Avoid This Stock

Yesterday, I showed you how LikeFolio’s new Outlier Discovery Grid could be used to spot “under the radar” opportunities on stocks set to benefit big from major consumer trends.

Which raises a compelling question…

Can the same process be used to spot stocks that investors should avoid… or even make bearish bets against?

The answer is yes, and today I have the perfect example.

The Case Against Kohl’s (KSS)

Last week, we sent our members a bearish note on Kohl’s ahead of their earnings report.

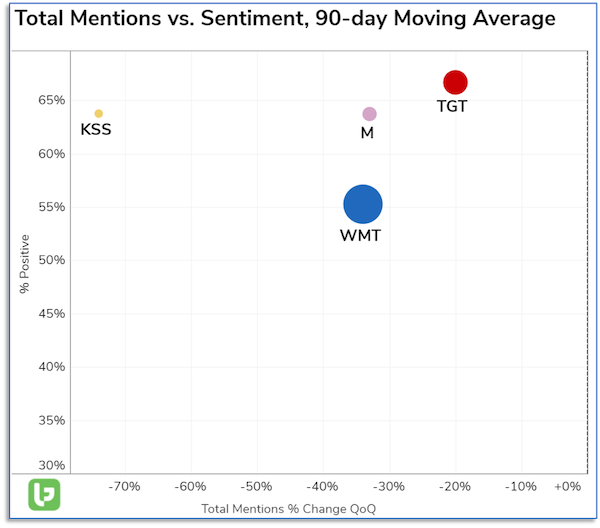

In this report, we shared a view of the Outlier Discovery Grid for comparable retailers:

Caption: Kohl’s is significantly underperforming peers on the LikeFolio Outlier Discovery Grid

As you can see from the chart above, Kohl’s is definitely not in that magical spot at the top-right… the Outlier Zone.

In fact, it’s just the opposite, sitting far off to the left (indicating low consumer demand growth) and positioned slightly lower than two major competitors (indicating less-happy customers).

That’s simply not good.

And the company’s own data confirmed our thesis.

After Thursday’s earnings report, investors punished the company’s disappointing results, sending shares nearly 10% lower on the day.

By simply plotting companies on the Outlier Discovery Grid, investors in Kohl’s could have saved the heartache of a 10% loss… and savvy traders could have banked big profits through short-selling or put options.

Best of all — I don’t think this bearish opportunity is over.

In fact, given the company’s poor consumer data when compared to peers, I believe Kohl’s stock will be in for a rough ride for some time to come.

Andy Swan,

Founder, LikeFolio