How to Beat a Legendary Billionaire at His Own Game

Over the past two weeks, I’ve shared one of the most incredible investment strategies I’ve ever come across.

Known as the “All Seasons” portfolio, it has outperformed 99% of retirement funds over the long run. But it has done so with just a fraction of the gut-wrenching volatility of most of these funds.

Specifically, it has returned nearly 10% a year on average over the last 90-plus years. Over that time, it has suffered just 17 losing years (18%), compared to 25 losing years (27%) in the overall market. And the average loss in those years was just 4%, compared to more than 13% for the market as a whole.

In other words, this is a rare portfolio that even conservative investors can comfortably buy and hold for the long term. If there’s a “Holy Grail” of investing, this might be it.

As I explained, this portfolio is the brainchild of legendary hedge fund manager Ray Dalio.

Dalio founded Bridgewater Associates — the world’s largest hedge fund with more than $150 billion in assets under management (“AUM”) — and is one of the world’s leading experts on portfolio risk management.

The “All Seasons” portfolio is a more accessible, “do-it-yourself” version of Bridgewater’s exclusive “All Weather” strategy.

The former holds just five different assets — stocks, intermediate-term government bonds, long-term government bonds, gold, and commodities — making it simple enough for even a novice investor to follow.

Yet, backtesting shows it has performed nearly as well as the latter, which holds a complex, proprietary mix of up to 40 different assets with leverage.

(For what it’s worth, you couldn’t invest in the All Weather strategy even if you wanted to. It is permanently closed to new investors, including many of Bridgewater’s wealthiest clients.)

Last week, I shared how Money Talks readers could invest in the All Seasons portfolio using a mix of low-cost mutual funds or exchange-traded funds (“ETFs”).

Again, if you’re a conservative investor who wants to safely grow your wealth while spending as little time as possible managing your investments, the All Seasons is an excellent option.

However, I believe we can improve upon Dalio’s original portfolio with a few tweaks based on the latest data, a little common sense, and our powerful TradeSmith tools. So that’s what we’re going to do…

This week, I’ll share an “upgraded” version of the All Seasons portfolio that anyone can buy and hold for the long term, whether you’re a TradeSmith subscriber or not. As you’ll see, just a couple of simple changes could make this portfolio even more robust.

And then next week, I’ll show you a special version of the All Seasons portfolio designed specifically for TradeSmith subscribers. This one combines the best of Dalio’s brilliant approach with our proprietary risk-management and market-timing tools. I think you’re going to love it.

Alright, let’s get to it…

The first upgrade I’d make to this portfolio applies to the stock allocation.

In the original All Seasons, Dalio recommended holding 30% of the portfolio in stocks via low-cost, diversified index funds. By default, most folks have interpreted this to mean funds based on the S&P 500 or other U.S.-focused indexes.

However, this could be a problem for those of us who live and work exclusively in the U.S.

Whether we’re aware of it or not, a large percentage of our wealth and income is likely already tied directly or indirectly to the health of the U.S. economy.

Investing exclusively in U.S. stocks only compounds this “country risk” further. And it could lead to less favorable returns in a long-term buy-and-hold portfolio.

Fortunately, there’s an easy solution to this problem: We can simply invest a portion of our stock allocation in non-U.S. stocks through a similar low-cost mutual fund or ETF.

Like the assets we looked at last week, there are many choices among foreign stock index funds. But I like the following two options from Vanguard, which offers some of the lowest-cost funds in the industry:

- Mutual Fund: Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

- ETF: Vanguard Total International Stock Index Fund ETF (VXUS)

Each of these funds offers broad, low-cost exposure to large-cap, mid-cap, and small-cap stocks in both developed and emerging markets outside the U. S.

I should also mention that Vanguard offers two similar international index funds: the FTSE All-World ex-US Index Fund Admiral Shares (VFWAX) and the FTSE All-World ex-US ETF (VEU).

These two funds also offer exposure to foreign stocks in both developed and emerging markets with similarly low fees. However, they hold only large- and mid-cap stocks while excluding small-caps. As a result, they track only around 3,000 total stocks each versus more than 6,000 stocks in the two funds I mentioned earlier.

Both pairs of these funds have performed similarly since their inception. But you may prefer one or the other based on these differences.

So, how should we divide the original 30% allocation between U.S. and international stocks?

As I mentioned before, Dalio based the All Seasons portfolio on a “risk parity” approach.

He found that the most successful investors don’t allocate their portfolios based on the amount of money invested in each position. Instead, they allocate their portfolios based on the amount of money at risk in each position.

We recommend this same approach here at TradeSmith. In fact, I believe this is one of the MOST IMPORTANT things we currently do to help individual investors.

Typically, risk-parity strategies are off-limits to all but the wealthiest individual investors in sophisticated hedge funds. But with powerful tools like our Position Size Calculator, Risk Rebalancer, and Pure Quant portfolio builder, TradeSmith has made them accessible to everyone.

As I explained in an earlier edition of Money Talks, our approach to risk parity uses a proprietary measure of risk we call the Volatility Quotient or “VQ.” The VQ tells you exactly how risky any individual asset is.

You might be surprised to learn that the VQs of these international stock index funds are slightly lower (less risky) than the VQs of the U.S. index funds I mentioned earlier.

As a result, our system would generally recommend allocating around 55% of your stock exposure to international stocks and about 45% to U.S. stocks. This division works out to approximately 16% and 14% of your total portfolio, respectively, for a total stock market allocation of 30%.

Of course, this approach assumes you own no other investments. If you already have significant exposure to foreign assets, you may choose to hold more of this portfolio in U.S. stocks and vice versa.

