Signs of Life Emerging in Business Travel

For the past year, a clear divide has lingered in air travel.

Leisure travel mentions began rising months ago, while indications of traveling for work were slower to return.

Delta says it has handled “record-breaking” customer volumes all year, reaching 96% of 2019 levels as leisure travelers return to the skies.

Note this is Delta helping customers, not total bookings, but demand is significant enough that the company is hiring to deal with capacity.

According to TSA airport-security checkpoint data, the number of passengers recorded Thursday and Friday before the July 4th holiday weekend surpassed the totals for the same days in 2019.

Got it: Leisure travel is back, bolstered even higher thanks to pent-up demand.

At LikeFolio, we were way ahead of pent-up travel demand, calling out building demand to get away in early January…

And now, Consumer Mentions suggest a NEW travel trend is top of mind for consumers…

In fact, this is what helped us nail Delta Air Lines (DAL) earnings earlier this week.

Now Boarding: Business Class

How did we do it?

We spotted a major surge in one kind of travel that had previously remained severely depressed: business travel.

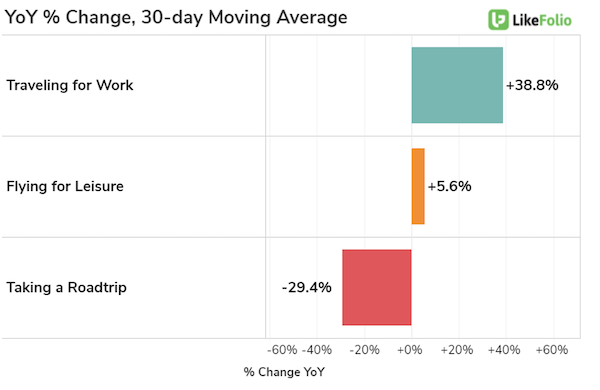

Traveling for work Mentions increased +39% YoY, the fastest-growing travel trend we are tracking.

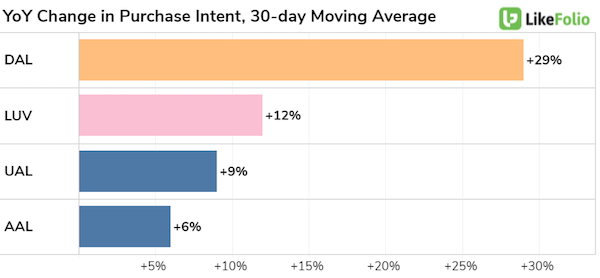

This is good news for a company like Delta… and you can see it moving the needle in Purchase Intent growth: +29% YoY.

Delta is outpacing other airlines on this YoY view, perhaps partially because fellow Consumer Happiness leader Southwest Airlines (LUV) lends itself to leisure travel… so demand returned sooner for that airline.

Delta still has a long way to go to return to full pre-COVID levels. Total consumer mentions remain -28% lower versus 2019.

And business travel hasn’t completely normalized.

But the momentum is building.

Earnings Powered by Real-Time Consumer Insights: $DAL

Heading into Earnings Season, LikeFolio reported an official “neutral” status.

While business travel is returning, Delta still has a hill to climb.

My brother (and LikeFolio co-founder) Landon talked about these factors on the TD Ameritrade Network prior to the company’s earnings release.

What happened?

Delta confirmed exactly what LikeFolio data discovered: Business travel is coming back.

- Pace of corporate recovery accelerated during the quarter: Corporate volumes experienced steady improvement through the quarter from 20 percent recovered in March to 40 percent recovered in June, driven by increased vaccination rates, the re-opening of offices, and improvements in demand in business-heavy markets like New York and Boston.

And the best part: The market reaction was neutral, just as we had predicted.

Shares traded around approximately -1% lower following the report.

Real-time consumer insights are a powerful tool in spotting the success (or failure) of companies as the economy reopens.

As always, LikeFolio clients will be the first to know when consumer data suggests a major opportunity is building in any stock.

Andy Swan

Founder, LikeFolio