Block (SQ) Is Moving to the Top of My List

It’s a tough time to be labeled a growth stock.

There’s no denying that.

Many high-growth names are trading 75% below highs reached in 2021.

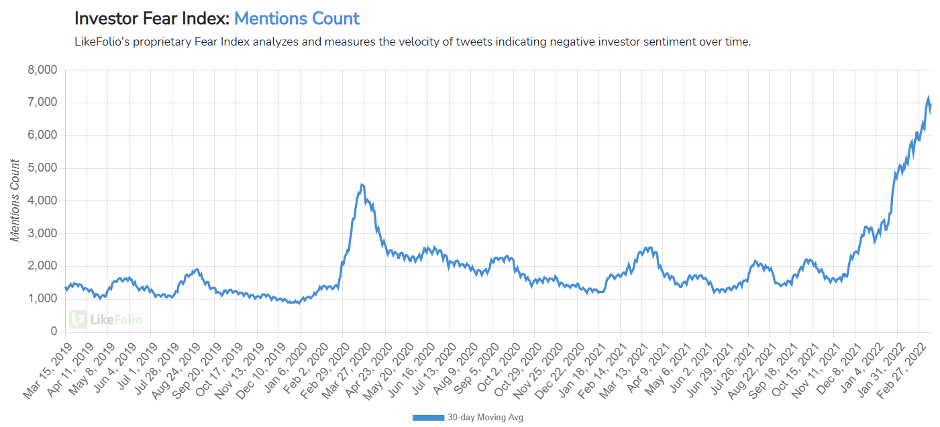

LikeFolio’s Investor Fear Index, which tracks mentions of bearish sentiment, is establishing new all-time highs.

“Ouch” is one way to look at it.

But another way is to realize that now is a great time to begin looking for long-term opportunities.

And even better, you can lean on LikeFolio data for defensive and offensive moves, thanks to our real-time insights into consumer behavior.

Ask yourself: Does my trading or investing thesis still hold water?

We’ve identified at least one company that is holding a lot of water… or in this instance, consumer currency.

Digital Wallet Adoption Is Led by a Certain Block

Back in December, we wrote about how “Digital Wallets Are Blurring the Lines between Finance and Tech.”

At the time, Digital Wallet Mentions were soaring.

But what’s happened since then? Has the trend continued?

Great question.

Since then, we’ve noticed a few key trends supporting digital wallet adoption:

- International Adoption

Latin America’s adoption of digital wallets and prepaid cards has surged significantly.

According to the report from Research and Markets, the prepaid card and digital wallet markets in the region are on track to increase from $62.96 billion in 2022 to $107.53 billion in 2026.

- E-Commerce Support

A recent FIS report showed that digital wallets accounted for nearly half (48.6%) of global e-commerce transaction value in 2021.

The report says digital wallets are expected to represent 52.5% of e-commerce value in 2025.

So it seems there has been a significant shift in consumer behavior, with people now preferring digital wallets.

