Is Ford Beating Tesla at Its Own Game?

The Electric Vehicle Tipping Point

I can’t believe I’m saying this. But there’s been a disturbance in the force.

What do I mean?

Tesla, one of LikeFolio’s top performers over the past three years, is losing ground — to Ford.

To be fair, both companies are faring extremely well in the eyes of consumers.

Mostly thanks to a key trend we covered in detail last month.

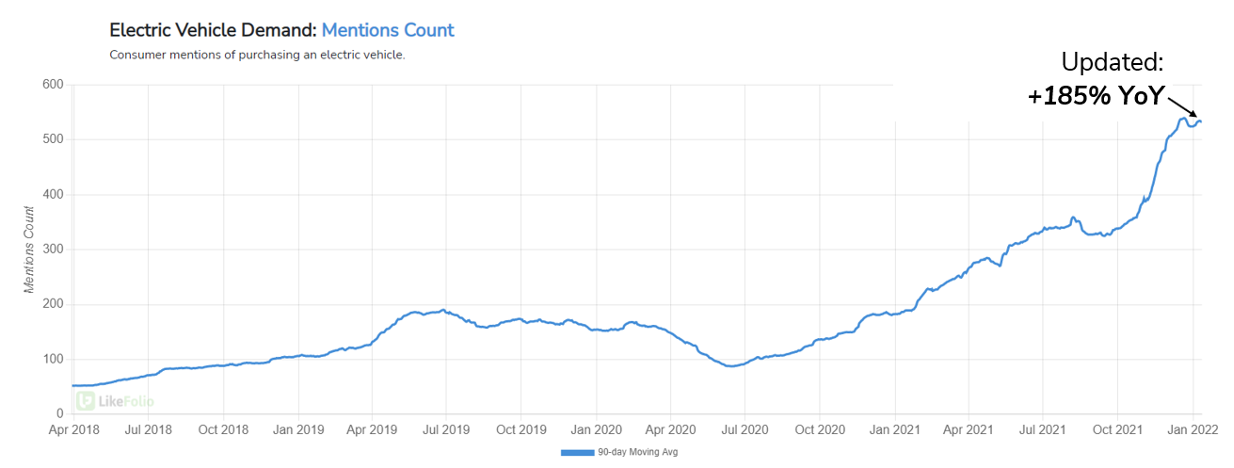

In December, LikeFolio data revealed a major tipping point looming on the horizon: A massive consumer preference for electric vehicles was unfolding.

To be frank, this shift in consumer acceptance was smacking us in the face.

Consumer Mentions of purchasing an electric vehicle had increased more than +170% YoY when our December MegaTrends EV Report was published…

Since then, electric vehicle demand growth has only accelerated.

More than half of U.S. adults say they are likely to consider purchasing an electric vehicle in the next decade, significantly higher versus 39% a year ago.

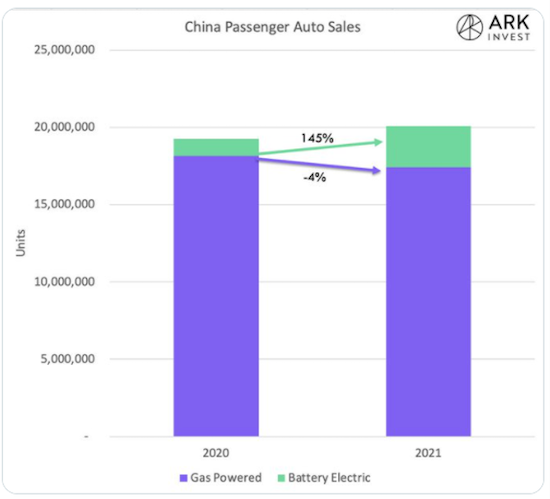

And China-based consumers are on the same page.

This chart from Ark Investment Management speaks volumes:

In China, gas-powered vehicle sales were down 4% in 2021, but electric vehicle sales were up an astounding 145% year over year.

That means EV sales accounted for more than 100% of China’s overall automobile sales growth in 2021 — a trend we fully expect to accelerate globally over the next two to three years.

We saw this coming from a mile away.

Ford (F) Belongs in the EV Automakers Camp

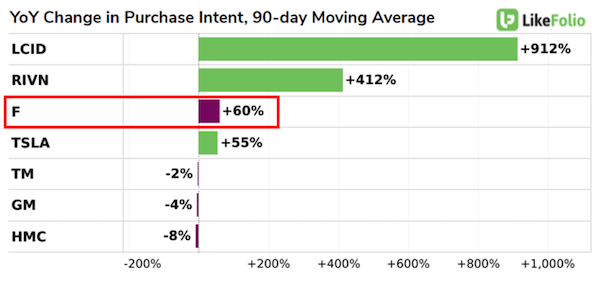

Consumer Demand for companies like Tesla, Rivian, and Lucid Motors, which produce only electric vehicles, is still booming.

