Boiling Point: How Much More Can Consumers Take?

You know prices are getting up there when a bag of mesquite barbecue beef jerky and a soda cost almost as much as a T-bone dinner with a glass of Cabernet. Yeah, I was a bit rattled, too, when the gas station attendant rang up a small mortgage for my afternoon snack.

Like me, consumers across the U.S. are increasingly facing sticker shock on just about everything. From expensive groceries and gas to soaring rents and home prices, the greenback simply doesn’t go as far these days.

We wonder, are people really getting squeezed like a family pack of Charmin? How are shoppers’ spending habits being affected?

Let’s take a step back and see what the LikeFolio data tells us about the current inflation pressures.

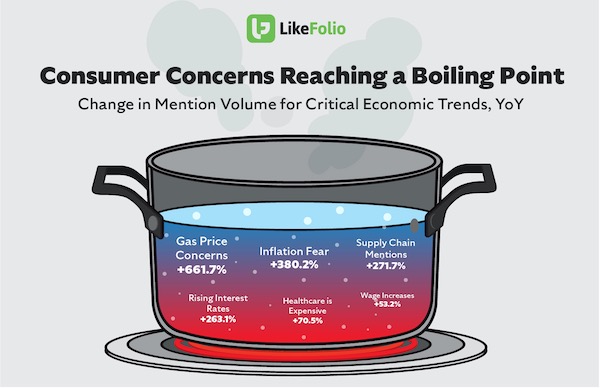

Data confirms: Inflation-related concerns from gas prices to health care are dominating consumer thoughts.

This shouldn’t be a surprise, especially as consumers shell out $4.22 on average for a gallon of gas as of this writing.

Even historically low mortgage rates are joining the inflation party. The average 30-year fixed-rate mortgage has snuck above 4% for the first time since 2019.

And with the Fed likely only getting started on its rate hike journey, affording a home or car is about to get more challenging.

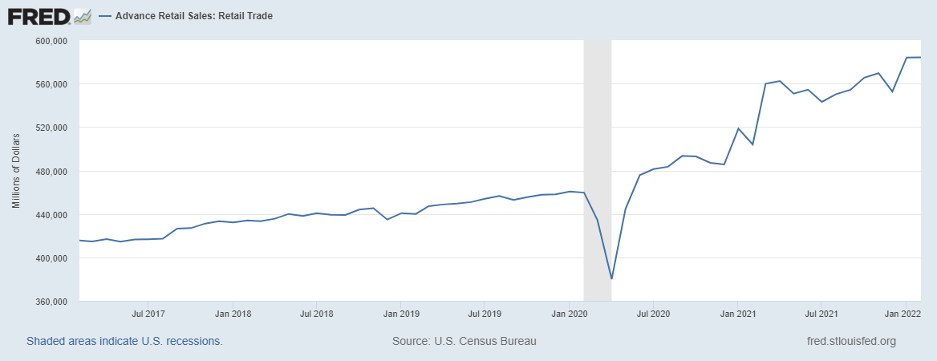

Despite these mounting pressures, the consumer-spending environment remains healthy. At least that’s what recent retail sales figures have shown (although they reflect easy year-over-year comps when lockdowns were still a thing).

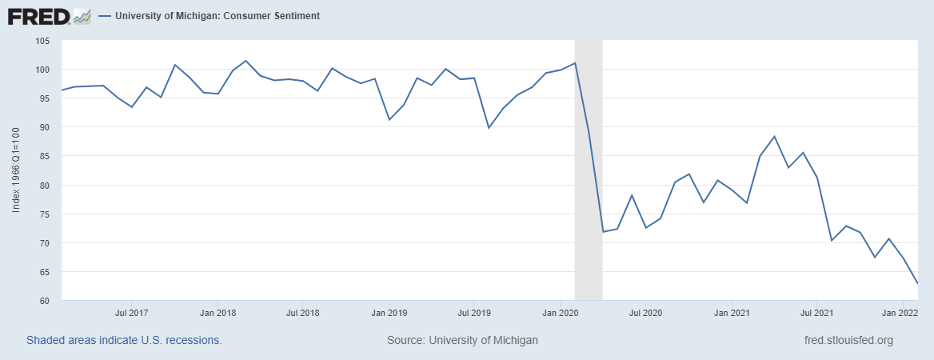

Consumer confidence readings tell a different story. Yes, higher heating, electricity, and internet bills do seem to be weighing on our collective psyche.

But is this shaky sentiment translating to a slowdown in discretionary spending? And what about spending on the essentials?

This is where LikeFolio data comes into play.

It’s really like a direct line connecting to actual purchasing behavior from consumers – because we’re listening to consumers all the time — in real time.

