One Fast-Casual Chain is Benefitting the Most from Reopening… and it’s NOT Chipotle

Not all restaurants are created equal. In fact, at LikeFolio we are constantly watching brands fall into and out of consumer favor.

We do this by listening on social media to understand how brands are faring in the eyes of consumers.

What do consumers like? What do consumers think could be better? And in the case of restaurants, are consumers increasingly eating what the restaurants are serving?

Here’s one company we’ve got our eye on, and how it popped up on our radar.

Fast-Casual Chains are Benefitting as Cities Reopen

When you’re trying to spot winners and losers, it helps to view the entire field at once. This allows you to compare companies to each other and understand what commonalities (or differences) may be driving performance.

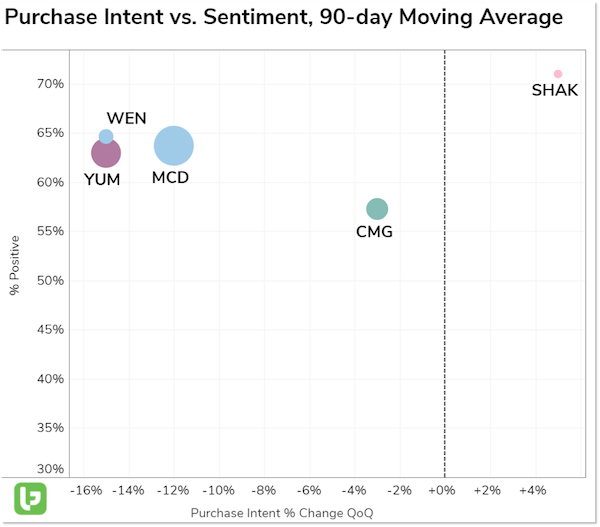

The Outlier Discovery Grid is a great tool that allows savvy investors to do just that.

It plots Consumer Demand growth versus Consumer Happiness levels.

Winners are typically located in the top-right corner with the strongest Demand Growth and highest Consumer Happiness.

LikeFolio’s restaurant-focused Outlier Grid reveals a near-term demand-recovery advantage for fast-casual chains versus traditional fast-food restaurants.

This mirrors external research findings.

And it makes sense.

Fast-casual chains were impacted more significantly than traditional “quick-serve” restaurants because they weren’t as equipped to transition to carry out, drive-thru, etc., and relied more heavily on dine-in.

And now things are shifting.

Here are our key takeaways from this powerful consumer data:

- Chipotle and, especially, Shake Shack are benefitting more as consumers resume the dine-in experience.

- Chipotle pivoted extremely well to digital ordering, but growth is waning. On its last report, online orders more than doubled and accounted for more than half of total sales. Now LikeFolio data for CMG shows signs of a slowdown: CMG digital order mentions have fallen -12% QoQ.

- Shake Shack is gaining traction as localities reopen. Shake Shack Purchase Intent Mentions have increased +5% QoQ, and digital mentions are up +1% QoQ, a stark difference vs. Chipotle.

- Shake Shack Consumer Happiness sits significantly higher than all other peers, as many consumers applaud elevated food quality.

- McDonald’s (MCD) is outperforming traditional fast-food chains, including Taco Bell and KFC (YUM) and Wendy’s (WEN), but is lagging fast-casual competitors. On its last report, McDonald’s confirmed a strong recovery in the U.S.: Revenue increased +9% YoY, driven by increased ticket size, but the number of visits remained negative, which is what the data is picking up on.

Keep an Eye on Shake Shack (SHAK)

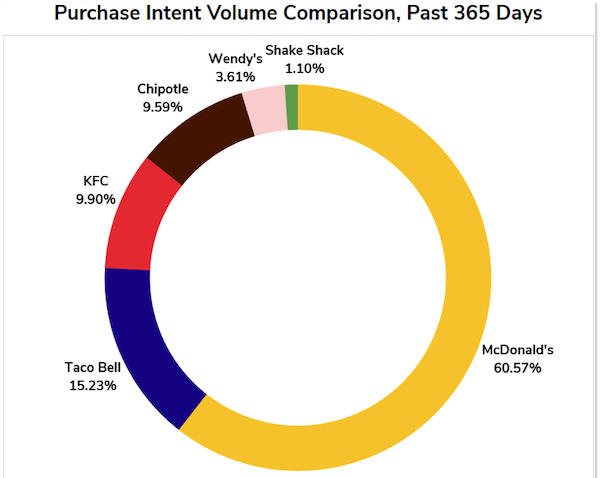

To give scale, McDonald’s holds massive market share of restaurant demand, with an expansive retail footprint. The company operated nearly 40,000 restaurants worldwide in 2020. We see this reflected in total demand volume.

By comparison, Shake Shack — the restaurant that began as a hot dog stand outside of Madison Square Park — operated around 250 restaurants globally in 2020… meaning it has a lot of room for growth.

Shake Shack plans to expand massively in the next two years and to open 90 new restaurants through 2022.

We’ll be watching to see how much this moves the needle for $SHAK.

Right now, the company is gaining momentum in the eyes of consumers. Time will tell if Shake Shack can continue to outperform.

This is why we’re glad to have a pulse on real-time data.

Andy Swan,

Founder, LikeFolio