But data suggests we need to add another name to our EV winners list: Ford.

Just check out the YoY demand growth for the major players in the auto segment.

Did you catch that?

Ford jumped up a spot in LikeFolio demand growth rankings, sneaking itself right between Rivian and Tesla — an impressive feat for the auto industry dinosaur.

Especially impressive considering Tesla’s recent feat: The company delivered more than 936,000 vehicles in 2021 — almost double the number delivered in 2020 — shocking analysts.

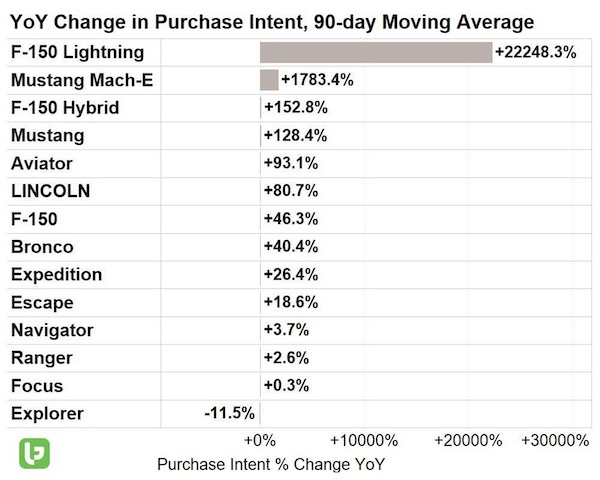

But the driver of Ford’s recent demand surge shouldn’t surprise anyone.

The top three brands driving Ford demand growth are tied to the electrification of its lineup.

Reported figures from Ford itself confirm LikeFolio data:

- F-150 Lightning reservations topped +200,000 by December 2021. This prompted Ford to double its Lightning production plans (again) to 150,000 units/year by 2023.

- Ford is tripling its Mustang Mach-E production to +200,000 units by 2023, noting, “it’s hard to produce Mustang Mach-Es fast enough to meet the incredible demand, but we are sure going to try.”

Consumer Mentions reveal a diverse audience clamoring for Ford’s all-electric truck, further reinforcing our tipping-point thesis: price and performance continue to attract new buyers — county lines aside.

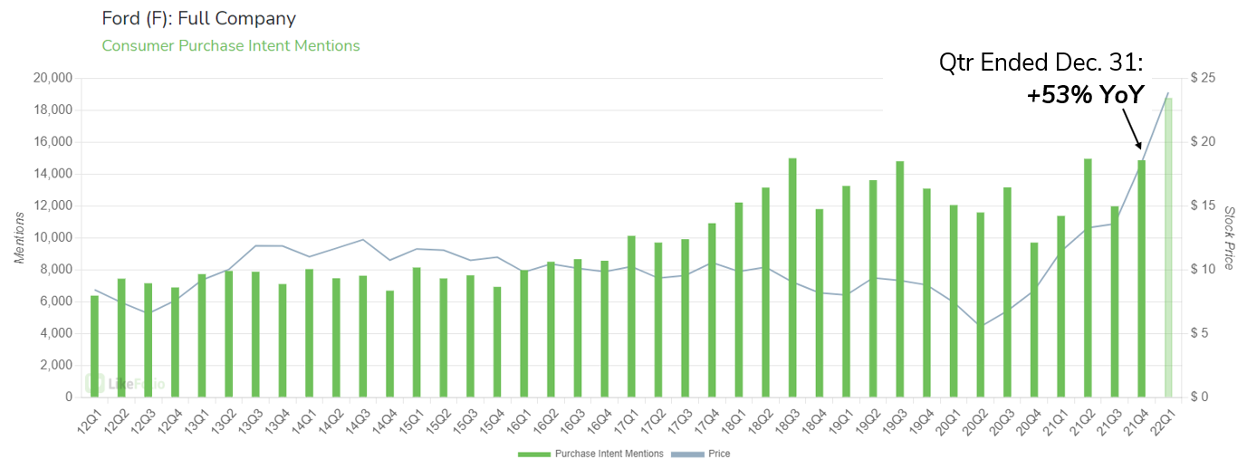

Ford isn’t slated to report Q4 earnings until February, but initial LikeFolio data looks incredibly positive.

Demand increased +53% on a YoY basis and has continued to accelerate into the current quarter at a blistering pace.

Keep an eye on this one. Any pullbacks present accumulation opportunities for long-term investors.

Much like Tesla a few years ago, LikeFolio’s data for Ford is extremely forward-looking.

Demand is undeniable. Now it’s only a matter of deliveries.

And if Ford can execute… no brakes.

Andy Swan,

Founder, LikeFolio