One of our Highest-Conviction Themes Right Now: Long Energy Stocks

|

Listen to this post

|

Editor’s Note: Today Keith is taking a break to share a high-conviction update from Chief Research Officer Justice Clark Litle. Keith will be back on Monday with more market insights.

Hi all, Justice Clark Litle here. I’m stepping in for Keith today, and I thought I’d share with you one of TradeSmith Decoder’s highest-conviction market themes right now.

It is long energy stocks, with a specific emphasis on fossil-fuel related names.

This may seem like a no-brainer — Wall Street has been abuzz over energy sector outperformance the past few days — but we’ve been bullish on oil and gas stocks for a while, for reasons that are powerful and aren’t going away.

TradeSmith Decoder’s first big foray into energy stocks came in December 2020, when we bought a basket of oil and gas names based on the strength of price action for the group, the tailwind of post-pandemic recovery, and a lack of oil and gas capital investment putting constraints on supply.

We also explained our oil and gas bullishness in a Feb. 18, 2021, TradeSmith Daily — back when yours truly was still writing it — titled “Crude Has Some Good Years Left (The Oil Age isn’t Over Yet).”

TradeSmith Decoder wound up cashing out of that first energy stocks basket for significant gains. We piled back into energy stocks (this time with a basket of 10 names) on Sept. 14.

The story was the same for the re-entry: Powerful price action, clear signals of economic recovery, and strong performance from crude oil and natural gas indicated robust global demand.

Here is an excerpt of the Sept. 14 Decoder broadcast where we bought back in:

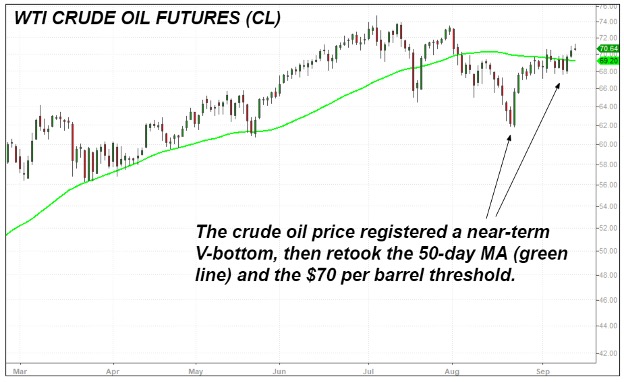

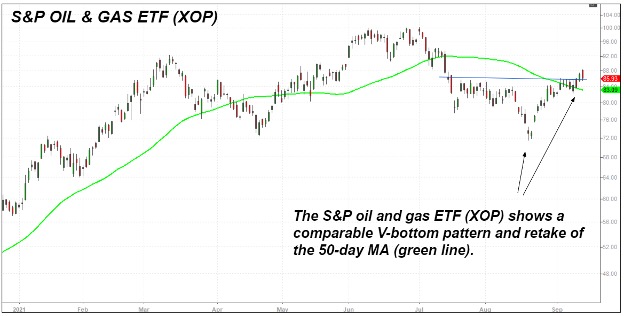

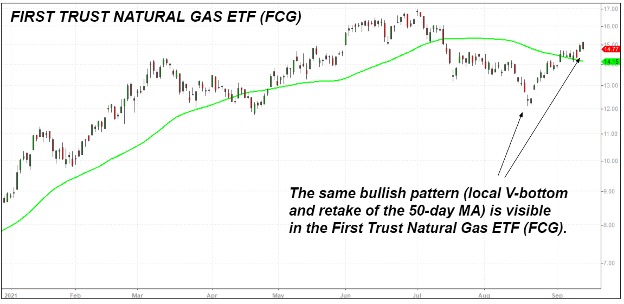

West Texas Intermediate (WTI) crude oil has retaken $70 per barrel, natural gas prices are at a seven-year high, and the Organization of the Petroleum Exporting Countries (OPEC+) is forecasting global demand above 100 million barrels per day in 2022 — an amount that would exceed pre-pandemic levels.

