Secret Defense Against a Downturn

At TradeSmith, we’ve built tools to help investors manage individual stocks. Through TradeStops, we provide custom trailing stops for each tracked public company.

But we also have a “kill switch” for the market.

Take a look at this chart. It’s our way of knowing when to be active in the markets… and when to get out and move to cash.

You can see last February, right before the worst of the crash started, this market’s health turned red and the S&P collapsed. But we knew at the exact moment when to exit the markets.

Are we facing another correction? Recent statements would suggest a “re-pricing” may happen for the market. Many pundits, economists, and other voices have suggested that rising rates would hammer equities.

It may come at any time.

But we’re not exiting stocks yet. And we’re sleeping well at night.

We’ll use our signals to guide us to higher prices, should they come. If and when this signals red and it’s time to walk away, you will hear from me right away.