Are There Real Profits in Fake Meat? Read This Before Investing in BYND.

When I was a little girl, my grandpa operated a cattle farm in Kentucky.

With hundreds of acres to explore, I loved hopping onto the back of his four-wheeler to go out, watch the cows graze on the dewy grass, and look for newborn calves.

I was raised to care for cows and to respect what they provide.

So when I first heard about plant-based burgers, I was intrigued… and conflicted.

Could this plant-based “meat” even come close to replacing the juicy steak and hamburger I’d come to love?

When I tried some offerings, I found out quickly that for me, it could not.

But that doesn’t mean I couldn’t profit from Beyond Meat Inc. (BYND). The initial frenzy behind plant-based foods is how LikeFolio was able to issue a Bullish Alert for Beyond Meat very shortly after the company’s IPO (June 2019), when shares were trading near $96.

In the months to follow, BYND shares would gain as much as +144% in value!

And LikeFolio also knew from the collective voices of millions of consumers exactly when the initial curiosity factor was dying down.

We issued a BYND Bearish alert in October 2020. Right now, shares are trading around -77% lower.

So… is the (fake) bleeding done for Beyond Meat? Are there any new waves of interest in plant-based food that could spark a rally in the BYND stock price?

LikeFolio data suggests… maybe not.

Here are three reasons why I’m still staying away from BYND.

1. Consumer Demand Growth Is Waning after a Temporary Product Pop

Beyond Meat launched meat-free “chicken tenders” in grocery stores in October of last year.

While the product launch generated some chatter among consumers, the mention volume has since normalized lower, currently averaging less than one mention a day.

Beyond also launched a “chicken” product in KFC restaurants in a nationwide campaign that started in January.

While both products generated a small bump in consumer demand, these levels are dropping.

Even considering these new product launches, BYND Purchase Intent Mentions have dropped by -21% on a YoY basis.

What’s going on?

It could be that plant-based foods aren’t picking up as many new fans…

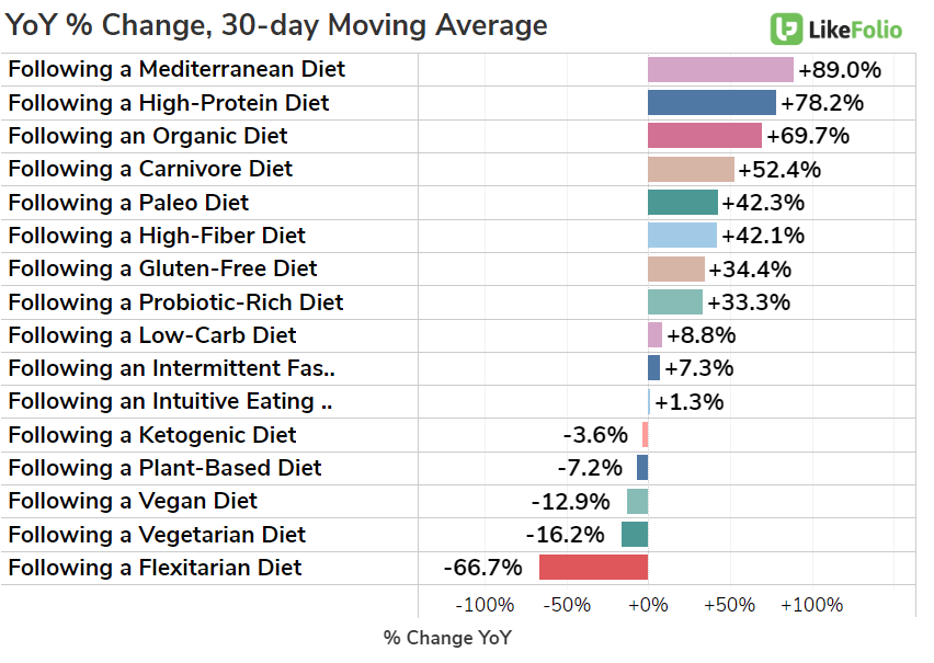

2. Plant-Focused Diets Are Losing Momentum

This doesn’t mean that vegans and vegetarians have jumped ship, but it does suggest that consumers are joining the plant-based team at a slower clip, which is not a great sign for explosive growth.

