This Old HOG Has New Tricks (Potential Profit Opportunity Unfolding as We Speak)

Staying in business since 1903 is no easy task, but Harley-Davidson Inc. (HOG) found the secret sauce to longevity — it became an iconic American brand.

Harley-Davidson is often recognized as representing the freedom to not only travel, but also live life on your terms.

It served as the main supplier of motorcycles to the military in World War II, and the “Captain America” Harley-Davidson driven by Peter Fonda in “Easy Rider” became as famous as the actor to motorcycle enthusiasts.

Having said all that, depending on your age, the company may still have the reputation of being your dad’s, or even your grandpa’s, motorcycle brand.

And investors aren’t cutting the company any slack just because it’s an American icon.

When it last reported earnings, Harley exceeded expectations, hauling in $1.49 billion in revenue instead of the expected $1.3 billion, but supply chain issues and production challenges ate into the company’s overall profit.

Persistent supply chain fears have seemingly weighed on the minds of investors, and the company just announced this past week that it is suspending vehicle assembly and shipments, excluding its electric motorcycle LiveWire, for two weeks.

As of this writing, the stock price is down 33% over the last year.

However, our data suggests that Harley may be getting a fresh upgrade in the minds of consumers, and for forward-thinking investors armed with the LikeFolio edge, any short-term decline in the stock price could provide an opportune time to establish a position in HOG.

Why?

Consumer trends and purchasing activity reveal Harley-Davidson is in the middle of a brand turnaround.

Harley-Davidson Is Reaching an Inflection Point

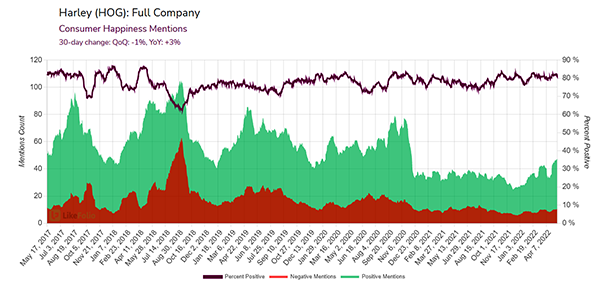

After several years of overall mention volume decline, Harley-Davidson mentions are beginning to gain steam, currently pacing +14% higher on a YoY basis.

And actual purchase intent mentions (indicators of consumer demand levels) are rising at an even steeper clip: +49% QoQ and +19% YoY; in the current quarter they are expected to close at +29% YoY.

Two major factors are helping to fuel Harley-Davidson’s momentum.

1. The Macro Environment Is Improving

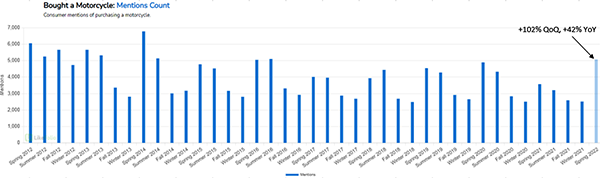

LikeFolio tracks consumer mentions of both motorcycle ownership and motorcycle riding.

Both core trends are on track for impressive growth.

Generic motorcycle purchase mentions are on pace for the highest demand in a quarter we’ve recorded since 2016, an estimated +102% QoQ and +42% YoY.

And mentions of riding a motorcycle are also cruising to a new all-time high.

External research supports these trends.

According to Statista, revenue in the motorcycle market is projected to reach $117.4 billion by the end of 2022, with an annual growth rate of 8.01%, resulting in a projected market volume of $159.8 billion by 2026.

2. Harley-Davidson’s Focus on Performance, Personalization, and Electrification Is Resonating with Buyers

On its last earnings call, Harley-Davidson noted that part of its strategic plan includes added performance, with eight new models in its 2022 lineup powered by the Milwaukee-Eight 117, “the most powerful factory-installed engine ever offered by Harley-Davidson for those riders who want nothing but the biggest and the best, building on our position as the most desirable motorcycle brand in the world.”

The company also noted long-term growth potential in parts and accessories that allow riders to customize their rides, and in the budding electric motorcycle segment.

So far, it’s working. Harley-Davidson consumer happiness levels are 82% positive: 3 points higher on a YoY basis, and 20 points higher versus 2018 lows.

Bottom line: Harley-Davidson is currently benefiting from several tailwinds.

Near-term demand is rising as long-term motorcycle revenue is expected to grow, all while the company continues to improve its overall consumer happiness levels.

It’s not often that we see multiple metrics on LikeFolio, including a macro tailwind, line up as they have for HOG…

But when they do, we definitely take notice. Stay tuned…

Andy Swan

Founder, LikeFolio