This level of insight is extremely valuable for investors. It will help us identify if and when consumers reach a breaking point.

Here’s how.

To Spend or Not to Spend

We’re going straight to the source to learn what kind of impact inflation is having on people’s daily spending decisions.

LikeFolio’s vast library of consumer mentions, Purchase Intent mentions, and Happiness data reveals much about how our attitudes are shifting—and where our dollars are going.

Let’s divide things into big-ticket items, discretionary purchases, and essentials to learn if consumers are feeling the burn.

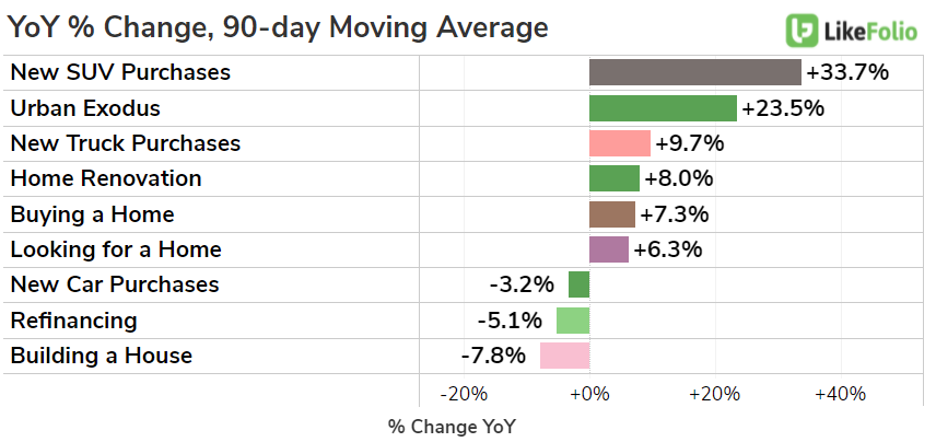

1. Big-Ticket Items

Traditionally, these are the first purchases to go as consumers tighten their wallets.

For example, buying a home or a new car, or renovating their existing home.

While refinancing and new home building mentions are tempering, other trends remain positive. This tells us that consumers haven’t reached their breaking point — yet.

However, this could change very quickly.

2. Discretionary Purchases

The next level of consumer spending to get cut is discretionary purchases, and an interesting consumer mindset is at play due to the events that unfolded over the last two-plus years.

Consumers recognize that they’re paying a lot more than they are used to, but coming off a pandemic, they’re putting their burning need for getting out and having fun at the controls.

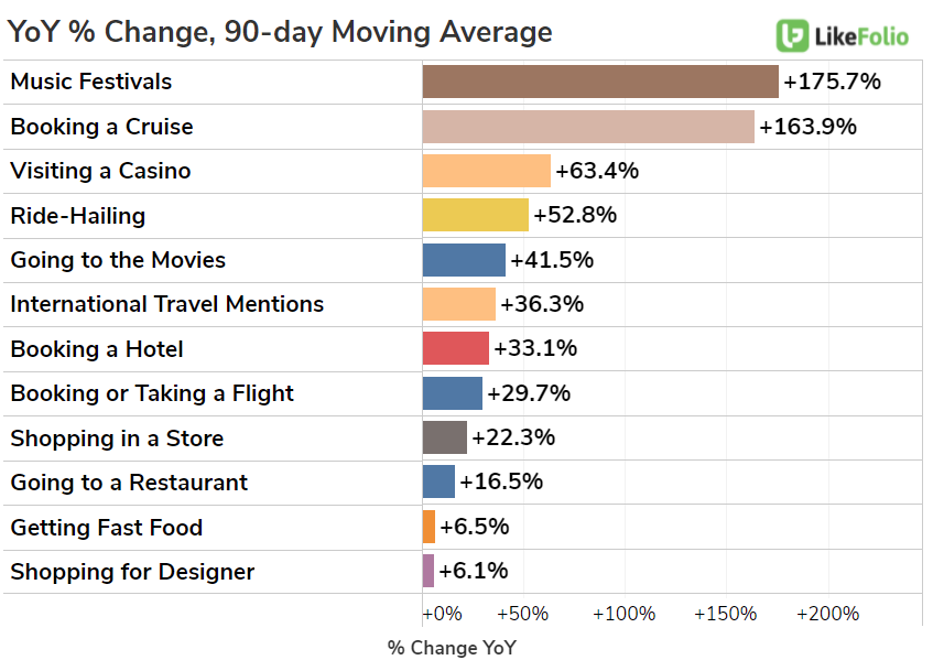

Data suggests consumers are still splurging on things they’ve missed out on: booking trips, going out to eat, attending that music festival, and upgrading their wardrobe.

