354% Profit in Five Days — As This Stock Crashed

Everyone has their favorite stocks to trade.

For me, one of those is definitely Peloton (PTON).

I’m not sure what it is about this stock, but I just love the action on it.

Maybe it’s because I’m an avid customer — and plan my days around a workout on their bike.

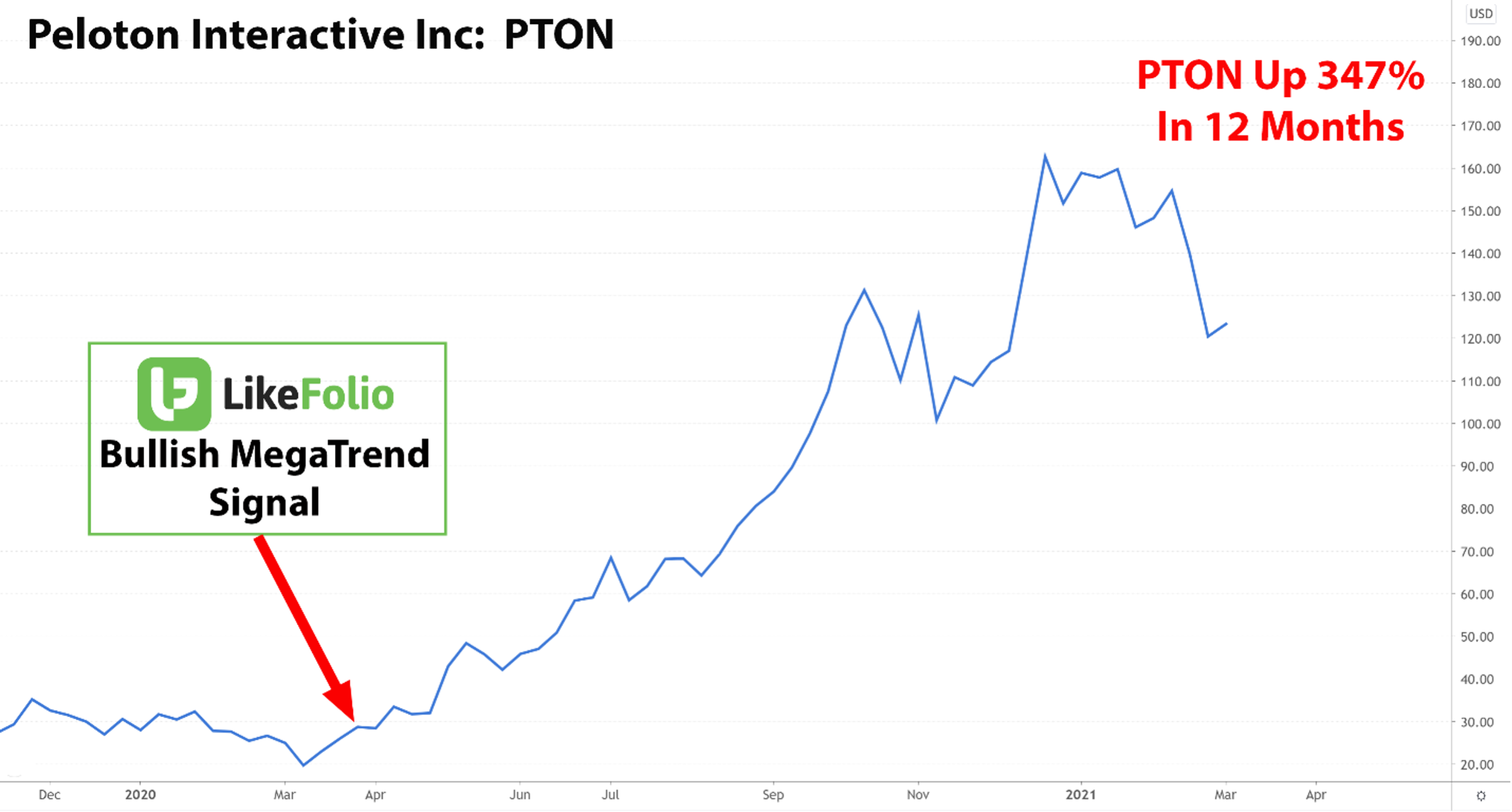

Or maybe it’s because we’ve had such a profitable history of trading the stock, being one of the first to catch on to it as a “pandemic winner” prior to its huge move higher in 2020…

OK… it’s definitely that one.

So when I think about turning the calendar to 2022, PTON is at the top of my mind.

Today I’d like to share with you why I’m so excited about trading this stock. Naturally, it starts with a recent home-run trade, but this time in the opposite direction…

354% profit in FIVE days? Here’s how…

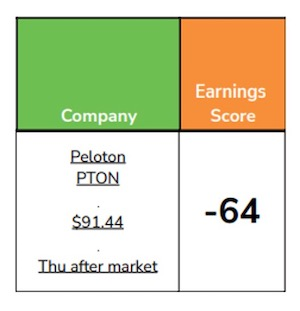

Just last month, in Week 4 of the Q4 Earnings Season, our famous Sunday Earnings Sheet came out with a strongly negative score for PTON as the stock headed into its quarterly report:

Now, our Earnings Scores range from -100 (most bearish) to +100 (most bullish), so I consider anything -60 or lower to be a very bearish signal.

