We’re Not Touching This IPO…

Using Real-Time Consumer Insights to Spot Potential IPO Winners… and Losers Too (BIRD)

We’ve tracked a flurry of new IPOs over the last few months.

RIVN. HOOD. ONON. WRBY. BIRD.

We talked about the massive IPO success of Rivian yesterday, and why we think the company has serious long-term potential.

When names like this hit the market, the excitement is palpable. And we’ve recorded huge swings in share prices.

Some moves good, some moves bad… depending on which side you’re betting on.

In times like these, I like to channel my inner Kenny Rogers. If you’re gonna play the game… you gotta learn to play it right.

While all newly minted publicly traded companies are subject to near-term volatility, analyzing consumer metrics can help to bring the potential winners — and more importantly, losers — to the surface.

By “losers,” we mean names that data suggests may already be tapped out when it comes to growth.

One name on our radar: Allbirds (BIRD).

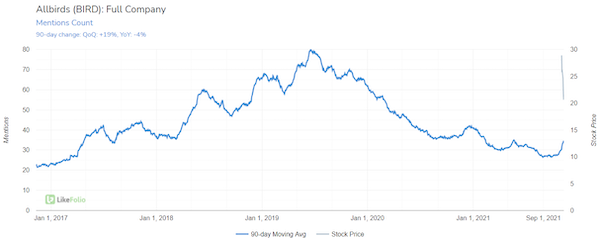

Consumer buzz surrounding the Allbirds brand has dropped significantly in the last two years, currently pacing -4% lower YoY.

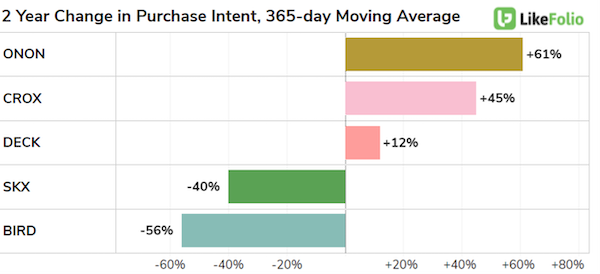

But sometimes it helps to view a company against its peers. How does this name stack up against the “comfortable shoes” segment as a whole?

According to LikeFolio data, not too well.

Allbirds seriously trails peers when it comes to demand growth.

Meanwhile, fellow trading newbie ONON (think On Cloud shoes) is flexing. And in what should be no surprise to LikeFolio members, Crocs is too.

At the end of the day, we aren’t betting on BIRD.

BIRD shares are currently trading around 25% below the Nov. 3 (IPO date) close, but they remain above the initial share price of $15.

Sometimes it’s nice to know when to stay on the sidelines.

We’re keeping our distance from Allbirds for now, but we’re tracking powerful consumer metrics for all of these footwear companies in real time.

When things change, LikeFolio members will be the first to know.

Megan Brantley

Head of Research, LikeFolio