The big question: Is this pent-up demand that will shortly fizzle?

We’ll be watching these trends (and related companies) very closely so we know exactly if and when this euphoric boon begins tapering.

3. Essentials

Finally, the last area where consumers may tighten their belt is related to consumer staples.

Reduced spending on food, toiletries, and cleaning supplies may be the final sign of an impending breaking point. After all, tough economic times can cause consumers to hit the supermarket less frequently, rotate to generic brands, or find other ways to stretch their dollars.

Tracking mentions for companies like General Mills (GIS), Campbell’s Soup (CPB), Kraft Heinz (KHC), Clorox (CLX), Kimberly-Clark (KMB), and Colgate-Palmolive (CL) is a great way to keep an eye on staples to see if demand begins slipping.

We’ve also got a close eye on discount retailers. So far, stores like Dollar General (DG) and Dollar Tree (DLTR) are not experiencing a major traffic influx. Granted, even discount retailers have raised prices, but since they remain the safety net for many strapped consumers, we’ll be monitoring developments there.

Our conclusion: Consumers are definitely feeling the heat, but they aren’t sweating profusely.

Frugality at the Forefront

Still, we know that economic pressure is building based on how consumers’ attitudes around being fiscally responsible are evolving.

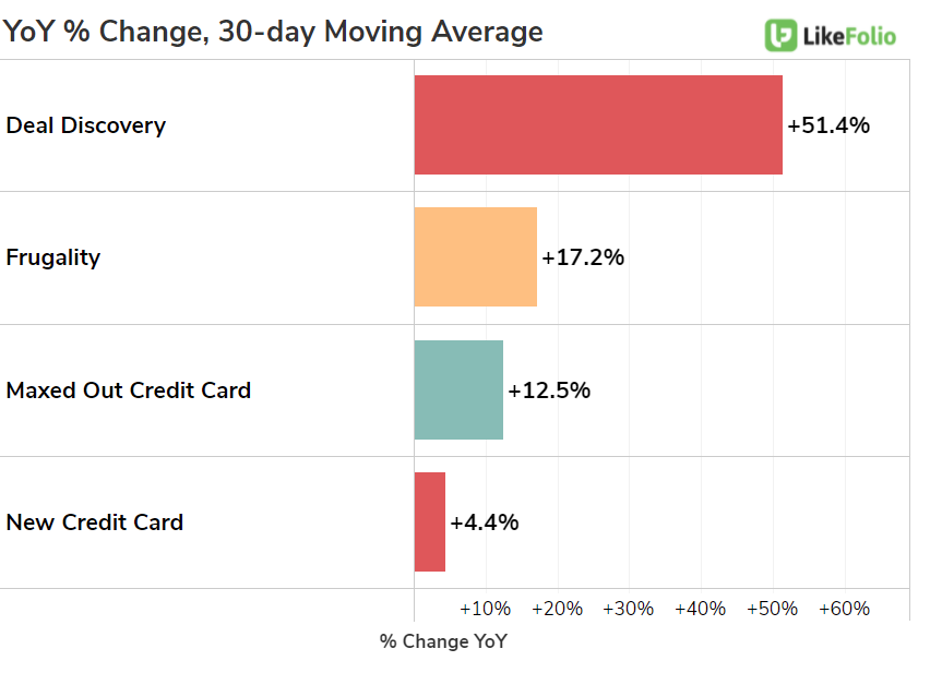

Discussions around being frugal have clearly picked up since the start of the year. Frugality being up +17% YoY tells us that consumers are increasingly exploring ways to save.

This is consistent with the trend in Deal Discovery mentions. The consumer search for deals and discounts is at its highest level in more than a decade.

Summary: Squeeze Play

The reality is, Americans can’t hide from rising gas, grocery, car, and home prices. But they aren’t exactly running away from them either.

While bargain hunting is definitely on the rise, the consumer doesn’t appear to be getting squeezed just yet.

Discretionary spending remains up in key areas like housing, autos, and leisure. People also don’t seem fearful enough to avoid paying for nonessential services like contractors and ride-hailing.

But with some interesting patterns underway, there are some things we’ll be monitoring to see if the full-court press is applied.

After all, with inflation persisting and rates rising, the economy’s grip on consumers is poised to strengthen before it weakens.

Eventually, people may get fed up, say “Ex-squeeze me?!”, and walk away from certain purchases.

And thanks to LikeFolio data, we have “insider” info directly from the consumer’s mouth, telling us exactly if and when that begins to unfold.

As always, members will be the first to know.

Andy Swan

Founder, LikeFolio