The Digital Dollar is High on the Fed-and-Treasury Priority List

The digital dollar — a USD version of central bank digital currency — is now a “high-priority project.”

That was the phrase used by Jay Powell, Chairman of the Federal Reserve, in a U.S. Senate hearing on Feb. 23. “We are looking carefully, very carefully, at the question of whether we should issue a digital dollar,” Powell said.

With each passing day, the digital dollar project is making progress behind the scenes. Just as importantly, political momentum strongly favors a digital dollar.

The incentives are there, and the technology is close behind; the digital dollar is an idea whose time has (almost) come. What that means for the U.S. economy — and the world — we shall see.

The Federal Reserve wants a digital dollar and is now laying the groundwork. Fed Chairman Powell made that clear via two days of hearings on the hill — one with the U.S. Senate and one with the House of Representatives — on Feb. 23-24.

U.S. Treasury Secretary Janet Yellen — the most pro-labor, pro-Keynesian, pro-Modern Monetary Theory (MMT) U.S. Treasury Secretary in the nation’s history — is also a digital dollar fan. Her enthusiasm is a big shift from the attitude of the prior Treasury Secretary, Steven Mnuchin, who showed little interest at all.

In a Feb. 22 virtual interview with Andrew Ross Sorkin of the New York Times, Yellen expressed her favorable view of central bank digital currencies (CBDCs).

“It makes sense for central banks to be looking at” CBDCs, Yellen said, adding that “too many Americans don’t have access to easy payments systems and banking accounts, and I think this is something that a digital dollar, a central bank digital currency, could help with.”

It was probably no accident that Yellen’s pro-digital-dollar comments came just before Powell’s Senate and House testimony, where he delivered more or less the same message.

The Federal Reserve, meanwhile, is doing more than just talking. It is digging deep into the technology of a digital-dollar project.

On Feb. 22 — the same day Yellen spoke approvingly of CBDCs — the Fed announced via press release that Sunayna Tuteja would be joining the Federal Reserve System as its new Chief Innovation Officer.

Prior to her just-announced new job, Tuteja was the head of digital assets at TD Ameritrade. In effect, this means that, rather than hiring consultants to help them figure out the crypto space, the Fed put a crypto person in charge of all innovation initiatives moving forward.

The Federal Reserve also released a white paper on Feb. 24 titled, “Preconditions for a general-purpose central bank digital currency.” You can access the paper here. The introduction is notable:

“Money is a social and legal construct underpinned by trust. Conceptions of money have evolved and money has taken many forms over the years. In North America, pre-colonial trade was often conducted in wampum, corn, and fur pelts. In fact, wampum, which are decorative beads made from shells, were recognized as official currency by the Massachusetts Bay Colony in 1650.

“The Federal Reserve note, which was first issued in 1914, is a relatively recent development by historical standards. Today, there are ongoing discussions on a new form of central bank money distinct from physical cash and limited-access central bank deposits. This report focuses on the potential for a general-purpose CBDC that can be used by the public for day-to-day payments…”

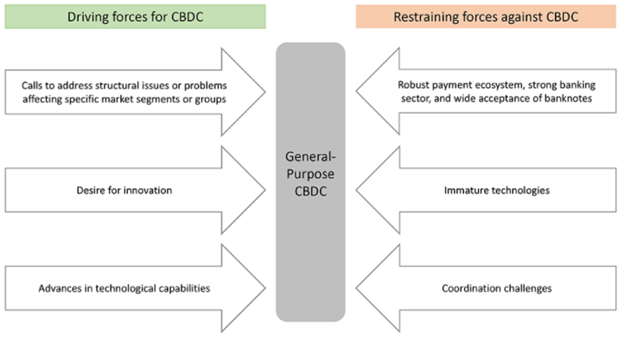

The report takes an in-depth look at the various issues surrounding a digital dollar, from technology to policy to safeguards and stakeholders. It uses the following graphic to illustrate driving forces and restraining forces (incentives and obstacles) to issuing a CBDC:

If you’re getting the sense this is a full-court publicity press in favor of a digital dollar initiative, you wouldn’t be wrong. While it is still early days, Powell and Yellen are clearly laying the groundwork for political buy-in and public acceptance.

Why is a digital dollar needed? Some fear the motives behind this blatant push for a CBDC.

In policy terms, it’s possible a digital dollar could pave the way for all manner of creative transfer payments — going from “helicopter money” stimulus drops to precision-targeted delivery of funds to households, sliced and diced by income decile or geographic region.

Then, too, there are the “big brother” possibilities of money that can track its own movements, or have built-in expiration dates, or be turned off or blocked by a central authority. The Chinese government is arguably using its digital currency rollout to extend and deepen its vision of a digital authoritarian state; it is possible that, in embracing a digital dollar, U.S. authorities could go in a similar direction.

Powell and Yellen are aware of the policy dangers in promoting a CBDC, and the possibility of skeptics questioning their motives.

As such, the Federal Reserve has wisely separated out the technology side and the policy side for the sake of optics, with the basic idea being: “We’ll figure out the technology and the logistics, and then leave it up to you — Congress and the public — in terms of where you want to go on the policy side.”

In the House Financial Services hearing on Feb. 24, Powell said:

“So this is going to be an important year. And this is going to be the year that we engage with the public pretty actively, including some events that we’re working on. Which I’m not going to announce today, but there’s things that we’re working on…

“The sense of this is not “here are the decisions we’ve made, what do you guys think.” It’s “these are the trade-offs”… there are both policy questions and there are technical questions that interrelate between those two. And they are very challenging questions.

“And so we’re going to want to have a public dialogue about that with all of the interested constituencies… In the meantime, we’re working on the technical challenges, and also sharing with the other central banks around the world who are doing this. And we’ll need, depending on what we do, we could well need legislative authorization for such a thing.”

Powell understands the optics of this thing. In bringing about a digital dollar, he is presenting the Federal Reserve as a neutral facilitator of congressional will.

If the digital dollar winds up being a Trojan horse for modern monetary theory (MMT), Powell seems to be implying, that won’t be the Fed’s fault. It will happen if that’s what you want.

And in our view, that is exactly what will happen: The digital dollar will become a technology-driven mechanism for implementing a whole new world of MMT-style initiatives.

This will not happen because Powell and Yellen pull a fast one, in our view, but rather because it is exactly what the American public wants.

“Joe Biden’s $1.9 trillion stimulus package is one of the most popular bills in decades,” The Economist magazine writes.

“According to data compiled by Chris Warshaw, a political scientist at George Washington University,” The Economist goes on to add, “the spending bill is one of the most popular pieces of important legislation in three decades.”

As it turns out, Democrats like helicopter money, and Republicans do, too. Americans on the whole, on a surprisingly enthusiastic and bipartisan basis, have an attitude amounting to “the more, the better” when it comes to direct stimulus payments.

In the future, a digital dollar will make it easier to send out laser-targeted relief payments; to spot-target weak geographic regions; to directly credit specific industries or households; to facilitate near-instant tax rebates; and so on.

Americans will love this — a critical mass of them, anyway — and that means the political will is there, with pandemic-era precedents getting the ball rolling.

And if you think all of this sounds wildly inflationary, we agree — but remember the timing aspect. “Growth first, inflation later” is the sequential order of impact. First the U.S economy grows like weeds, in a kind of honeymoon stretch coming out of the pandemic — and then the macro picture will truly get interesting.