Markets are Increasingly Anticipating a “Biden Sweep”

When news of the president’s COVID-19 diagnosis hit, in the wee hours of Friday morning, overnight markets reacted with shock and fear.

By the end of the day on Friday, though, the Dow Jones Industrial Average and S&P 500 had mostly recovered, with small caps (via the Russell 2000 index) even turning positive on the day. In Monday’s premarket session, meanwhile, the major indexes were green, if only slightly.

This might seem strange, given the level of uncertainty the country is still faced with. For example, the state of the president’s health remains unclear.

While the Trump administration has said the president could be released from Walter Reed National Military Medical Center as soon as Oct. 5 (today), outside experts have noted that, first, the treatment regimen undertaken by the president suggests a severe case of COVID-19, not a mild one; and second, that premature hospital release is generally not advisable for any COVID-19 patient at risk of sudden relapse. (The virus is known for appearing to go into remission, then roaring back without warning.)

Still, markets have two reasons to push higher in the presence of such uncertainty.

The first reason is improved odds of a new stimulus package prior to the election. The second reason is increased odds of a “Biden Sweep,” in which Democrats take control of both the White House and Senate.

It is not so much that the market is rooting for a Biden Sweep outcome, but rather that a sweep by either party indicates more stimulus and spending (and avoidance of the dreaded “gridlock” scenario).

The likelihood of a near-term stimulus package has risen because of the president himself. On Saturday, Oct. 3, the president tweeted out the following:

OUR GREAT USA WANTS & NEEDS STIMULUS. WORK TOGETHER AND GET IT DONE. Thank you!

A concerted push from the White House to achieve a stimulus deal tilts the pre-election outcome in favor of agreement, rather than deadlock. It means Republican legislators could be pressured (by the White House directly) to meet Democrats halfway, or possibly even more than halfway, on the modified $2.2 trillion stimulus bill that was ratified by the House of Representatives on Thursday, Oct. 1.

Markets would breathe a sigh of relief at another multi-trillion stimulus package going through, especially in light of Friday’s ugly jobs report (which suggests the economic recovery could be slipping).

At the same time, the odds are increasing of a “Biden Sweep,” in which Democrats retake both the White House and the U.S. Senate.

This would create enough unity among legislators to get substantial spending on the books in 2021, well beyond additional COVID-19 stimulus. Markets would be very happy about this

We can see what betting markets think of the “Biden Sweep” scenario via contract pricing from PredictIt, a site that allows wagers on various aspects of the 2020 election.

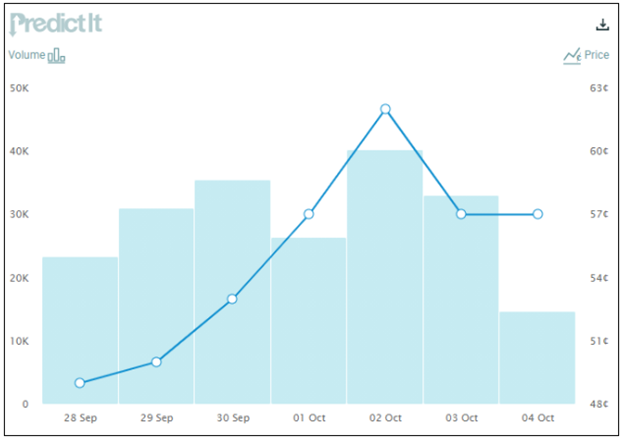

The PredictIt chart below shows contract odds for the question: “Will Democrats win the White House, Senate, and House in 2020?”

On Sept. 28, the PredictIt odds of a Biden Sweep were 49%. By Oct. 2, they had risen to 62%, before retreating to 57%.

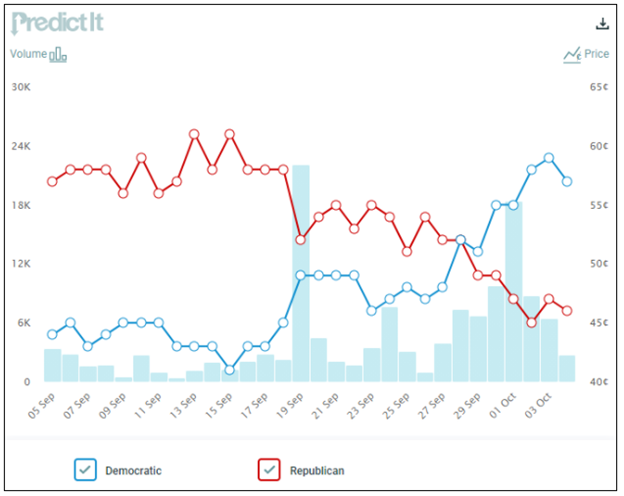

The change in favor of a Biden Sweep is also due to individual U.S. Senate races, and not just the outlook for the presidential election itself. For example, the shift in expectations for the Iowa Senate race is striking, as the chart shows below.

For much of the year, the incumbent, Iowa Sen. Joni Ernst, was easily favored to beat her unknown Democratic candidate, Theresa Greenfield. But then, after a poor debate performance from Ernst, the positions were reversed. Now Greenfield, the blue line on the chart versus Ernst in red, is a notable favorite to win.

We can also see odds of a Biden Sweep increasingly priced into various industries and sectors, as determined by the market itself.

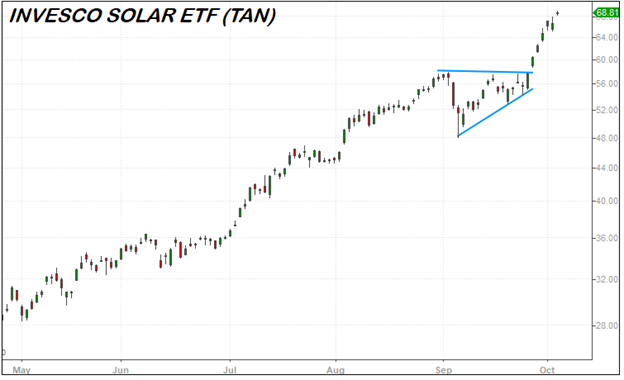

Green energy stocks, for example, are outperforming heavily, with the Invesco solar ETF (TAN) surging to new heights, as seen in the chart below. This suggests an expectation that trillions of dollars in “Green New Deal” stimulus is coming — an outcome that requires Democratic control.

Meanwhile financial stocks, as evidenced by XLF, the bellwether financial stocks ETF, are still stuck in the mud below their 200-day moving average.

At the same time, fossil-fuel-related energy stocks, as evidenced by XLE, the bellwether energy ETF, are also in a serious slump. Both XLF and XLE would likely be doing better (perhaps much better) if Republicans were expected to maintain control.