To take advantage of this opportunity, I put together what we call simply a “Very Bearish” trade strategy, which seeks to profit three to five times what you risk.

Sure enough, Peloton delivered the exact earnings report that our powerful consumer insights data had predicted: slow growth and a lackluster outlook.

Here’s how the stock reacted (our bearish entry is marked with the red arrow):

Just like that, PTON stock crashed overnight, causing pain for shareholders but lots and lots of profit for savvy traders with a unique data advantage.

In fact, the “Very Bearish” trade strategy that I suggested ended up creating a 354% profit… in just five days.

With that kind of success at our backs, you can see why I’m so pumped about the profit opportunities around PTON stock as we head into 2022.

To get a jump start, let’s take an early peek at how that powerful consumer data is looking at the start of December…

Is PTON entering a “make or break” moment right now?

Peloton shares have stabilized in the mid 40s recently as Wall Street continues to digest the devastating earnings report we just discussed. A new coronavirus variant detected in South Africa, which stoked fears of potential increased social restrictions, also played a role in the stock’s price action.

Should traders be optimistic for a Peloton resurgence?

Here’s what LikeFolio’s consumer data suggests.

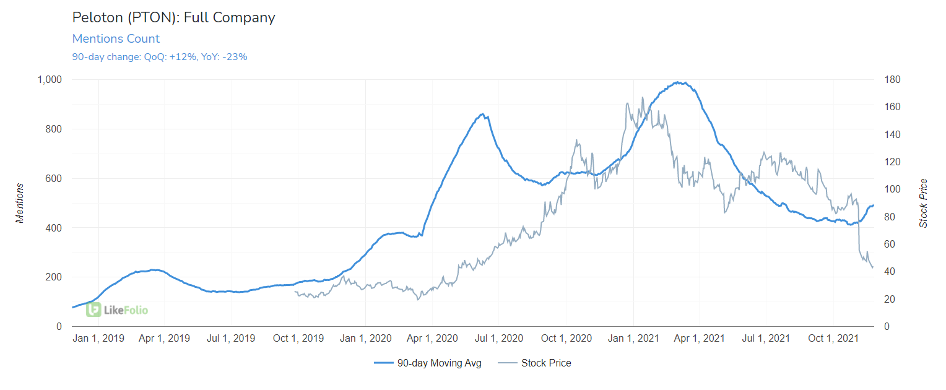

Peloton mentions are rising into the holiday season but remain well below pandemic levels.

The Mentions metric is the LikeFolio metric that is most highly correlated to Peloton revenue, at 0.79. So this is a very important metric to keep an eye on.

While mentions remain significantly higher versus 2019 levels (+138%), this rate of growth is stalling. Mentions are -23% lower YoY.

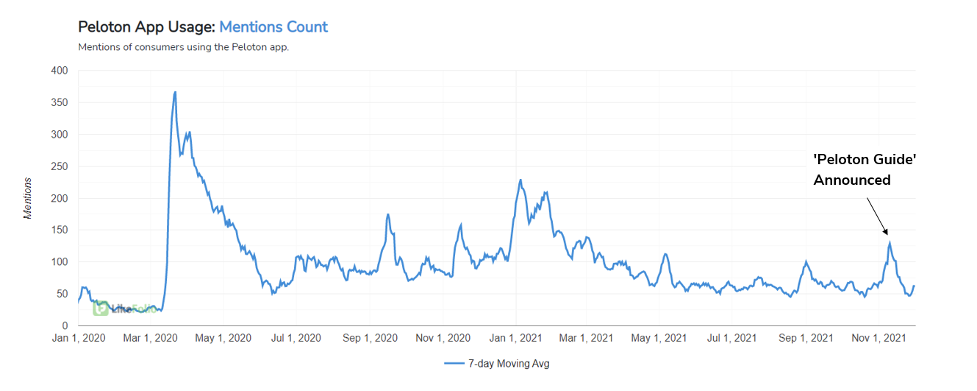

Peloton’s latest offering, Peloton Guide, was just announced on Nov. 9

This new product, featuring dumbbells, a camera, and heart rate monitor that connect to the user’s TV, drove conversations about how consumers have been utilizing the strength-training element of Peloton’s app. It seems strength is the most common area where users are seeking platform improvement.

The initial response to the product looks positive.

Overall Peloton App Usage mentions remain +332% higher versus 2019 and are gaining steam into the quarter, as is seasonally expected.

On a year-over-year basis, mentions are -34% lower.

Bottom line: Consumers don’t appear to be significantly concerned about the new coronavirus variant yet — but as a whole, Peloton growth is still decelerating.

Make no mistake, consumers who do have a Peloton machine LOVE the product and associated services.

A Consumer Happiness rating higher than 83% positive (and rising) is nearly unheard of in the LikeFolio universe.

Nautilus (NLS) equipment lags by more than 6 points, for comparison.

But for now, Peloton’s loyal customers may not be enough to fuel the growth rates Wall Street wants.

Stay tuned during an extremely important New Year’s resolution season just over a month away.

This is when consumers really tip their hands, and we’ll be listening.

And you can bet that whichever way this powerful consumer data takes us on PTON stock in 2022, we’ll make sure LikeFolio members are along for the ride!

Andy Swan,

Founder, LikeFolio