It continues to be a back-and-forth situation with the delta variant, but the market seems to be telegraphing resilient oil and gas demand, which fits the “powering through” narrative. At the same time, investors still appear to be in the grip of TINA — shorthand for “There Is No Alternative” to stocks.

And so, with tech looking quite overplayed, energy stocks could be a prime recipient of capital flows over the next few quarters, generating the possibility for another 25% to 50% upside in attractive energy names.

In that broadcast, we also shared the following three charts, which confirmed bullish price action across the broad energy complex.

Looking back, our expectation of 25% to 50% upside over the next few quarters was off the mark in one key respect. Rather than taking months, the targeted upside levels materialized within weeks!

As of the Oct. 5 close, the Decoder portfolio had position gains in the range of about 25% to 50% for five of the 10 names we bought on Sept. 14 (with most of the others in double digits).

We are staying involved, though, because the powerful upside move in energy stocks could have a long way to go. At the time of this writing, the world is experiencing a full-blown energy crisis, with severe natural gas shortfalls in Europe and coal shortfalls in China and India.

Those shortfalls are also pushing up the crude oil price — where demand was already robust and supply was tight — because crude oil is being used as a substitute for painfully expensive natural gas inputs.

(To give an idea of what we mean by painful, the benchmark natural gas contract in Europe recently traded at levels equivalent to $200 per barrel of oil.)

Historic Transitions Don’t Happen Overnight

The bottom line is, everyone wants to move away from dirty fuels like oil, gas, and coal. Renewable energy is the future and fossil fuels are the past: That is what the experts say.

Then, too, the ESG investing movement (ESG stands for environmental, social, and governance) is built around this trend of moving away from fossil fuels, and giant money managers like BlackRock — a company that stewards nearly $10 trillion in assets — have been aggressively pushing ESG.

The problem is that the transition to renewables can’t come fast enough to meet oil and gas demand here and now, and fossil fuel energy producers have been starved of capital investment for years.

Nobody wants to fund long-term projects for oil and gas anymore, because conventional wisdom says fossil fuel demand will be on its way out by 2030. But fossil fuels still power the world today, and renewable energy sources aren’t yet ready to replace fossil fuels at scale.

As a result of the above, when demand ramps up in a post-pandemic global recovery, the world discovers that there isn’t enough oil or gas around.

And for China and India, there isn’t enough coal around either — not because the coal is no longer available, but because both countries have been trying to reduce their historically heavy levels of coal usage, and it takes time to restart coal production once it has been shut off.

Then, too, China is exporting its energy crisis to the rest of the world through aggressive purchases of oil and gas on the open market.

As a result of bottlenecked coal supplies, Chinese factories cannot hit production targets due to a lack of electricity. That is a dangerous predicament with China’s economy facing a real estate slowdown, and so the Chinese government has mandated a ramp-up of fossil fuel imports at any cost. That makes energy more expensive globally.

Lacking a Cure, This Could Last a While

Commodity traders have an old saying: “In commodities, the best cure for high prices is high prices.”

But that logic only works if high prices serve as a signal to ramp up capital investment.

A painfully high price implies that supply is too low relative to demand — so the thing to do is expand supply, until the extra supply that is brought online causes prices to fall again.

For oil and gas, this feedback loop is broken. Nobody wants to expand supply on a permanent and structural basis, because that would mean sinking capital into a dying industry.

That in turn means oil and gas prices could stay uncomfortably high — and occasionally spike to extreme danger levels — for years to come.

Investors are only now starting to grasp this reality. At the same time, they are noticing that the energy sector is still undervalued, especially in comparison to the nosebleed valuations of technology stocks.

And finally, investors are realizing energy is one of the few sectors that can outperform in a stagflationary environment. If inflation pressures rise against a backdrop of tighter monetary policy, much of the market will struggle — but energy stocks could still outperform. All of this bodes quite well for energy stocks not just for the rest of 2021, but well into the next year or two.