You can see a dramatic shift in YoY mentions on the chart below for:

- Following a Plant-Based Diet

- Following a Vegan Diet

- Following a Vegetarian Diet

- Following a Flexitarian Diet

Meanwhile, MORE consumers are following a high-protein and even organic diet.

These are some challenging headwinds for a plant-based company expected to return to growth in 2022.

And while Beyond may receive a short-term boost from its new food-service product line, its retail sales forecast looks a bit more grim.

Last quarter, U.S. retail sales fell -20%… and it’s the company’s most important segment.

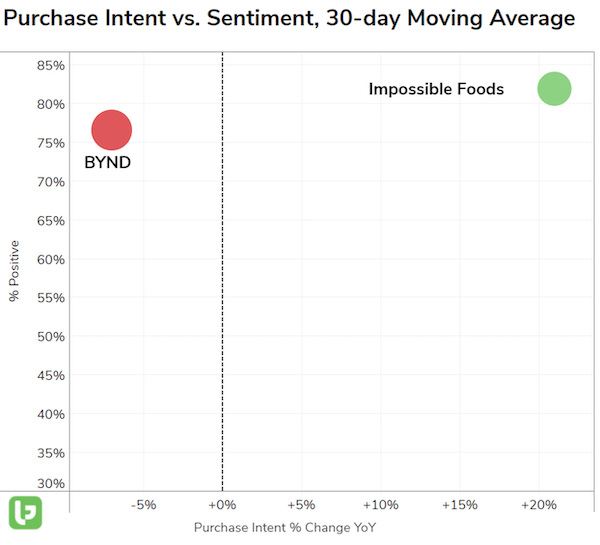

LikeFolio data also suggests there is an uphill battle in the grocery store aisles.

Not only is Beyond Meat losing steam to other plant-based competitors (namely, Impossible Foods), but food item pricing is rising across the board.

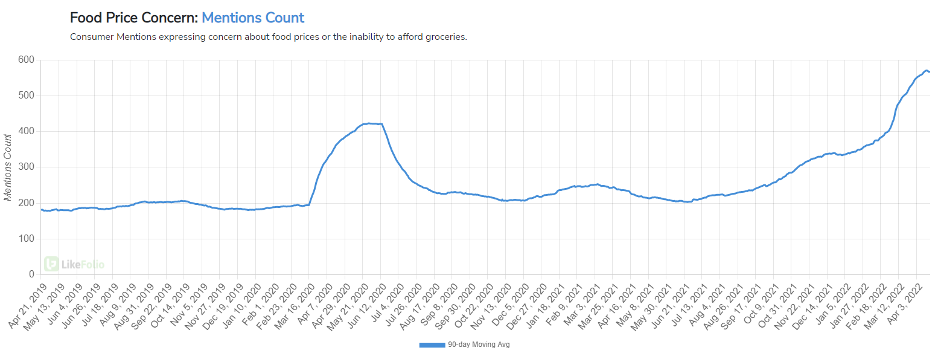

3. Rising Grocery Costs Weigh on Consumers

Inflation is trickling into the grocery aisle, with consumer mentions of rising food costs up more than +150% YoY.

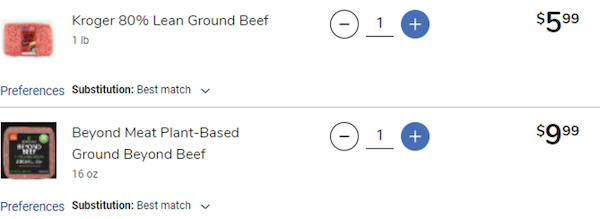

Beyond Meat was already struggling to achieve price parity with traditional ground beef.

For example, at my local Kroger, I can buy one pound of ground beef for almost half the price of one pound of Beyond Beef.

That’s a tough call to make if you are a consumer on a budget.

These folks agree:

The bottom line: LikeFolio data suggests Beyond Meat is still struggling against the current, and it has even more challenges ahead. We’re watching for a potential Bearish investment opportunity if consumer demand continues to degrade.

If you’re reading this right now, you’re ahead of the game because you have LikeFolio data to rely on to know when to make a move.

Grandpa would be proud.

Megan Brantley

Head of Research, LikeFolio