The Fate of Jack Ma, and Alibaba’s Reversal of Fortune, is a Warning for the U.S. Tech Giants

Imagine the U.S. government deciding that a visionary entrepreneur like Jeff Bezos or Elon Musk was too rich and too outspoken.

Then imagine Bezos or Musk being kidnapped — and completely removed from the public eye — even as the government openly and aggressively put their tech empire under siege.

This is apparently happening to Jack Ma, the e-commerce visionary who founded Alibaba in 1999.

In China, Jack Ma is the rough equivalent of Bezos and Musk combined. Alibaba, the first company Ma founded, is like a cross between Amazon, Google, and eBay. And with a personal fortune that topped $62 billion in 2020, Ma had long been a technology rock star and an inspiration to up-and-coming Chinese entrepreneurs.

At one time, Ma’s public presence, and cultural influence, seemed to be everywhere in China. He made guest appearances in Chinese action movies; sang duets with Chinese pop divas; appeared routinely in a television program he created (a talent contest for Africa-based entrepreneurs); and had a widely used nickname, “Daddy Ma,” cementing his status as an icon.

All of that could be over now.

The trouble started a few months ago, with the initial public offering (IPO) for Ant Financial Group.

Ant Financial was another hugely successful enterprise, focused on consumer lending and digital payments, that was attached to Ma. The Ant Financial IPO was set to raise nearly $35 billion by way of a dual listing in Hong Kong and Shanghai, and it would have been the largest IPO of all time. (We wrote about it on Oct. 28.)

But then, at almost the last possible moment, the Chinese government killed the Ant Financial IPO citing regulatory issues. (We wrote about that on Nov. 10.)

Rumor had it that Xi Jinping, China’s leader-for-life, had ordered the cancellation himself. Ma had apparently pushed the envelope too far with public criticism of China’s banks and regulatory agencies.

Cancelling the Ant Financial IPO was a brutal shock. But that was only the beginning.

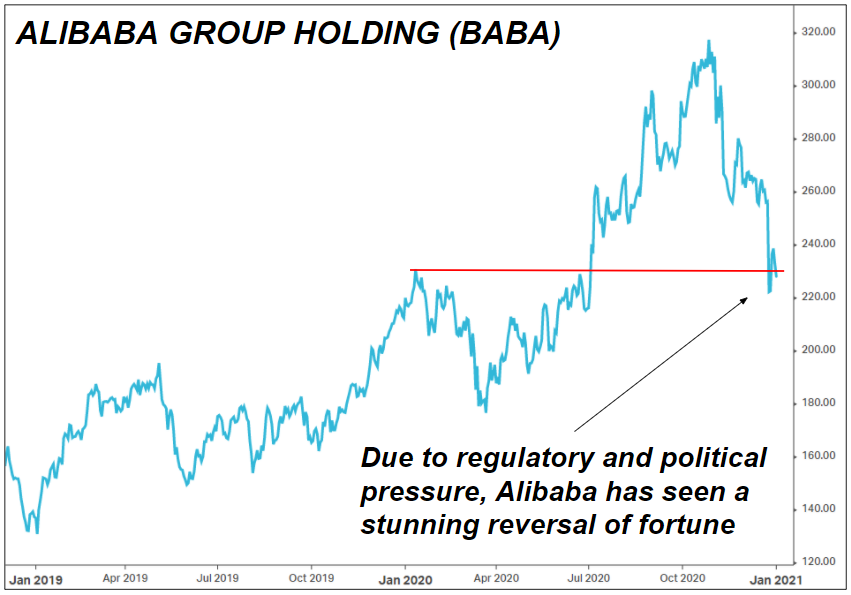

On Dec. 24, the NYSE-listed shares for Alibaba Group (BABA) saw an 18% decline — their largest single-day decline ever — on news that the government had launched an investigation into Alibaba for monopolistic practices (China’s version of antitrust).

And now, in the first week of 2021, a drumbeat of concern is rising over Ma’s disappearance.

The television program Ma created, African Business Heroes, was known to be a project close to Ma’s heart. He routinely appeared on the show as a talent judge.

But in the December 2020 finale for African Business Heroes, Ma was replaced with another judge. His photo was also removed from the show’s website, and his name removed from the promotional materials.

When observers of Ma’s business and social circles realized the changes that had been made to the show, it further dawned on them Ma had not been seen in the flesh since October. He was simply gone.

In the dystopian novel 1984, author George Orwell introduced a concept known as “the memory hole.” If the Ministry of Truth wanted something to be forgotten, they would use a memory hole.

Jack Ma himself may have been thrown down the memory hole.

This matters to Western investors in part because Alibaba (BABA) is a popular holding. The company is a true technology juggernaut, in the mold of Amazon or Google, and the price chart is now a disaster. How much further could BABA fall? That may depend on what the government has in mind.

Another common factor here is a growing backlash against high-profile, multi-billionaire tech entrepreneurs. In describing how Ma’s fortunes have turned, New York Times columnist Li Yuan wrote the following on Dec. 24:

But lately, public sentiment has soured and Daddy Ma has become the man people in China love to hate. He has been called a “villain,” an “evil capitalist” and a “bloodsucking ghost.” A writer listed Mr. Ma’s “10 deadly sins.” Instead of Daddy, some people have started to call him “son” or “grandson.” In stories about him, a growing number of people leave comments quoting Marx: “Workers of the world, unite!”

While the U.S. does not look poised to subject its tech founders to Marxist backlash, ill winds of mounting regulatory and political pressure have been blowing around the juggernauts (Google, Facebook, Amazon, Apple) for a decent while now.

All are under intensifying scrutiny, and at least two of the four (Google and Facebook as of this writing) are facing full-blown antitrust actions.

Investors thus far have been complacent in regard to these actions. The share prices for Google and Facebook climbed and otherwise shrugged, respectively, in the aftermath of major investigation announcements (which we covered here on Oct. 22, and here on Dec. 11).

Be aware, though, that a regime change in the U.S. Senate — with, say, Democrats cementing majority control after the Georgia run-offs — could change the complacency picture quickly.