I’m Watching These Three Recent IPOs

Freshly minted publicly traded companies have been taken to the woodshed in the last month.

According to the Wall Street Journal, two-thirds of the companies that made their public debut in 2021 are trading below their IPO price.

This sell-off was in line with an overall sell-off in technology (growth) stocks at the end of the year.

But are all of these moves justified?

According to LikeFolio consumer insights, some hidden gems are emerging that look ripe for the taking for long-term investors.

Each of the companies below is recording a significant increase in consumer buzz and is bolstered by at least one growing consumer macro trend, a powerful combination in the LikeFolio universe.

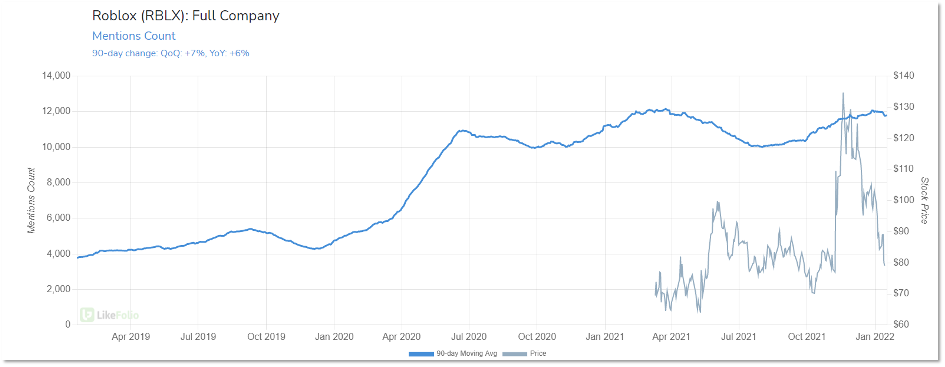

Roblox (RBLX)

- Mentions: +6% YoY, near all-time highs

- Trend Watch: Consumer discussions involving the metaverse: +12,760% YoY

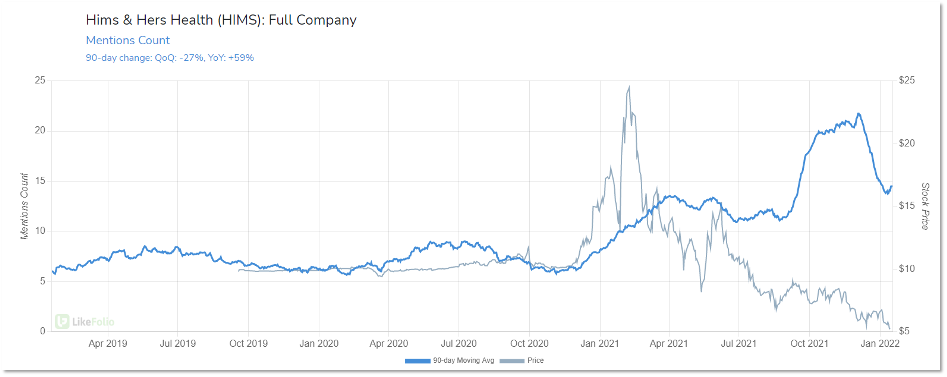

Hims & Hers (HIMS)

- Mentions: +59% YoY, recording strong Q4 activity

- Trend Watch: Telehealth demand: +28% YoY (Boosting Immunity, Digestive/Gut Health, Improving Mental Health all showing YoY increases in mention volume)

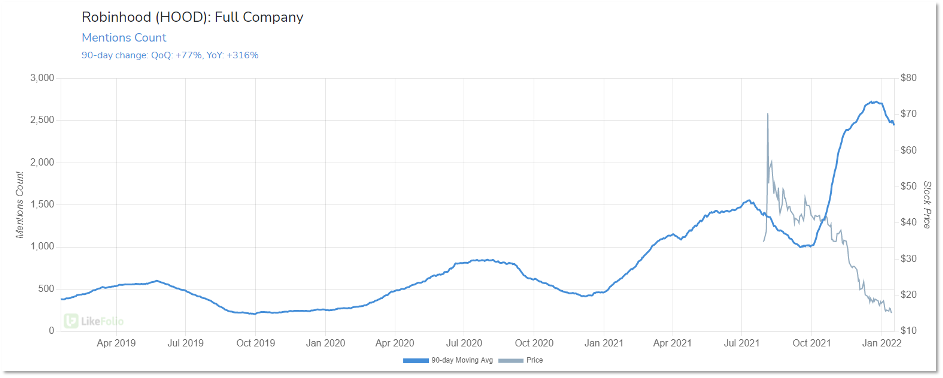

Robinhood (HOOD)

- Mentions: +316% YoY, near all-time highs

- Trend Watch: Consumer mentions of learning to trade: +43% YoY (Trading stock mentions across the board are up +13% YoY).

Keep an eye on these names.

High levels of consumer buzz growth alongside rising consumer macro trends is an extremely positive indicator… especially when the stock is headed in the opposite direction.

The market may be in for a surprise, but we certainly won’t be.

Andy Swan

Founder, LikeFolio