And finally…

- LikeFolio Data Supports Continued Expansion

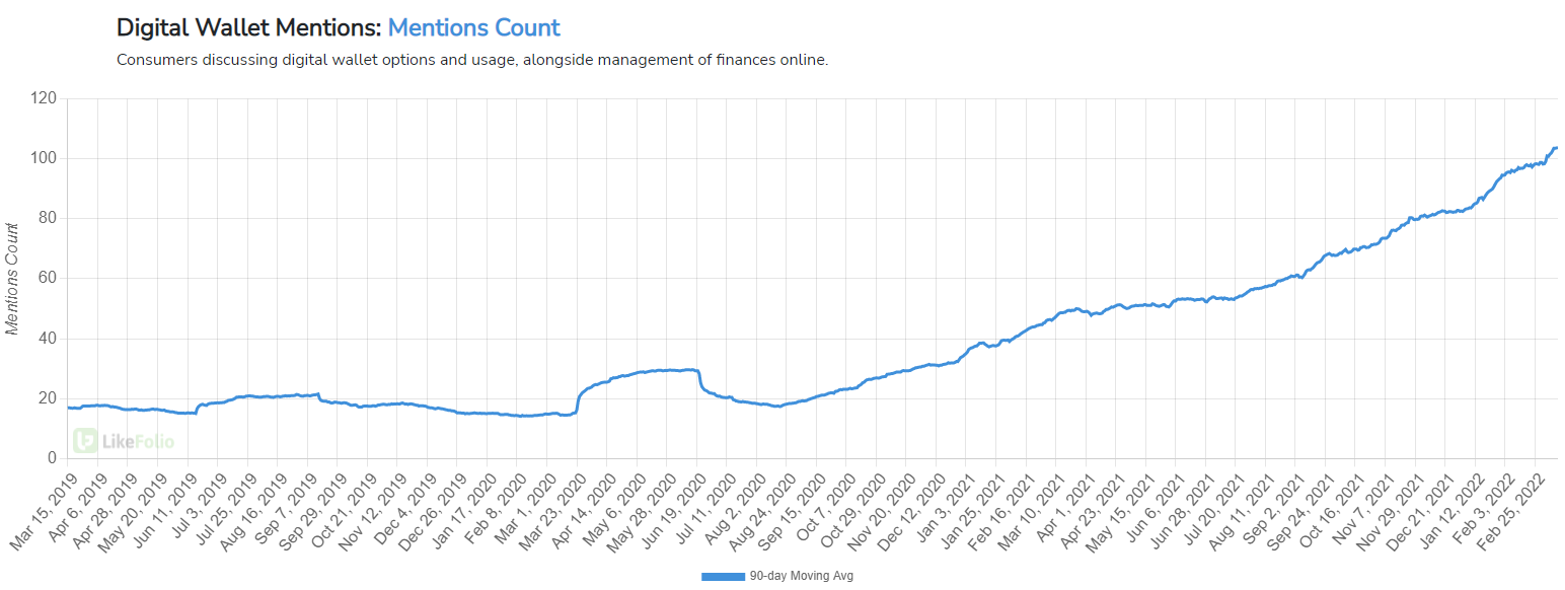

LikeFolio’s tracking of Digital Wallet Mentions shows a continued increase from November, trending +27% quarter over quarter (QoQ) and +113% year over year (YoY).

Not too shabby, right?

You can see continued acceleration in growth since around August 2020, creating an even more compelling story as we move forward.

According to a survey from finder.com, in July 2021, 150 million American adults said they’ve swapped cash and credit for digital wallets at least once, rising +36.2% from two years earlier.

The primary reason survey respondents gave for using digital wallets was the convenience.

Companies like eBay are jumping on the digital wallet bandwagon, while Visa, Mastercard, and American Express are also promoting digital wallet use in some form or another.

As this piece from JPMorgan explains, a Visa rule change means that merchants are now being incentivized to accept digital wallet payments.

There was even a report by the Wall Street Journal stating that Shake Shack is offering bitcoin as a reward for purchases made using Block’s Cash App digital wallet.

The common theme? Many consumers use digital wallets because of convenience.

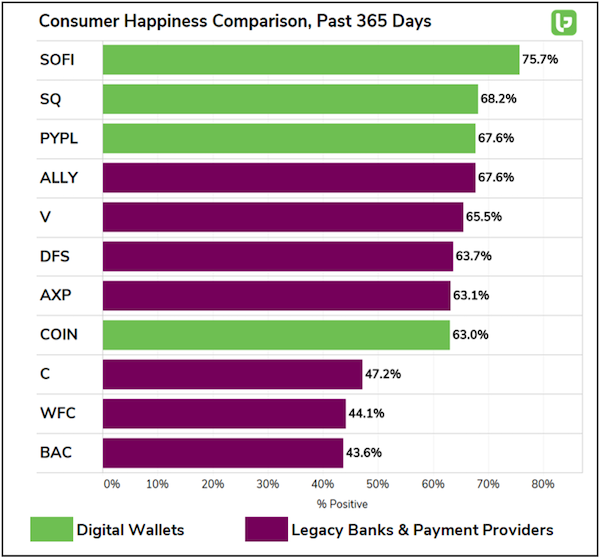

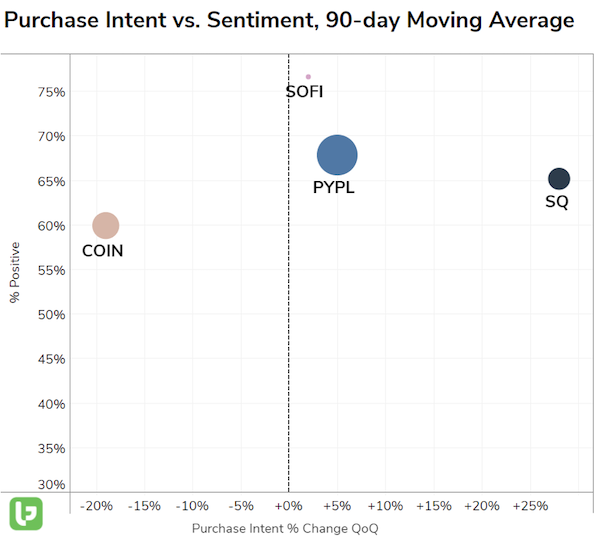

LikeFolio shows that people are still happier with digital wallet providers compared to legacy banks and payment providers…

Only Coinbase, which primarily operates as a cryptocurrency brokerage, has seen its Happiness score fall below that of its digital wallet peers and other legacy banks and payment providers.

So, with the case for digital wallet stocks clearly robust, which company is leading the way?

Well, here are three reasons we are focused on Block (SQ) as the go-to digital wallet stock.

