Verizon: Can The Face of the 5G Wars Finally Break Out?

|

Listen to this post

|

If you turned on NFL football at all this past weekend, you saw one of the most competitive battles in all of America today.

I’m not talking about the Baltimore Ravens against the Cincinnati Bengals or the showdown between the New Orleans Saints and the Seattle Seahawks on the gridiron.

I’m talking about the 5G battle in the wireless communications space.

T-Mobile (TMUS), AT&T (T), and Verizon Communications (VZ) are in an advertising onslaught to attract new customers to their 5G bases.

The three companies aren’t just spending money on marketing. They’re engaging in a price war that incorporates steep discounts, huge promotional offers, and massive infrastructure investment.

Friday, I discussed how AT&T is trying to reconfigure its corporate structure to return to its roots as a phone and internet company.

Today, I want to talk about the major changes at Verizon, the nation’s largest mobile network in terms of subscriber base.

More importantly, I’ll explain how investors might want to handle VZ stock this quarter.

“Buy” the Numbers

At the end of the second quarter, Verizon Communications had the largest customer base in the wireless telecommunications industry. With 121.3 million subscribers, the company topped T-Mobile (104.8 million) and AT&T (97.8 million).

Last week, the company reported relatively solid earnings and issued a strong forecast. Third-quarter revenues increased by 5.5% year-over-year, more than 30% of its customer base has signed up for premium unlimited wireless services, and it added about 700,000 new accounts for the quarter.

The bad news: It missed revenue expectations by $340 million. That is the biggest miss since the first quarter of 2020, when COVID-19 began to accelerate.

Shares did pop from around $52 per share to nearly $54 after the report. However, the stock has retraced slightly since last Wednesday. Why?

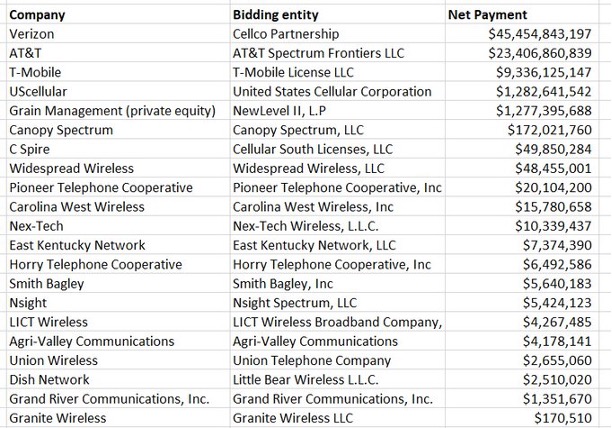

After all, the company trades at a very low price-to-earnings ratio of under 10, pays a rather attractive dividend of 4.8%, and continues to generate significant optimism about its growth in the 5G spectrum. Verizon has invested $45.45 billion in the auction for 5G spectrum buildout, more than the rest of its U.S. competition combined.

And Wall Street has an average price target of $59.43 for VZ stock over the next 12 months, according to research company TipRanks. Investment bank Cowen even raised its price target to $71 from $68 and said that the stock is “meaningfully undervalued.”

Warren Buffett owns the stock.

Hedge fund manager Ray Dalio owns the stock.

And it’s commonly recommended among newsletters due to its cash flow stream.

Yet according to TradeSmith Finance, the stock has been in the Yellow Zone for a month and in a sideways momentum trend for eight months.

What gives?

The 5G Wars Accelerate

Over the last week, Verizon and AT&T have pulled back on aggressive 5G promotions designed to attract new customers. Verizon’s recent promotion was extremely costly to the company, offering existing customers unlimited access to its “ultra wideband” 5G network at a discount of $10 to $20 per user.

In addition, the company was offering trade-in offers for free 5G phones. Users could trade in their phones and receive up to $800 per phone toward the purchase of new phones like the iPhone 12 mini 64GB or Samsung Galaxy S21 5G 128GB.

Now, with the new iPhone 13, 13 mini, and 13 pro entering the market, the company is offering all three devices for free to existing and new customers.

These promotions are expensive, and they eat into revenue and profits. Verizon has a strategy, as it aims to get 50% of its customers to sign up for its “premium unlimited” plans by 2023. That would be a big jump from the 30% that it just reported during its earnings report.

At the same time, T-Mobile announced its new $1,000 offer to encourage customers from other networks to switch to its 5G network. The reason: T-Mobile is spreading the message that people who are signing up for 5G phones from AT&T and Verizon are lacking a robust 5G network.

At the core of this marketing blitz is a price war.

And it is amplified by a very concerning factor. The companies are cutting prices and subsidizing iPhones and other devices that might not be in ample supply in a few months. As I’ve noted before, Apple recently cut its forecast on iPhones due to the ongoing semiconductor and parts shortage around the globe.

These companies don’t just sell phones. They also sell smart watches, laptops, and tablets. Meanwhile, T-Mobile’s CFO recently called out South Korean device manufacturer Samsung for falling “behind the eight ball” on the shortage of components.

Finally, for Verizon, there looms another challenge. The company is soon expected to close on a $7 billion deal to purchase América Móvil’s division TracFone by the end of this year. While the deal would bring upwards of 20.1 million subscribers under Verizon’s fold, news just broke that TracFone lost 185,000 U.S. customers during the third quarter.

The primary reason for this decline: The company blamed a “limited supply of handsets, especially in the range of mid and low prices.” At a time that iPhones are priced north of $1,000 and the three big companies are subsidizing those costs, less-expensive phones are disappearing from the shelves because of a supply crunch and because these devices don’t generate as much money.

Right now, the headlines suggest that Verizon is a cheap stock that is winning the mobile battles. But under the hood, we find that it may be some time before this stock can catch momentum and bring in a wave of institutional capital. As always, we pay close attention to what TradeSmith Finance signals show us. A Yellow Zone stock combined with sideways momentum does not signal a buying opportunity.