It’s PSL Season

Fall is here.

Forget the sweltering temperatures outside. Or the Farmers’ Almanac. These things are irrelevant.

Savvy investors know there’s ONE publicly traded company that dictates when fall begins, like it or not. Any guesses?

If you said Starbucks, you’re right.

Every year, Starbucks releases fall menu items, typically near the end of August.

This fall menu includes the infamous Pumpkin Spice Latte, or “PSL,” among other seasonal treats.

If you know, you know…

And at LikeFolio, we know the annual release of the PSL has much larger implications than simply inciting caffeine junkies across the country.

This date can be a powerful indicator for future sales in the upcoming season.

Here’s what we’re watching… and why we think Starbucks may be gearing up for a very strong holiday season…

Starbucks Fall Menu Demand Just Surpassed 2020 and 2019

This year, Starbucks added a new twist to its fall menu: the Apple Crisp Macchiato.

And our system picked up on this new addition almost immediately. By 2 p.m. on the date of the fall menu release, our internal spike detector triggered a “high volume” alert.

These alerts let our research team at LikeFolio know that something out of the ordinary is going on. And these alerts run in real time, every hour of the day.

By 7 p.m., mention volume exceeded five times our established threshold.

Events like this are rare.

We track nearly 1,000 companies and behaviors and on an average week will get one or two 5x spikes per week.

SBUX was the only one to trigger at 5x that day.

Even more rare is the metric being triggered: Positive Sentiment.

Not only was volume high, but the outlier metric was tied to Consumer Happiness.

That’s an impressive combination.

Now, let’s zoom out.

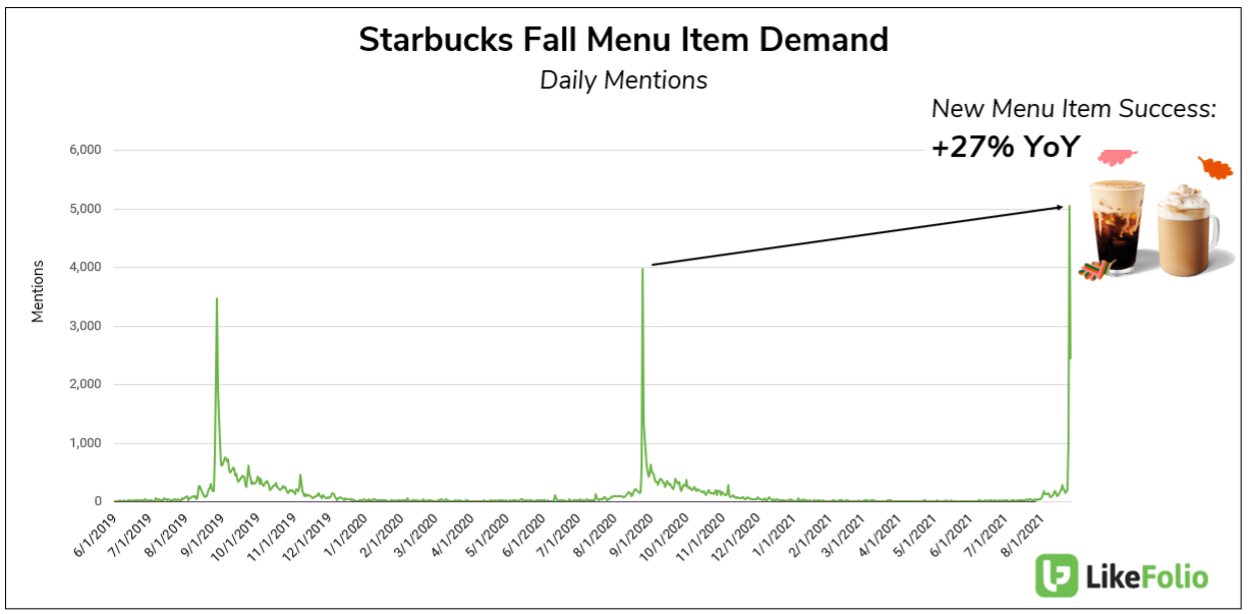

We expect a spike on these seasonal drops. How did volume in 2021 compare to prior years?

It’s much higher.

Consumer mentions for Starbucks’ fall menu items were +27% higher in 2021 versus 2020, and +45% higher than in 2019.

In addition, overall Consumer Happiness increased +8 points on the menu launch date (+8 points YoY AND +8 points versus the previous daily average).

Playing Starbucks from Here

Consumer Happiness is the most predictive long-term indicator for Starbucks’ sales growth… and annual events are great goalposts to use.

So, this real-time consumer data suggests Starbucks’ sales growth can be expected to continue in the U.S.

In addition, this refreshed Starbucks demand is being driven by multiple consumer trends, including:

- Consumers returning to the office: +35% QoQ

- Rising demand for coffee: +20% QoQ

- Rising demand for caffeine: +14% QoQ

Last quarter, Starbucks posted an earnings beat driven by a strong domestic performance: “In the U.S., our momentum accelerated in Q3, posting year-on-year revenue growth of 90% and two-year revenue growth of 16%. Comparable same-store sales grew 83% and importantly two-year comp grew 10%.”

While we can’t anticipate recovery in China (what dinged Starbucks on its last report), we do know the company’s largest base is energized.

This is a powerful edge for investors. We’ve got an eye on Starbucks long term.

When we spot actionable trading opportunities, our members are the first to know.

Megan Brantley

Head of Research, LikeFolio