The Case for Block (SQ) from Here

Reason 1: Rising Consumer Demand

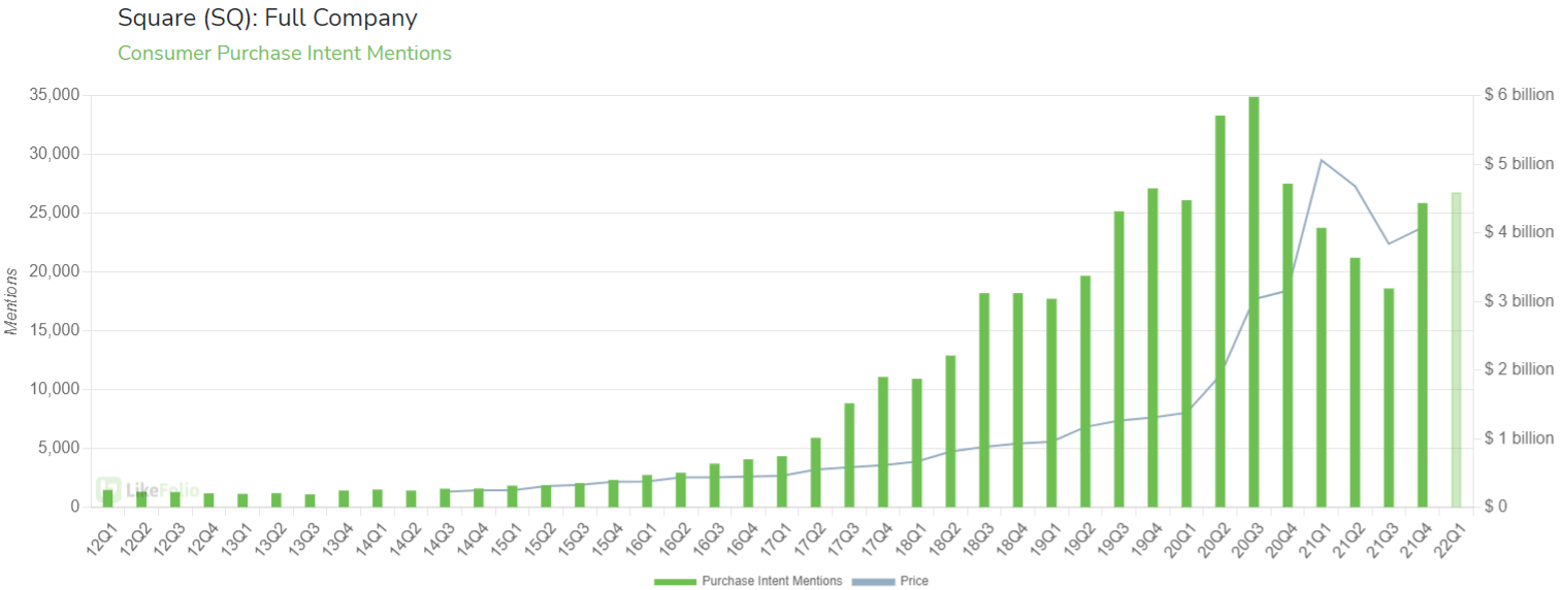

Square’s demand is gaining momentum once again and is on track to close Q1 at +4% QoQ and +13% YoY.

Reason 2: Block Is Outperforming Peers

This one is easy to see.

When comparing Block with the other digital wallet companies, SQ is garnering the most significant levels of near-term momentum.

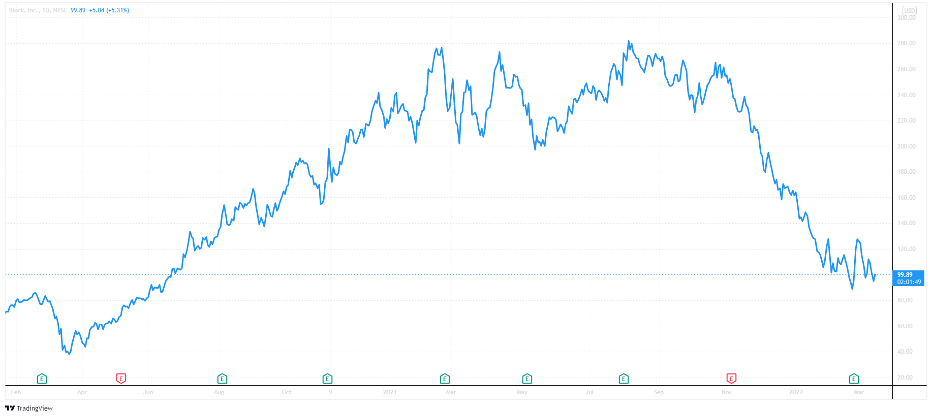

Reason 3: A Compelling Entry Price

Last but not least is the stock’s current price.

Like most stocks of late, Block’s shares have experienced a downturn, falling more than 60% in the last six months.

This entry point is starting to look attractive, with shares trading just above pre-pandemic levels.

The Bottom Line

Data supports a long-term bullish outlook for Block (SQ).

The company is experiencing a rise in demand this quarter and is outperforming its peers.

This demand specifically for Block, alongside the rapid adoption of digital wallets and digital wallet payments, suggests the company is definitely one to watch.

Our thesis on the digital wallet revolution hasn’t changed.

We’ll continue to alert LikeFolio members to short- and long-term opportunities in this space… and with the stock market punishing growth stocks at the moment, we expect to find more opportunities than ever.

Andy Swan

Founder, LikeFolio