Given what I’ve just told you about “country risk” in stocks, you might assume we would want to diversify our government bond holdings as well. But I think that would be a mistake, for a couple of notable reasons.

First, while there are plenty of U.S. Treasury-focused funds, there aren’t any great, low-cost ways to own foreign-government bonds through funds today.

Most international bond funds hold primarily corporate bonds rather than government bonds. And corporate bond funds carry a different risk profile than those focused exclusively on government bonds.

Second, diversification doesn’t necessarily offer the same benefits in government bonds that it does in stocks.

Thanks to the U.S. dollar’s role as the world’s reserve currency, U.S. Treasury bonds are generally considered “risk-free” investments.

Of course, this doesn’t mean they’re literally free of risk. All investments carry some risk. But no matter how bad things get, the U.S. government can always print more money to pay back its bondholders.

So, while inflation could dilute the value of your investment in Treasury bonds, there is virtually zero risk that you will lose your principal due to default.

You can’t necessarily say the same thing about investing in the government bonds of any other country. So, we’re going to leave our allocations to intermediate- and long-term U.S. Treasuries the same.

Instead, the second upgrade applies to the portfolio’s allocation to “alternative assets.” As I explained last week, the original All Seasons portfolio recommended splitting 15% of your money between gold and commodities.

These assets are generally uncorrelated to both stocks and bonds. And as Dalio noted, they tend to do well in “seasons” where those traditional assets underperform. These seasons include times when the economy is “overheated” or when inflation is high.

However, something significant has changed in the world of alternative assets since Dalio created this portfolio in 2014. Investors now have an exciting new option that simply wasn’t available at that time.

Regular Money Talks readers can probably guess I’m referring to Bitcoin.

(Believe it or not, when I first started thinking about sharing Ray Dalio’s approach with you, I actually forgot about including Bitcoin! Fortunately, a reader pointed this out and reminded me last week. So, thank you again for the feedback! I read it all!)

Bitcoin has only been around a little over 10 years so far. But it has quickly earned a reputation as “digital gold,” a scarce asset that can maintain (or grow) its value over time and dampen the volatility of a diversified portfolio.

Bitcoin already arguably fills this role better than gold itself. And these advantages could become even more significant as crypto assets move into the mainstream and become accessible to more investors.

In short, I believe any well-diversified portfolio needs to include at least a little exposure to Bitcoin today.

However, as I explained in my four-part “Getting Started with Crypto” series last month, there aren’t yet any great ways to own Bitcoin through traditional investment accounts.

Several Bitcoin ETFs are currently awaiting approval from the U.S. Securities and Exchange Commission (“SEC”). So, I suspect it is simply a matter of time before investing directly in Bitcoin becomes much easier.

But until then, your best option is to buy some Bitcoin directly through a dedicated crypto exchange. (If you missed my “Getting Started” series, you can catch up here: Part 1, Part 2, Part 3, and Part 4.)

Finally, as we did with our stock allocation, we’ll rely on TradeSmith tools to help us equalize our risk among gold, commodities, and Bitcoin.

Based on the VQs of Bitcoin and the gold and commodity funds I highlighted last time, our system would recommend allocating roughly 6% of your total portfolio to gold and commodities and approximately 3% to Bitcoin.

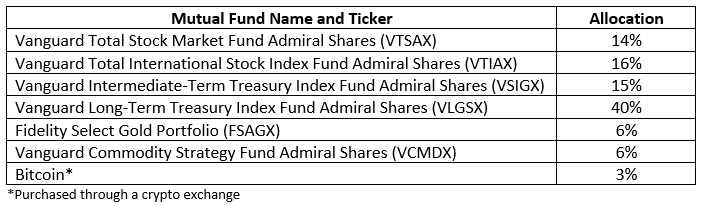

With these changes in mind, here’s our complete “upgraded” All Seasons portfolio for mutual fund investors:

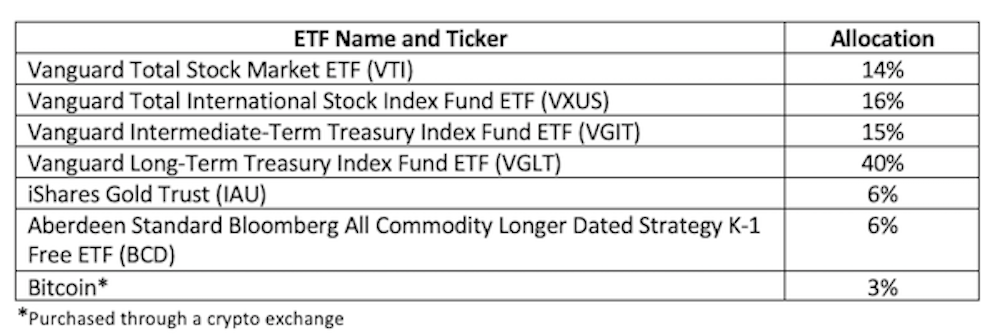

And here’s the “upgraded” version for ETF investors:

There you have it. These are relatively simple changes, but I’m confident they’ll produce even better long-term returns than Dalio’s original All Seasons portfolio.

Like the original All Seasons portfolio, I’d recommend monitoring this portfolio monthly and rebalancing it at least once per year.

If you’re looking to make safe, profitable investing as simple and painless as possible, I encourage you to give it a try.

You could even test drive it on paper or with a small amount of money and compare it to your current portfolio. You might be surprised by the results.

But again, if you’re a TradeSmith subscriber, I think you can do even better. And next week, I’ll be back with a few more ideas for you.

I’ll show you how you can own individual stocks inside the All Seasons portfolio, and how to apply our Health Indicator system to earn even better returns with less risk.

In the meantime, I’d love to hear what you think about these improvements so far. You can reach me directly at [email protected].